THE BIG SHORT - by John Goodall of Landbay

Aside from our regular weekly profiles, we do like to mix things up from time to time and offer you some opinion pieces and a provide a platform for our founders to keep us up to date with what they are doing. Today we are pleased to publish an opinion peice, contributed by John Goodall, Co-Founder and CEO of Landbay, who has recently been to the movies!

Landbay were profiled here on FinTech Profile back in January.

Over to John:

With new comedy-drama ‘The Big Short’ recently scooping the Oscar for ‘Best Adapted Screenplay’ it’s an opportune time to highlight the benefits that peer-to-peer can bring to the mortgage lending industry – a £1.3 Trillion segment of our economy and the fastest growing part of UK’s alternative finance sector.

The Big Short laid bare how Wall Street’s appetite for mortgage debt (at any cost) lead to the creation of a toxic housing bubble. The complexity of the financial instruments used meant that many banks, including a number of the UK’s largest, had no idea where their money was going or what it was they were insuring. As things began to unravel the domino effect became unstoppable and as a consequence, an asset class previously considered one of the safest (and the backbone of the American dream) was now to blame for one of the worst financial meltdowns in history.

So how does peer-to-peer fit into all of this?

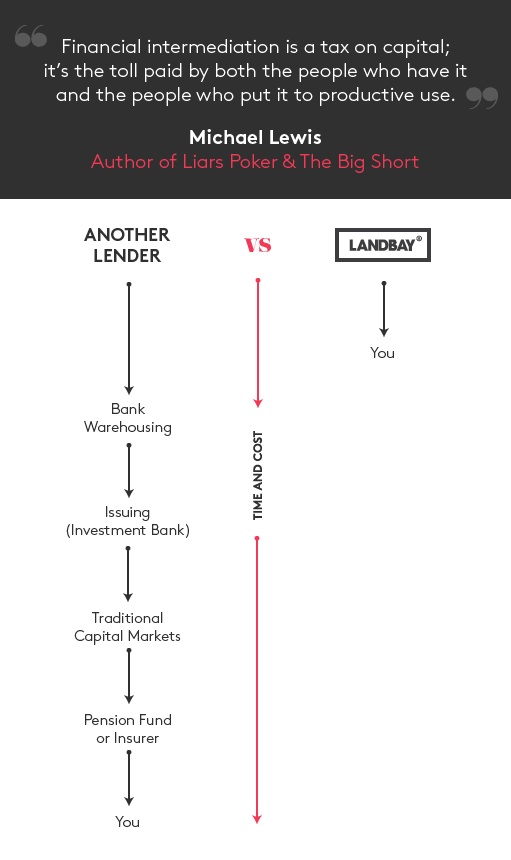

This is a very simplistic view of how a direct lending model streamlines the way that mortgages are funded.

Many people don’t realise that they are already funding mortgages via their pensions, investment funds and insurance premiums – these traditional managers of our money continue to be significant investors in mortgage securitisations, both in the UK and further afield.

Mortgage securitisation is where lots of mortgages are pooled together and turned into an homogenous, tradeable security. Each step in the process adds to the complexity and distances the mortgage asset from the end investor. When the financial rewards are so large for each of the players involved, so is the incentive for standards to be lowered in order to generate fees.

Peer-to-peer removes these layers of cost (ie, Investment Bank, Magic Circle, Big 4, Rating Agency and Fund fees) and in doing so also removes the opacity that can cover up poor lending practices. Removing the fees also means that a better deal can be passed on to the end investor… that’s me and you.

As the part-owner of a peer-to-peer mortgage you have a direct lending relationship with the borrower and can see where your money is going. Whilst lending on any peer-to-peer platform does carry risk (lending is not protected by the FSCS) the level of transparency makes it a purer form of investment, which is fairer for all.

Our thanks to John for submitting this piece.

If you would like to submit an article or be profiled on FinTech Profile, please contact emma@fintechprofile.com, who will be pleased to hear from you.