Rob Guifoyle of Abe

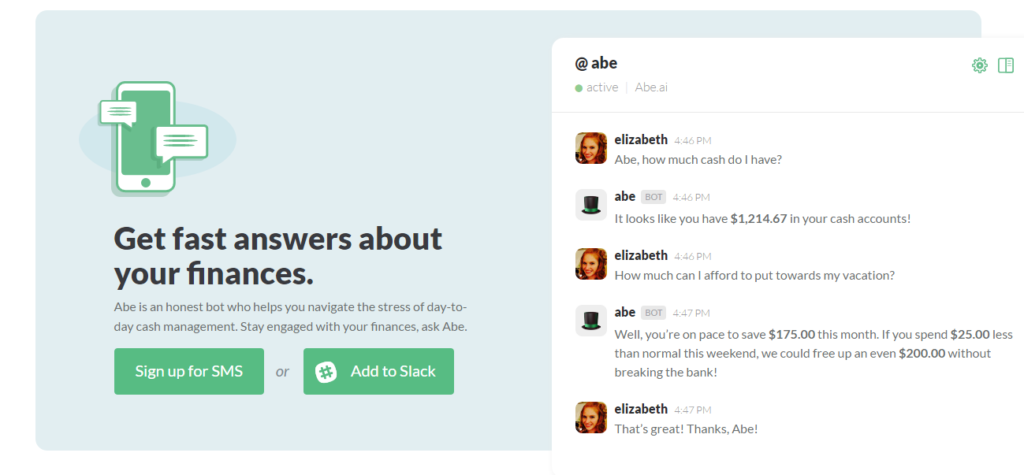

Today on FinTech Profile we talk to Rob Guifoyle, CEO of Abe. Abe budgets out your cash so you save more and stress less.

As usual – our questions are in bold.

—–

Who are you and what’s your background?

My name is Rob Guilfoyle and I’m the CEO of Abe.ai. Prior to co-founding Abe, I helped build a cloud based financial education solution for the 401k and retirement markets. As the technical and product lead I designed solutions now in use at enterprises clients such as Harvard’s Cancer Institute. Before working in the financial services industry, I was responsible for managing analytics initiatives for the Eastern European Coca-Cola Distributor. There I architected multiple international deployments of mobile and embedded analytics products.

What is your job title and what are your general responsibilities?

What is your job title and what are your general responsibilities?

Day to day I provide the strategic leadership and manage the technology initiatives of the Abe platform. I interface with consumers, channel partners and banks to guide the direction of the products & services created by Abe.ai.

Can you give us an overview of Abe’s business?

Abe is a consumer-facing personal financial management (PFM) tool, but we also provide a turnkey conversational banking solution for banks. The revenue earned from banks allows us to NOT attempt to squeeze value out of our users, through well-disguised “recommendations” like Mint or CreditKarma.

Banks are attracted to Abe because we require literally no integration with the existing core banking platform. This allows us to introduce conversational banking features across the largest messaging platforms in the world overnight. Beyond this, we offer account aggregation and financial coaching out-of-the-box. Abe allows banks to do more than simply holds funds and facilitate money movement. It lets them offer traditional personal banking services at scale.

How is Abe funded?

We raised $550,000 from 3 angel investors.

Why did you start Abe? What problems does Abe solve?

We built Abe to help people be better with money. When it comes to personal finances, people are irrational. Often making financial decisions in a charged state of emotion, which overtime can sabotage their opportunity at long-term financial health.

We see Abe as a “self-driving” force that can leverage automation and A.I. to navigate a consumer to a healthier financial position. We see a future where an intelligent agents acts as the steward of a household’s cash and constantly routing cash to the “right” places at the “right” time.

Our big vision for Abe is an AI that you control to automate your entire financial life.

Who are Abe’s target customers? What’s the revenue model?

We license our software to community banks with $250M – $1B in assets. These community banks want to be innovative, but may lack the internal resources to invest in cutting-edge technologies to improve their existing product and service offering.

With Abe, these community banks can remain innovative and competitive, without the need for a large capital investment into the design and build of conversational banking software.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

If I had a magic wand, I would create a strong sense of normality in the data models used by banks. Companies interacting with hundreds or thousands of different banks are forced to use aggregation layers that normalize the data structures. Innovation would sky rocket if everyone knew how to access their data or how to securely allow others to access it.

Oh, and I would make real time payments real.

What is your message for the larger players in the finance industry?

Just because you are in a highly regulated and highly scrutinized industry doesn’t mean you should be scared to get out of the box. The last time I switched banks was because Chase’s mobile app allowed me to cash a check with my phone. Instead of three 40-person teams, try forty 3-person teams with a fail fast mentality. Your employees will surprise you.

What phone are you carrying and why?

iPhone 7. Apple marries hardware and software better than any company.

Where do you get your industry news from?

I listen to Breaking Banks by Brett King and his “Fintech Mafia” posse. I also really enjoy reading the Finnovation Friday weekly digest by Travis Engebretsen of Seacoast Bank, Technically Sentient by Rob May for all things AI, and I’m subscribed to a ton of weekly digests for “bots”.

Who are three influencers in the FinTech sector that everyone should be following on Twitter?

Jennifer Tescher – @jentescher – she’s the CEO of Center for Financial Services Innovation and literally leading the conversation on consumer financial health.

Ron Shevlin – @rshevlin – he’s the Director of Research, Cornerstone Advisors. I find his candor on the next “fintech sensation” refreshing.

Vitalik Buterin – @VitalikButerin – he’s the creator of ethereum.org crypto-currency. The possibilities and positioning of ether is incredible.

What’s the best FinTech product or service you’ve seen recently?

The BBVA API marketplace is really interesting. They’ve opened APIs created during the Simple acquisition to the US fintech public, and are now essentially offering “Banking as a Service”.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

- Banks who embrace being platforms (Bank as a Service) will be catalysts to new innovation.

- Incidents like Wells Fargo’s cross selling tactics will continually move younger generations to trust companies like Facebook and SnapChat to hold their money as opposed to traditional institutions.

—–

Thanks to Andrew for his answers today. You can find out more about Abe on their website or Twitter.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.