Tyler York of Achievable

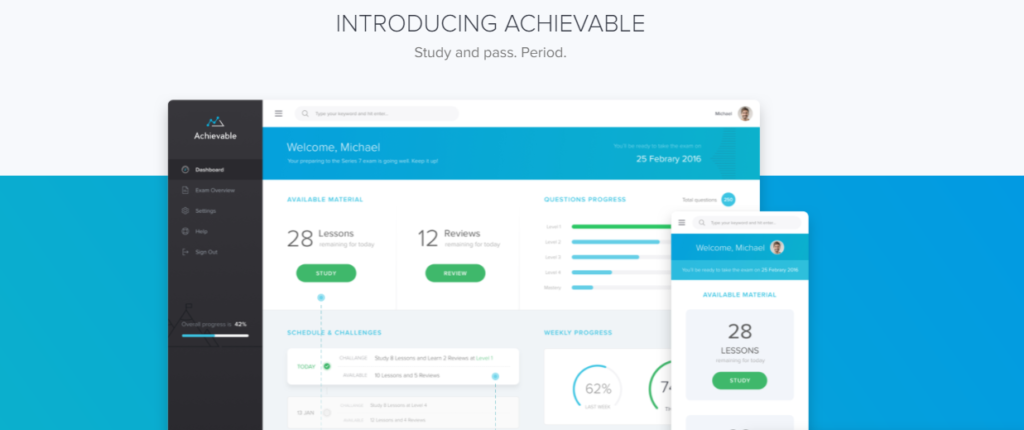

Today on FinTech Profile we are pleased to welcome Tyler York of Achievable – an online and mobile test prep platform for the FINRA Series 7 exam. Achievable models a student’s memory using learning science and delivers a personalized experience, improving test scores and saving students half the time.

Over to Tyler.

Our questions are in bold.

—–

Who are you and what’s your background?

Who are you and what’s your background?

Hi. I’m Tyler York, and I co-founded Achievable with my friend Justin Pincar. I first met Justin at Carnegie Mellon, where we were roommates for two years. He studied computer science and I (foolishly!) studied marketing. I started my career in the mobile gaming space, running marketing for a startup called Betable and then managing the sales and marketing teams at Fuel Powered that acquired over 80 million users for the platform. I then decided to try my hand as an enterprise sales representative at Anaplan, where I was a top performer and brought in multiple lighthouse deals.

Justin’s startup career began at Admob, where he architected and built AdMob’s AdWhirl to serve over a billion daily impressions. After being a part of the AdMob acquisition by Google, he followed his passion for education to University Now, where he crafted their learning management system as a founding engineer, and Cerego, where he led and grew their SF-based engineering team as it rebooted their lifelong learning platform.

Justin’s experience in education technology lead him to think about the best way to leverage this learning methodology called spaced repetition, which was super effective at teaching students but hadn’t yet found the right application. We had both spent much of our lives interested in investing and finance – Justin has also built and sold a Bitcoin casino, and helped a friend build a simple trading program in college. We had a lot of friends that knew that finance tests were a huge pain, especially since a lot of it was memorizing trivia like the contribution limit on a Roth IRA. Combining this great learning technology with our knowledge of the finance sector lead us to build Achievable.

What is your job title and what are your general responsibilities?

I’m the Founder and CEO, which means I handle all of the day-to-day sales, marketing, and partnerships initiatives.

Can you give us an overview of your business?

The FINRA Series 7 is an exam that you’ve probably heard of – newly hired financial advisors must pass before they can advise customers or sell securities. The average pass rate for the FINRA Series 7 exam is 65%, and almost all employees that fail the exam twice are terminated – rough. What you may not have known is that each terminated employee cost their firm roughly $50,000, costing large wealth management firms millions per year. Current product offerings are split into expensive in-person education or ineffective textbooks, with very few good mobile or online products that take the experience beyond the textbook.

Achievable is an online and mobile test prep built to bridge this gap. The product models a student’s memory using learning science and delivers a personalized experience, improving test scores and saving students half the time. In a 254-student pilot with a large financial firm, students leveraging Achievable scored an average of 15% higher on the applicable chapters than their peers.

Tell us how you are funded.

We are bootstrapped, which we love because it provides us the most freedom.

Why did you start the company? To solve what problems?

It is incredible to us that the pass rates for many high stakes exams are so low. Things like the Series 7, CFA, CPA, BAR Exam, and many others often have national pass rates between 45-65%. Students spend hundreds (or thousands) of dollars and hundreds of hours preparing for these exams, so what could be causing these low pass rates?

When looking at the traditional test prep industry, we realized that incumbents were not motivated to improve their students’ study experience or outcomes (aka test scores). Their product was “the book” or whatever product their student was using to succeed. Once the book was sold, the students’ success was out of the company’s hands – and they didn’t mind having it that way. We knew that through a modern online product, we could follow the student as they studied and get a lot more information about how they were doing as they learned the material. We could then use this information to adjust the course for them – giving us agency in their success. We know that this approach helps students pass these tests.

Who are your target customers? What’s your revenue model?

Our customers are people taking the FINRA Series 7 exam, generally either young people beginning their career in wealth management or more experienced professionals that had their Series 7 lapse. We charge $299 per student.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

The one change I wanted to see when I first got into this sector was the fact that people needed to first get a job and be sponsored before they could take the Series 7 or other certification exams. This seemed really frustrating for new wealth management employees and employers. Employees have to go through all of the stress of getting a banking job, only to need to pass a test to actually keep that job. If you fail the test twice, you are often let go – a huge disappointment for the employer and the employee. Now luckily, FINRA is actually changing this – they’re releasing a new exam next year that you can take without sponsorship called the Securities Industry Essentials exam, or SIE. This will be a much better system.

What is your message for the larger players in the Finance industry?

My message would be that you don’t need to accept uncertainty in whether employees will pass or fail certification tests. These failures are expensive, and they can be avoided through personalized training. The goal of Achievable is to become the Guaranteed Pass Platform – you study with Achievable, you increase your predicted score until you know you’ll pass, then you take the test, then you pass.

What phone are you carrying and why?

iPhone – I’ve had one since the iPhone 1 with AT&T unlimited data, and I’m never giving it up if I can!

Where do you get your industry news from?

I really love WallStreetOasis and WealthManagement.com, they’re both so focused on the specific interests of wealth managers and finance. I’m also a big fan of reddit.com/r/investing and reddit in general.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

I don’t spend a ton of time on Twitter lately, but maybe I should!

Can you suggest the name of an Angel Investor or VC that might be interested in being profiled?

Hunter Walk of Homebrew Ventures is a great investor that has put seed capital into some very cool fintech companies, including Chain and Bond Street.

What’s the best FinTech product or service you’ve seen recently?

I love Robinhood, more for the mobile app than the free trades. They have the best fintech mobile app on the market and show how powerful it is for consumer adoption to have a great mobile experience.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

I fully believe that we will continue marching towards widespread use of cryptocurrencies and the digital economy will lead the charge. In my training and education related corner, I am seeing financial firms of all sizes and maturity become much more technologically literate. Gone are the days where the big companies are the “slow, old dinosaurs”. Often times it is now them leading the charge and looking for a competitive advantage through use of a startup or new product. Their younger employees certainly understand the importance of technology, and a lot of these companies are giving these young leaders the resources run with those projects and make an impact.

—–

Our thanks to Tyler for answering our questions today. To find out more about Achievable, visit their web site: https://achievable.me or reach out via Linkedin or Twitter here.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.