Adam French of Scalable Capital

For today’s profile we are joined by Adam French of Scalable Capital.

Scalable Capital are members of the global FinTech industry body, Innovate Finance, and will be attending IFGS 2016 on April 11th at the Guildhall, London.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

I am Adam French, co-founder and Managing Director of Scalable Capital. I spent the last 8 years working in London in the financial services industry. As Executive Director of Commodities Trading at Goldman Sachs, I was responsible for the commodity structured products franchise including risk management and developing client solutions. Prior to this, I worked in Derivatives Trading where I was responsible for electronic trading for private clients in fixed income, currency and commodity products. It was at Goldman where I met my fellow co-founders and we realised the opportunity which was the idea behind Scalable Capital.

What is your job title and what are your general responsibilities?

It’s my job to build and run our UK business. It’s going well so far; we’ve gone from a team of one, working in my kitchen, to a team of 10, with a view of the Shard.

Can you give us an overview of your business?

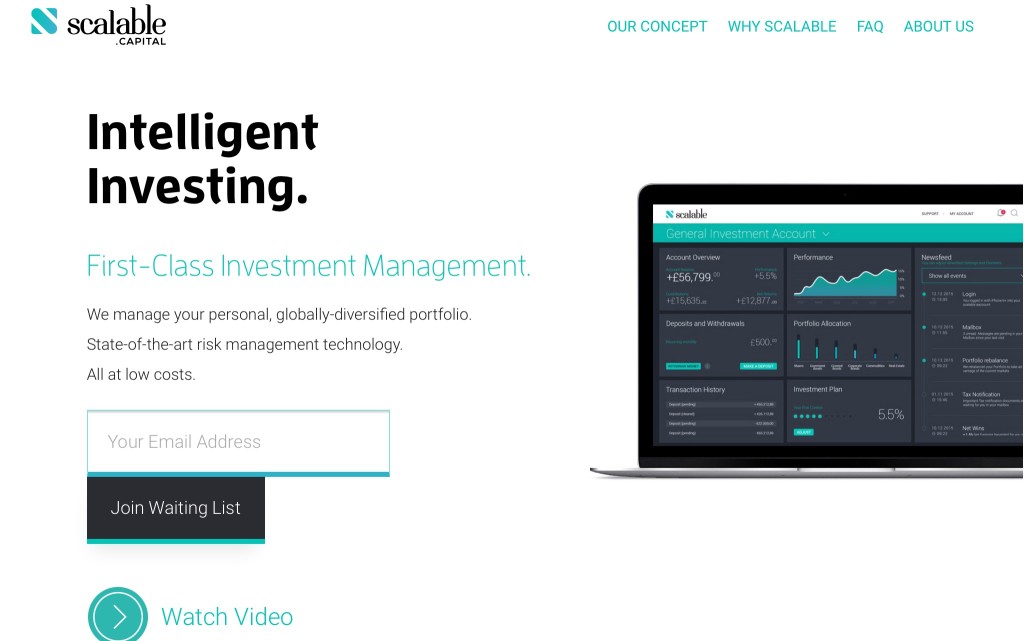

Scalable Capital is a new digital investment manager that offers savvy retail investors institutional quality products at a low cost. We have developed a proprietary model that brings something new to the robo-advice space.

Scalable Capital invests customer funds into a tailor-made portfolio of globally diversified ETFs across equities, fixed income, real estate and commodities. In contrast to other online and traditional wealth management platforms, Scalable Capital dynamically allocates each investor’s portfolio based on a quantitative measure of their risk appetite so that risk-adjusted returns are maximised in every market condition.

Tell us how you are funded.

Scalable Capital has closed one of the largest seed-funding rounds in the European FinTech scene, receiving funding of almost 4 million Euros.

Our biggest investor is Holtzbrinck Ventures, one of the most successful growth capital funds in Europe. With Monk’s Hill Ventures, we also have a well-known international investor on board. In addition, the German Startups Group is involved.

Why did you start the company? To solve what problems?

Scalable Capital is our answer to the question of what a modern, fair and professional investment service should look like. From our experience in the finance industry, we wanted to create an investment service that we could use and recommend to our friends. Unfortunately, that didn’t exist before.

Who are your target customers? What’s your revenue model?

Our service is aimed at professionals that are too busy to invest on their own and smart enough not to get ripped off. We’ve also seen vivid interest from several institutional investors such as wealth managers and family offices.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

Create empowered clients. We have an opportunity to create a more client-centric investment management service to ensure our clients are the core focus of everything we do. Hopefully this is something the banks can take onboard as well when dealing with their customers.

What is your message for the larger players in the Finance industry?

Innovate or be left behind.

What phone are you carrying and why?

iPhone 6s, to check my portfolio on the go.

Where do you get your industry news from?

City AM

FT

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Laurence Wintermeyer @lwintermeyer CEO of Innovate Finance

Anna Irrera @annairrera Trading and tech reporter at Financial News (part of @wsj)

Taavet Hinrikus @taavat CEO and co-founder of Transferwise

What’s the best FinTech product or service you’ve seen recently?

We were impressed by Revolut, the global money app connected to a multi-currency card. Revolut offers a foreign exchange and international money transfer platform supporting 23 currencies, and promises to be cheaper than the established banks. It runs through an iOS/Android app.

We made a video interview of Vlad, CTO at Revolut, check it out here.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

2016 and beyond will bring the coming of age of FinTech. So far we have seen many 1.0 solutions but we are now moving towards a 2.0 world. For example in digital wealth management we have seen the 1.0 model opening up the online world for distribution but offering the same “old-world” service under the hood. The next generation will use technology where it really matters – in the way your money is managed. Technology being used in ways which go far beyond what is currently offered by the traditional services and being solutions which were previously reserved for institutional investors to the retail investor.

– – – – –

Thanks to Adam for his answers today. You can find out more about Scalable Capital on their website, twitter, facebook and linkedin.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.