An overview of: Tamara (Buy Now, Pay Later)

Thanks to my colleague Vippin who’s contributed this summary profile overview of the Buy Now, Pay Later leader, Tamara.

Over to Vippin:

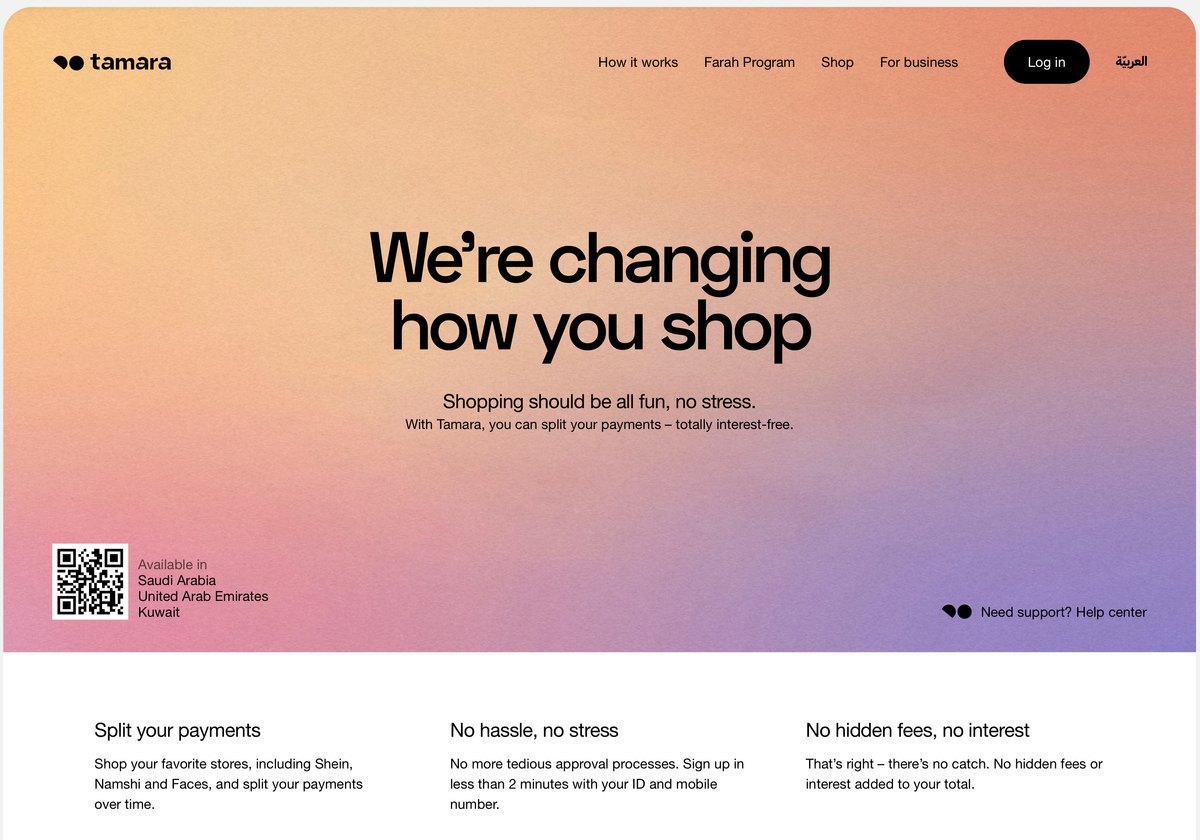

Tamara is of one of the Buy Now, Pay Later leaders here in the Middle East.

The company has over 3 million customers with more than 4000 partner merchants, which include brands like Shein, Adidas, Namshi, Swarovski and IKEA. It has customers of all age groups, but Millennial and Gen Z are the highest in number. Also in terms of gender, the share of women is higher as compared to men. It was also the first BNPL institution to be accepted into the Saudi Central Bank’s (SAMA) sandbox program, allowing it to test its products. It has expanded its reach to the UAE and Kuwait markets and is planning to cover the entire Gulf region in the future.

Tamara is MENA’s Fintech startup based on the Buy Now, Pay Later financing model. It allows customers to buy the products now and pay for them at a future date with no interest or hidden fees. This helps its customers buy big-ticket items. The main source of revenue is from the fees paid by the merchants who have partnered with Tamara. Tamara was founded by Abdulmajeed Alsukhan, Turki Bin Zarah, and Abdulmohsen Al Babtain in the year020. The inspiration was to digitize the “balance book”, a sales note-keeping system commonly found in neighborhood mini-markets. Tamara began with the aim of offering a payment solution in the shape of an electronic payment ledger for a web store.

The app received initial funding of $110 million in a Series A round by payments giant Checkout.com, which paved the way for its future success. In its series B funding round, it managed to raise $100 million under the guidance of Sanabil Investments and participants such as Coatue, Shorooq Partners, Endeavor Catalyst, and Checkout.com.

Its rapid growth is due to the pandemic, along with the support of the local authorities of Saudi Arabia, who supported the rollout. Tamara’s innovative platform offers a safer option that helps to reduce problematic cash on delivery systems that involve both customer and merchant face-to-face interaction.

The organization’s monetary system is built on strict adherence to Islamic Sharia rules and guidelines and fully agrees with AAOIFI Sharia norms.

Thanks very much Vippin. I’ll have more profile pieces about other interesting FinTech companies coming soon.

If you’d like to contribute a profile piece, just drop me a note at ewan@fintechprofile.com.