Benedikt Manigold of Cubits

Today’s profile is with Benedikt Manigold of Cubits.

Cubits is a platform to buy, sell and accept Bitcoin and was founded by Julian Mautner, Tim Rehder, Andreas Lehrbaum.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

My name is Benedikt Manigold. Having finished school in Germany (my home country) and a year travelling and working, I returned to the UK, where I had spent a year during high school already, to attend university. I obtained a degree in Management & Finance from the University of Warwick and subsequently undertook numerous internships, including some in shipping and the financial services arena. Later, I started work-ing at J.P. Morgan in London. I started out as an Investment Banking Analyst in the Technology, Media and Telecoms Team. Over the years I spent with the team advising large corporates on M&A transactions and Equity Capital and Debt Capital Markets, my focus shifted from the Telecoms to the FinTech, payments and eCommerce industries. I was intrigued by the fundamental change the payments industry was undergoing, and the enticing propositions of up and coming FinTech businesses.

At Cubits, we focus on cryptocurrency and blockchain technology, contributing to what we think is one of the most innovative and disruptive aspects of the financial industry. Mobile payments and digital currencies will be implemented fully into consumers’ buying behaviour soon. FinTech and the way we transfer value are something that touches everyone around you, and therefore is a great place to be.

My partners and colleagues at Cubits are an international bunch, with back-grounds in finance, Internet entrepreneurship, computational Intelligence/science and marketing. The majority of Cubits employees are working in the field of IT, front and backend development. The rest of the team is working in the fields of Marketing & Sales, Product Development and administrative fields.

What is your job title and what are your general responsibilities?

As Cubits’ CFO I spearhead our finance and data analytics efforts. My duties are mainly within the scope of finance & accounting, business modelling and the presentation of performance indicators. Some of the work in that respect, including the securing of sufficient capital, will change or increase as the business matures. We constantly try to improve our processes and transaction handling, as well as adding to our portfolio of partnerships with payment gateways and processors. I actively take part in all monitoring and streamlining of processes as well as communication with our partners and partners-to-be.

However, I also spend a lot of time on regulation and licensing, and try to provide input in all aspects of strategic decision-making and product development. We are all quite close to the product, regardless of our position within the company, and are passionate about driving the understanding of digital payments and digital currencies.

Can you give us an overview of your business?

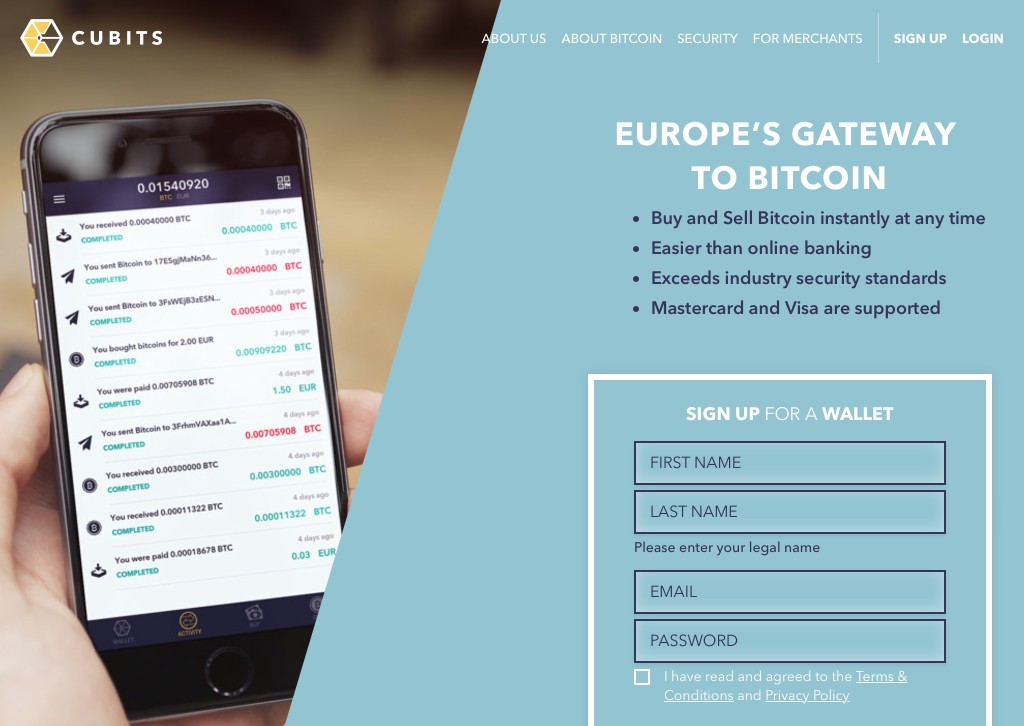

Founded in 2014, Cubits is an all-inclusive platform to buy, sell and accept Bitcoin. Our easy-to-use interface allows users to buy and sell Bitcoin instantly with 17 supported currencies.

The Cubits Wallet offers secure Bitcoin storage and easy Bitcoin transfers and payments. We work in tandem with Onlinebanktransfer.com, Sofort, OK Pay, SEPA and Swift to offer our customers a fast and easy buy and sell process.

Cubits’ flexible API also allows merchants to accept Bitcoin immediately, offering various shopping cart plugins including Shopify, WordPress, Magento, Shop-ware or osCommerce.

We are a full-service Bitcoin service provider, because we want everyone to use Bitcoin, everywhere.

Tell us how you are funded.

Until now, Cubits is in private ownership and self-funded. We are however open to commercial partnerships and external funding, and are reviewing our options in that context.

Why did you start the company? To solve what problems?

We are passionate about solving existing problems, about helping to make things run quicker, smoother, and more efficient. In terms of payments or general transfer of value between two parties, Bitcoin helps us do exactly that. eCommerce, as well as the wish to send money from one end to the world to another, should be easier than via traditional methods never designed for today’s technological capabilities. Bitcoin has the potential to solve many of the issues associated with the way we transact, for individuals and businesses alike and at the same time.

With our mission “One world, one currency”, we want to build the future of finance. By combining the power of Bitcoin and the blockchain with traditional financial tools, we offer a way to introduce a new era of finance, where payments are faster, cheaper and more secure.

We follow the vision to “Make Bitcoin easy to use”. We aspire to be the biggest blockchain-based financial institution in Europe – leaders of finance fit for a global society – empowering instant financial communication between anyone, anywhere in the world.

Who are your target customers? What’s your revenue model?

We mainly target Bitcoin “Early Adopters”. Those are people who may have heard about Bitcoin or have paid with Bitcoin before. The reason for that is that we are a Europe-based company and compared to China and the US, the Bitcoin adoption is slightly slower. We want to capture those who have a general interest in technology first, those who are willing to think forward and who use innovative products. Beyond this target group, it is our goal to educate more about Bitcoin and to provide a more in-depth understanding of how Bitcoin really works and why one should use it. In the long term, we obviously want to help build and address the mainstream market and get online-shoppers using cryptocurrencies.

On a B2B level, we are focusing partially on the gaming industry, because Bitcoin offers many advantages for online gamers and operators alike. Within this industry, digital currencies in general are already enjoying popularity and we offer them the best suite of products and services out there.

We further address benefactors, people who are willing to donate money for those in need. We do not charge any transaction fees for incoming donations, because we believe donations shouldn’t cost anything. Therefore, we want to motivate more donors to use Bitcoin instead of credit cards, because a large amount of the money is, frankly, wasted on paying transaction fees. Our current Bitcoin Donation Project (https://donate.cubits.com/en.

Quotes from customers:

1. “Since I started using Bitcoin in 2011, I’ve used a lot of wallets -¬ so I can say the Cubits Wallet is the fastest and most user-friendly¬ wallet in the ecosystem.”

(Aleksandr Kievi OS Services Entrepreneur and Bitcoin Early Adopter)

2.“Cubits offers the most user-friendly bitcoin acquisition platform available today. Verification is easy, and no need to wire money days before making a purchase.”

(Dennis Amsterdam PhD Student and Lecturer in Literary Studies)

3.“Using Bitcoin helped us save so much money on our honeymoon trip backpacking across Europe. We exchanged Bitcoin to local currencies instantly with Cubits so we didn’t have to pay for expensive exchange rates.”

(Daniel and Maria Warsaw Designers usingBitcoin since early 2013)

If you had a magic wand, what one thing would you change in the bank-ing and/or FinTech sector?

I would increase the speed and security of money transfers. Efficiency and safety, at competitive cost, are the crucial aspects of transactions. If you can combine these while taking trust issues between unknown parties out of the equation – jackpot! Transactions based on the blockchain allow for exactly that, with only the currently limited liquidity in the way of a perfect global payments network. As you can combine “instant”, “free” and “global” with conditions that are cryptographically built into the transfer, there are no intermediaries needed. No centralised risk. No stolen personal data.

Since the blockchain can already do these things, the “magic” would be to get global institutions on board. The in and outs of the blockchain, the gatekeepers so to say, are currently banks and financial institutions. If the network were to expand to include these, to a certain degree to not diminish the blockchain’s core features, then this network could really live up to its’ potential.

What is your message for the larger players in the Finance industry?

“The financial revolution has just begun. Be prepared for a dramatic change over the next couple of years. A change within the consumer behaviour and a change in how technology changes the way people communicate financially. Blockchain technology is at our door step and will soon disrupt the banking system, empowering anyone connected to the Internet.”

What phone are you carrying and why?

I use an IPhone for most of what I do. I like the interconnectivity with other Apple products I use, plus I like the wealth of applications available and ease of use. For our proprietary monitoring systems and in-house analytics tools though I use an Android-based phone.

Where do you get your industry news from?

I usually stay up-to-date with most of the common financial and tech news outlets, online and in print. On the Bitcoin scene, there is Coindesk, Newsbtc, Bitcoin Magazine and Cointelegraph, but Reddit and other platforms for Bitcoiners tend to be the best places to turn to if you want to really get the implications of the news straight.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Jon Matonis, @jonmatonis, Founding Director of the Bitcoin FoundationMarc Andreessen, @pmarca, Entrepreneur, Investor, and Software Engineer

Cameron & Tyler Winklevoss, @winklevoss / @tylerwinklevoss, Bitcoin co-founders and investors

What’s the best FinTech product or service you’ve seen recently?

I appreciate services such as PayNearMe, an electronic cash-transaction net-work, that enable consumers to make purchases, pay rent, bills or make transfers without relying on traditional banking. The movement of businesses and services online is a major obstacle for cash dominant consumers and merchants.

Generally, products and services aimed to solve real problems of consumer finance are fun to watch, as they prove that solutions can often be much simpler when reached with a bit of creativity and without the lack of agility that hinders many large multinational companies.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Running the risk of repeating myself, I cannot stress enough how big of an impact we attribute to the blockchain over the coming years. As more and more banks are currently looking into blockchain technology, the sector is really heating up on all ends. There will be new ways in which people transact globally, one that is above the rules of politics and geographical borders, and truly about efficiency and inclusion. Those around the globe that are not part of our traditional financial system yet will be gain access to a wealth of services that make their lives easier, as will everyone who is already part of the financial world. But inclusion is a major driving force.

Apart from that, I believe that we will see a lot of interconnection between the Internet of things and digital payments. Cars that pay the meter themselves or pay their fuel, heaters that automatically pay for the electricity used, etc. There will be much more precision and timeliness when it comes to smaller, trickling payments for all sorts of things. We are very much looking forward to what is to come.

– – – – –

Many thanks to Benedikt for his answers today. You can find out more about Cubits on their website, Twitter, Facebook, Google+ and LinkedIn.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.