Christian Gabriel of Capdesk

Today we are joined by Christian Gabriel of Capdesk.

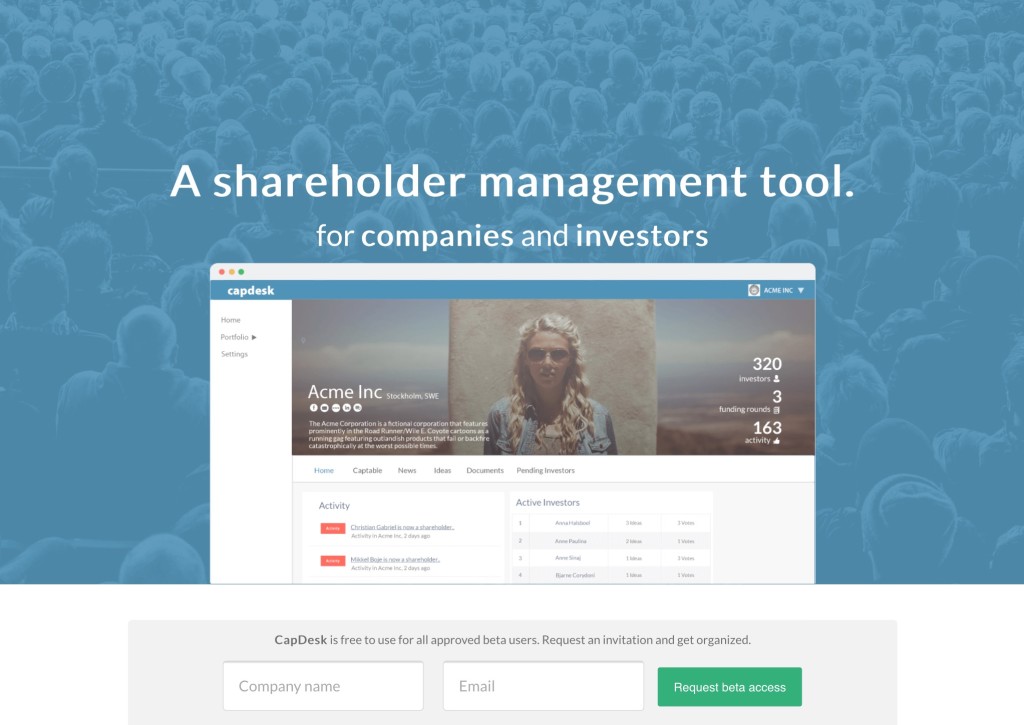

Capdesk is a social shareholder platform.

– – – – –

Who are you and what’s your background?

My Name is Christian. I have been working with alternative finance since its very beginning. I started by broadcasting investments opportunities from an old theatre in Copenhagen. Then I started working as a country director for FundedByMe – the biggest equity crowdfunding platform in the nordics. After some years working in equity crowdfunding, I decided to found Heartreacher, a crowd consultancy helping all through the process of crowdsourcing and crowdfunding. I found that in order to really succeed with equity crowdfunding, we need to reinvent the way we handle unlisted shares, so I created the social shareholder platform Capdesk. Other than that I have studied computer science and communication at the University of Copenhagen and have been a competitive tennis player in my teens.

What is your job title and what are your general responsibilities?

Founder. My job is to reinvent the way we handle unlisted shares from scratch together with my fantastic team.

Can you give us an overview of your business?

Capdesk is the worlds first social shareholder platform. Our mission is to make shares more than a column in a spreadsheet and bring them to life. By providing companies with a social shareholder page and digitalizing their entire captable, we can create new experiences for shareholders in unlisted shares. In short we aim to be a merge between computershare and facebook.

Tell us how you are funded.

We are funded by

– Nicolaj Højer – a wellknown Danish business angel.

– The Danish Innovation Fund

Why did you start the company? To solve what problems?

I started Capdesk, to solve all of those problem I experienced when working with equity crowdfunded companies and their shareholders. Equity crowdfunding helps sell shares, we help administrate them.

Who are your target customers? What’s your revenue model?

Our target customers are unlisted companies with +100 shareholders. We earn money buy selling the software as a subscription based service.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

Governments not owing money to banks

What is your message for the larger players in the Finance industry?

Don’t see banking as a financial supermarket. Find one product and perfect it.

What phone are you carrying and why?

iPhone 6, fast and beautiful

Where do you get your industry news from?

The Economist. Altfi, wired

Can you list people you rate from the FinTech sector that we should be following on Twitter?

@henrysward

Can you suggest the name of an Angel Investor or VC that might be interested in being profiled?

Nicolaj Højer Nielsen

What’s the best FinTech product or service you’ve seen recently?

Angellist

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Payment: Makes no sense how many people are still using expensive services like Paypal and how far emerging regions like Africa is compared to the west

Insurance: Insurance is all about trust and a bank account, still it has not seen much change, this will change.

Home loans: Why don’t you know the people who have invested in your homeloan, and why should the bank earn money on doing the due-dilligence, they have showed several times they are not fit to do so. Wisdom of the crowd will emerge also in this field.

– – – – –

Thanks to Christian for his answers today. You can find out more about Capdesk on their website, twitter and LinkedIn.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.