Christian Tiessen Of Savedo GmbH

For today’s profile we are joined by Christian Tiessen from Savedo GmbH.

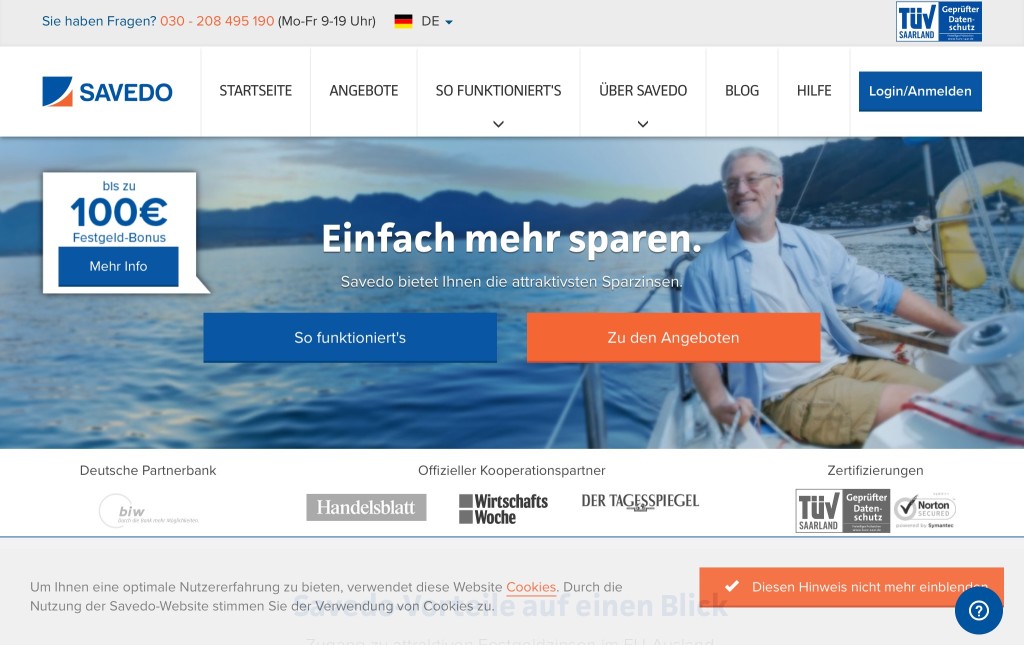

Savedo GmbH are a European Online Platform for Financial Assets. Founded by Christian Tiessen and Steffen Wachenfeld.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

My name is Christian Tiessen. I studied Business in Germany, Singapore and Spain. After a few experiences in consulting and corporates, I founded my first start-up in e-commerce when I was 24. I helped scale it up, we grew rapidly, and within a very short period of time were acquired by the American company Fab followed.

Now, Financial Services is a sector that is just at the beginning of a massive change, which makes it a very exciting space for me to work in. Especially as I can leverage my know-how obtained at prior experiences to build a great consumer brand. Therefore, it was the logical next challenge. I felt that starting a business in the FinTech space right now could give me the opportunity to create something meaningful and make a real difference.

What is your job title and what are your general responsibilities?

I am co-founder and managing director at Savedo. I am responsible for the distribution and marketing of Savedo’s products, the internationalization of the platform, and the company’s finances.

Can you give us an overview of your business?

Savedo is an online platform where private individuals from Germany, Austria, and other European countries can invest in safe and lucrative savings products provided by partner banks from all across the EU. The company operates as a portal for the involved banks to enter new European markets and gain access to new customer segments. On our platform banks can list their products and customers can access these offers from abroad without even leaving their sofa.

To go a little bit deeper: For private customers Savedo supports paperless processes, which makes investing in other countries very easy. Product offers, application forms, and all other documents are provided in one’s own language. Customer care is also in our customers’ mother tongue. Another part of our product is an online banking functionality that allows customers to manage their bank accounts across multiple banks, at the same time guaranteeing highest safety and quality standards.

Tell us how you are funded.

We are backed by multiple international investors, both VCs and Business Angels.

Why did you start the company? To solve what problems?

The German market is one of the biggest savings markets in the world, with over 2 trillion EUR in savings. Imagine trillions of euros, resting in accounts with little to no returns. Still, most savers are loyal to their banks for several reasons – mostly because of habit or lack of alternatives. So, we brought high-yield saving products to Germany and made hopping from one bank to another as fast and as unproblematic as possible. On top of that, our products, compared to most other investment forms, are very safe. Deposits within the European Union are protected up to 100.000 EUR per customer per bank according to EU regulation. A unique selling point advertising foreign products to customers who are best known for their conservative attitude towards investments.

Who are your target customers? What’s your revenue model?

Everyone who has stashed some money on his account over the years (the minimum investment sum with Savedo is 5000 EUR) could invest with us. We are currently operating in three European markets – Germany, Austria and the Netherlands – expanding to other European countries has been on our agenda from day one. The goal is to become the largest European platform for retail investors.

Currently our core target group are people in advanced age who have a good chunk of money on their bank accounts and a preference for more risk-averse financial products or want to diversify their financial portfolio. Eventually, we will address the needs of younger target groups as well.

On the revenue model: our partner banks currently pay us commissions for the deposits brokered. At the same time, our service is completely free for the customer.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I am not the type of person for fantasizing. Change is happening anyhow. What banking needs are not miracles, but hard-working professionals who strive to make a true difference for the customers.

What is your message for the larger players in the Finance industry?

I guess one of the things more bank CEOs need to realize is that the future of banking lies both with banks and the new market players such as FinTechs. Many bank managers see FinTechs as either an annoying newcomer whom they gladly ignore, or a threat they will need to deal with in a near future, but certainly not now. This is a big mistake – banks need to keep moving, changing, and constantly improving. FinTechs are challengers, but they will be useful allies as well. By establishing strong collaborations, banks and FinTechs together can substantially improve customer experience and deliver better retail financial products.

What phone are you carrying and why?

I have an iPhone 6. It fits best to my phone case 😉

Where do you get your industry news from?

Linkedin, Twitter, Medium, my personal network for business / sector news. On general news, I have subscribed and regularly read German weekly newspaper DIE ZEIT.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Nigel Verdon @nigelverdon, Pascal Bouvier @pascalbouvier, Nasir Zubairi @naszub

Can you suggest the name of an Angel Investor or VC that might be interested in being profiled?

Rodrigo Martinez from Point Nine Capital.

What’s the best FinTech product or service you’ve seen recently?

As I am a big UX enthusiast: not entirely sure yet whether it will be the best solution in the market, but definitely intrigued by Berlin-based Cookies.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

FinTech is disrupting all traditional fields of banking. There is a FinTech company for almost all services provided by banks, but disruption is not taking place at the same pace everywhere. Currently we are observing the phase of payment disruption, lending is still on the rise, especially insurance is gaining more and more traction. But if you look at the market and investigate deeper into the disruption potential, for me the largest opportunities still lie within the asset management field.

– – – – –

Thanks to Christian for his answers today. You can follow him on twitter and LinkedIn. To find out more about Savedo GmbH check out their website, twitter, facebook and LinkedIn.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.