Clare Flynn Levy of Essentia Analytics

Today we are joined by Clare Flynn Levy from Essentia Analytics.

Essentia Analytics produces cloud-based software that provides professional investors with an accurate, continuous feedback loop to help them make better investment decisions.

Let’s get cracking with her profile answers, our questions are in bold.

– – – – –

1. Who are you and what’s your background?

I’m an American who found my way to London in the mid-90s and carved out a niche as a tech specialist fund manager, first on the long-only side with Morgan Grenfell Asset Management, and later on the hedge fund side with Avocet Capital. I “went native” into buyside fintech when I became President of Beauchamp Financial Technology, and have been involved in the industry ever since, as a hired gun, a consultant, and now an entrepreneur.

2. What is your job title and what are your general responsibilities?

As the Founder and CEO of Essentia, I’m focused on assembling a team of ex-fund managers, neuroscientists and world-class technologists, and inspiring them with product vision to create something truly novel. I spend a lot of my time speaking with customers and investors, but also thinking about the user experience – after all, Essentia is the software I wish I had when I was a fund manager.

3. Can you give us an overview of your business?

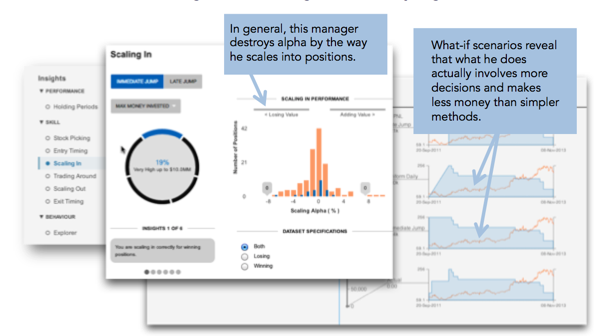

At Essentia, we provide software and expertise that gives fund managers a better understanding of their ownbehaviour and the context surrounding their investment decisions. I like to think of it as holding a mirror up to your process and performance – you get an authentic, accurate picture of where you’re adding the most value and where you’re tripping yourself up, so that you can play to your strengths and maximise your return on energy expended. That is useful if you are an individual portfolio manager, analyst or trader, but it’s also useful if you’re a CIO who wants to be effective in coaching his or her team members.

Essentia looks at different elements that impact investors’ behaviour and decision making from a range of sources, from the obvious (past trading data) to the not-so obvious (CO2 levels and sleep patterns, for example).

Ultimately we can use as much or as little data as the investor wants to provide to inform our analytics. We’re applying the latest behavioural finance research in what we do – much of it hasn’t been attempted outside of a university setting before – and we’re creating a data-driven feedback, much like what an athlete would use to achieve excellence. All of this makes Essentia a really exciting place to work – we truly are at the cutting edge of our field, and we believe passionately that professional investors can use technology like ours to continuously improve performance.

4. Tell us how you are funded.

We’re a privately-owned company funded by founders and angel investors from the fund management and technology industries.

5. Why did you start the company? To solve what problems?

Essentia is the software I wish I had when I was managing money. Human fund managers have never been under more pressure to prove that they add value; investors are realising that performance is at least as much a measure of luck as it is of skill. With limited hours in the day and unlimited information to digest, people who make investment decisions for a living need tools to help them to execute their investment processes in a convenient, repeatable and measurable way; they need a data-driven feedback loop to help them maximise return on energy expended, just like athletes. Those who manage investment managers for a living need tools for maximising team performance, just like athletic coaches. The problem has existed forever –only now has technology made it possible to solve via an off-the-shelf product.

6. Who are your target customers? What’s your revenue model?

Our target customers are those professional investors who want to improve their performance and maximise their skills – really, that’s almost every fund manager out there. We work with hedge funds of all sizes and large asset management houses that want their active managers to be truly active. They pay us to identify what their managers do best and where they can make improvements, then to use technology to facilitate that improvement.

7. If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

We’re out to change the status quo in investment management – I’d like to see more senior fund managers recognise that behavioural data analytics is neither touchy-feely nor scary – it’s the way forward.

8. What is your message for the larger players in the Finance industry?

Stop paying lip service to innovation and just do it. Create a path for truly innovative technology vendors to start working with your company quickly and easily, or make it truly worth their while to go through your procurement process.

9. What phone are you carrying and why?

An iPhone 6+. It’s a hand-me-down. I thought I’d hate the size, but I actually really like it.

10. Where do you get your industry news from?

Bobsguide

Citywire

Alpha Journal

11. Can you list 3 people you rate from the FinTechsector that we should be following on Twitter?

Innovate Finance, @InnFin: an industry body for the UK FinTech community

London Tech Advocates, @techlondonadv: a private-sector group supporting the London tech community.

Lauren Foster, @laurenfosternyc: covers behavioural finance and wealth management for the CFA Institute.

12. What’s the best FinTech product or service you’ve seen recently?

My nanny is a big fan of Azimo for sending money home.

13. Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

I think we’re going to see tech that empowers more humans to make more proactive and considered financial decisions. From robo-advisers to crowdfunding to tools like Essentia, I’m talking about technology that empowers humans, rather than replacing them; software that does the heavy lifting on analysing and communicating information about investment opportunities, risks and options, and supports humans in making decisions, which is still the thing that we do better than computers can.

– – – – –

Thanks to Clare for her answers today. Please check out Essentia Analytics on their website, twitter and LinkedIn.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.