Eamon Jubbawy of Onfido

This week’s profile is from Eamon Jubbawy of Onfido.

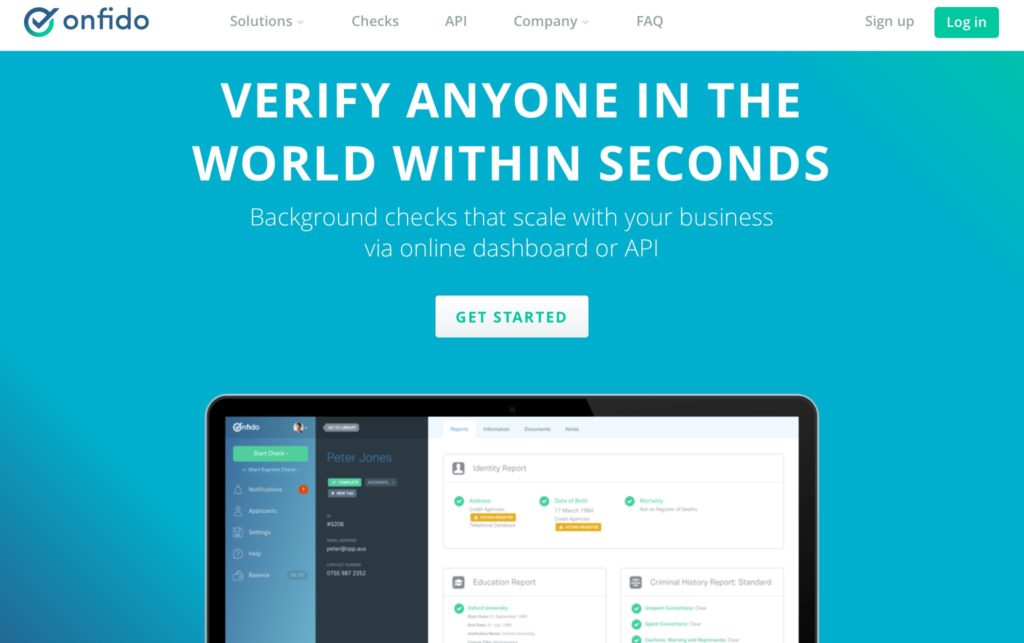

Onfido, a data-driven platform providing automated background checks for FinTech AML (Anti-Money Laundering) and sharing economy users, was set up just over two years ago by young entrepreneurs Husayn Kassai (25), Eamon Jubbawy (23) and Ruhul Amin (27). Having completed their studies at Oxford, the University participated in Onfido’s seed round in 2012.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

I’m Eamon, one of the co-founders at Onfido. I studied Economics and Management at Oxford University, where I met my co-founders Husayn and Ruhul.

Husayn and Ruhul were friends who had worked together on a previous project. Husayn also served as the President of Oxford Entrepreneurs, where he worked closely with me (as I was the Vice President), which was how the team came together.

Around three years ago, we founded Onfido, a platform that uses innovative technology to provide Anti-Money Laundering (AML) or Know Your Customer (KYC) checks to the financial sector.

What is your job title and what are your general responsibilities?

My role is COO – broadly speaking, I manage Onfido’s growth and international expansion. On a daily basis, I am in charge of managing Onfido’s recruitment processes (ensuring we hire only the very best talent), operations (ensuring the business runs smoothly) and the company culture.

Can you give us an overview of your business?

Trust is the backbone of the new global economy and we are in the business of helping companies build trust with the people who matter most to them. We offer a self-service platform through which companies can collect and verify information about their employees or customers.

Traditional background checking companies are heavily reliant on labour intensive processes whereby checks are processed completely manually by human data processors. We take the human touch out of this by automatically aggregating and delivering data and only intervening when there is a problem. By automating the process, we speed up the turnaround times as well as reducing the costs and the number of human errors compared to other background checking providers.

Tell us how you are funded.

We have received a total of $5.4m in funding. Our seed funding came from Oxford University, Said Business School and angel investors.

Our Series A is led by Wellington Partners (investors in Spotify and Dropbox) with participation from CrunchFund (Airbnb and Uber) and BrightBridge Ventures.

Series A angel investors include:

● Brent Hoberman (co-founder, Lastminute.com)

● Nicolas Brusson (co-founder, BlaBlaCar)

● Frédéric Mazzella (co-founder, BlaBlaCar)

● Greg Marsh (co-founder, Onefinestay)

● Spencer Hyman (co-founder, Artfinder)

● Dan Cobley (former MD, Google UK)

Why did you start the company? To solve what problems?

The three of us had interned and worked in the City and been through the slow, frustrating and cumbersome background checking process as applicants. We also knew from speaking to large companies while we were at Oxford Entrepreneurs that background checks were a huge pain point for them. We set out to use technology to solve that problem, and that’s what we’re striving to achieve.

Who are your target customers? What’s your revenue model?

Our target customers are any financial or FinTech customers who need to carry out Anti-Money Laundering (AML) or Know Your Customer (KYC) checks. This involves banks and large financial clients as well as startups in the FX or money transfer spaces.

Clients like Enterprise Finance love that they can rely on our pay-as-you-go pricing model whilst enjoying our match-rate guarantee: in other words, we guarantee that our data coverage is better than any other provider or your money back!

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

Business and technology are moving at such an incredible pace in today’s world that financial regulation is struggling to keep up with the developments that are occurring. In the FinTech space, there are companies that innovate new models and successfully grow but are sometimes held back as a result of outdated regulation. The traditional regulation model is broken and there needs to be earlier dialogue between the regulators and the innovators.

What is your message for the larger players in the Finance industry?

Although it’s often daunting to deal with a startup, the potential benefits very often outweigh the potential drawbacks. There’s too much of a “nobody ever got fired for choosing IBM” mentality, which delays many great technologies from being adopted earlier. I would recommend recognising that startups tend to be better, faster and cheaper and therefore well worth starting a trial with.

What phone are you carrying and why?

An iPhone 5 – because I haven’t got round to upgrading yet!

Where do you get your industry news from?

Finextra are a great source of FinTech news – I’d definitely recommend it to everyone in the space. Apart from that, The FT is the ultimate go-to source for finance.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Sally Davies (@daviesally) is a Tech reporter @FinancialTimes who is doing great work on the FinTech scene.

Innovate Finance (@InnFin) are holding some really important events for the FinTech sector.

Russ Shaw (@RussShaw1) is the Founder at Tech London Advocates and doing an excellent job of building the FinTech ecosystem.

What’s the best FinTech product or service you’ve seen recently?

The way that Seedrs and Crowdcube have democratised startup investing is truly remarkable – I love them both!

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

I think we’ll see the intersection between wearables and FinTech develop over the next few years. However, I should add that although the early adopters will lead the way in 2015 and 2016, we won’t see it become widespread until robust enough technology is developed to allay people’s fears about security and privacy.

– – – – –

Many thanks to Eamon for his answers today. You can follow Onfido on twitter too and LinkIn with Eamon here.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.