Eduardo Amo of Dato Capital

We’re back with another profile. This time we have Eduardo Amo of Dato Capital which provides corporate and financial information about companies and directors to a global market.

All our questions are in bold.

– – – – –

1. Who are you and what’s your background?

My name is Eduardo Amo and I’m a Computer Engineer specialized in Artificial Intelligence, Machine Learning and Search Engine design.

I got my MSc at the European University of Madrid in 2000 and the final year project was a search engine based in the HITS algorithm, very similar to Google’s PageRank. In fact, Google appears in the project as an example of another interesting approach based on the analysis of the hyperlinked structure of the web.

In the latter years at college I learned to analyse and process large amounts of data, especially for training neural networks and other machine learning algorithms.

Some of those datasets were based on biology data (one of the better fields to use those kinds of algorithms) and others were based on stock market data, and that stirred my curiosity for the FinTech world. I was an intern at an engineering company for some months, and later I joined IBM to develop human resources applications. When I graduated, I joined IBM Global Services as an IT Consultant, and one of the first projects was the design of an online banking service. That was my first FinTech job! Some years later I joined Oracle Corporation and I worked in other projects at various banks. After that, I started my company that developed financial related applications (procurement, workflow, ad management) for several years until we started Dato Capital. I’m also president of the Electronic Sector in the Open Data Companies Association of Spain (ASEDIE)

2. What is your job title and what are your general responsibilities?

My job title is Managing Director, and I deal with international agreements with data sources, worldwide regulatory policies about corporate information, and different meetings with the association, government sources and large clients.

3. Can you give us an overview of your business?

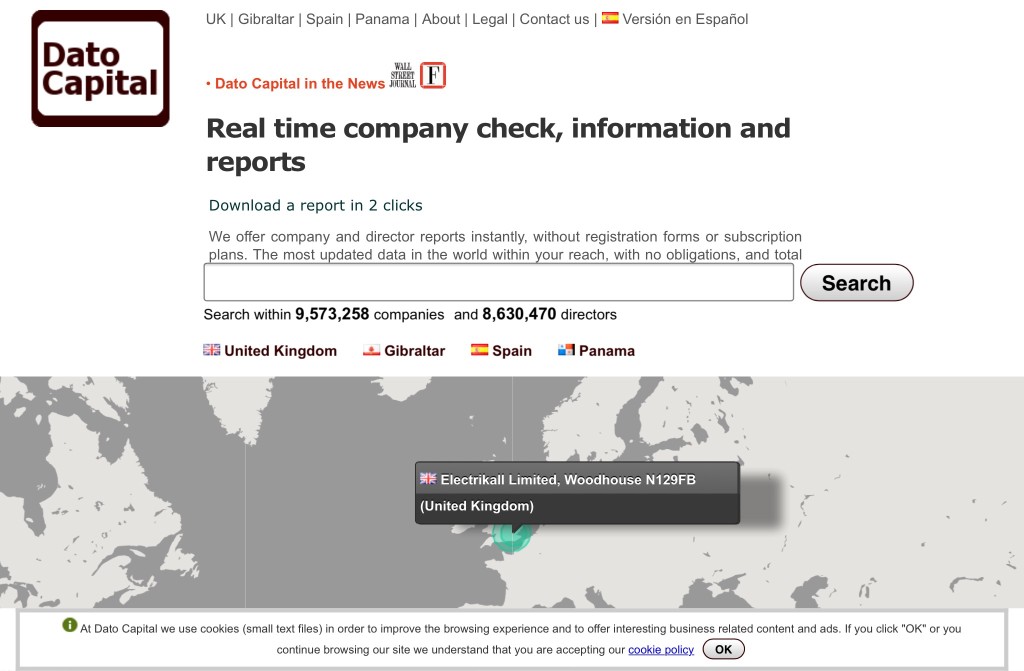

Online selling of corporate and financial information about companies and directors. Currently we cover the United Kingdom, Gibraltar, Spain and Panama, and more countries to come.

Our selling point is to offer the maximum information available in a simple, fast and clean interface.

For each company or director we have no more than two reports available, and they can be downloaded with two clicks, with results in minutes. The information includes financial statements, annual accounts, charges, mortgages, commercial data, shareholders, original documents, deeds, related companies and directors, trade and customs data, etc..

We sell the information on demand in a fee for service model. Our strong point is our technology. We have a proprietary and scalable platform that uses AI and Big Data technologies to process massive amounts of data very fast. Apart from the reports we sell on our website, we also work with other institutions and journalists to provide custom advanced reports. Many of our competitors don’t have their own database for each jurisdiction they work with, and buy the information from third parties. We process all the data sources directly, and there are several hundred of them.

4. Tell us how you are funded.

Dato Capital is a bootstrapped company.

5. Why did you start the company? To solve what problems?

It’s exhausting obtaining accurate information about companies and directors online, there are many websites but they are either too expensive, too complicated or have subscription requirements, and always provide too few details – so don’t represent good value for money. Dato Capital makes it simple. We offer the most data available, you know exactly what are you getting and when, and you don’t have to sign up for anything. Another reason for starting the company is the amazing computing challenge it represents.

6. Who are your target customers? What’s your revenue model?

More than 9,000 people have used our services so far. Our target customer is anyone in need of extensive, detailed and official information about a company or a company director. Key customers include lawyers, accountants, banks, tradesmen, auditors, governments, and law enforcement agencies. We help many customers urgently find financial information about companies in offshore jurisdictions.

7. If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I would make the Procurement departments of banks more accessible. Every FinTech startup must have an accessible channel to offer its products and services. This is a huge blocker, since there are already FinTech startups that could help banks save money and they can’t reach the key people at banks.

8. What is your message for the larger players in the Finance industry?

Take nothing for granted and be open for new technologies and partnerships with small players, because the finance world is going to change dramatically over the coming years.

9. What phone are you carrying and why?

Samsung Galaxy S4 because it’s powerful, fast, reliable and has the best mobile OS available.

10. Where do you get your industry news from?

Fortune Magazine and Financial Times.

11. Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

@lisafleisher – WSJ Tech Reporter about FinTech

@leimer – another banker interested in FinTech

@aden_76 – banker interested in FinTech

12. What’s the best FinTech product or service you’ve seen recently?

I find TransferWise very interesting. The concept is simple, the interface is clean and well explained. The same as Dato Capital

13. Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

-Security: As the number of FinTech startups increases, sooner or later there are going to be financial data breaches that are going to hurt the image of FinTech startups. Traditional banks are going to take advantage of this and the startups must be prepared (see Mt.Gox)

– Innovation: Also, traditional banks are going to innovate,

either copying FinTech startup models or developing their own.

–Regulation: One important downside that could come from data breaches. Governments can, and they eventually will, regulate against FinTech startups – so that is another trend to watch.

– – – – –

Thanks to Eduardo for his answers today. You can follow Dato Capital on twitter and you can reach out to Eduardo on LinkedIn.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.