Filip Karadaghi of LandlordInvest

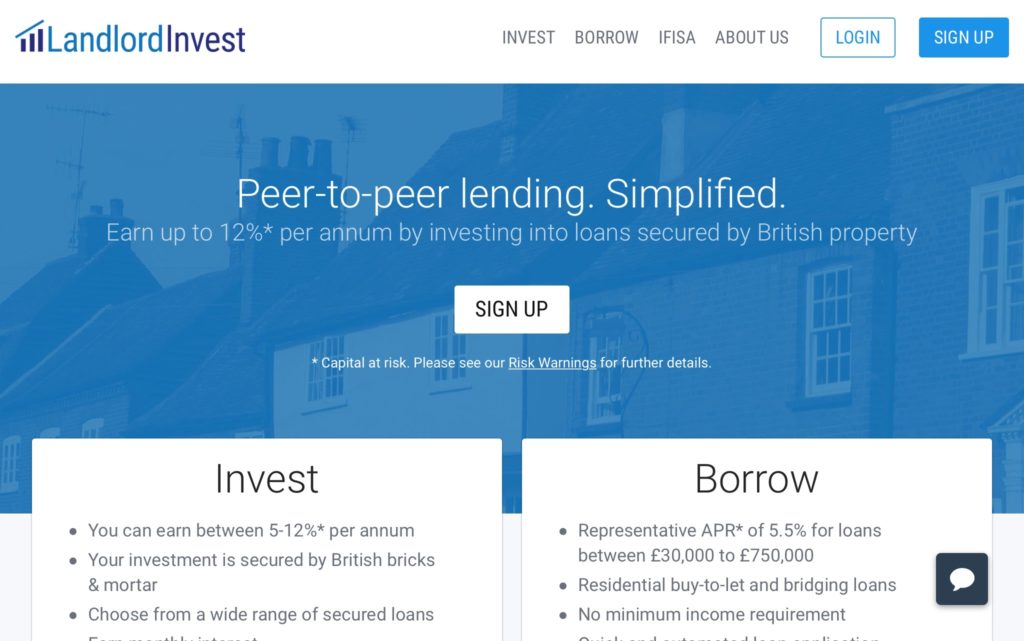

Back again with another profile and we have Filip Karadaghi this week from LandlordInvest; a fully FCA authorised Peer-to-peer lending platform for real estate loans.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

I went to University in Sweden and came to the UK immediately upon graduation. I worked for various City companies and at a single family office until I decided that I needed to try something new and decided to follow an old dream of becoming an entrepreneur. I did not have an idea when I left my corporate job but me and the co-founders quickly realised the benefits with peer-to-peer lending and saw the tremendous opportunity that it presented for both borrowers and lenders.

What is your job title and what are your general responsibilities?

I am both the CEO and the company’s Compliance Officer and have therefore responsibility for the overall management of the company together with ensuring that we always meet our regulatory objectives and requirements. Each day is different and I spend much of my time dealing with borrowers and lenders, working on new and existing deals on our lending platform whilst also ensuring that our compliance objectives are met on a daily basis and carrying out routine daily admin tasks.

Can you give us an overview of your business?

We are a peer-to-peer lending platform for residential and commercial property-backed loans. We were one of the first platforms for real estate loans that became fully FCA authorised and is the first platform of this kind to offer investors the possibility to earn tax-free returns by investing through the new Innovative Finance ISA, which became available this tax year.

Tell us how you are funded.

The initial funding came from the co-founders and subsequent rounds from angel investors. We are proud to be a lean start-up and try to keep as much as possible in-house which makes us more agile and flexible compared to many of our competitors.

Why did you start the company? To solve what problems?

We believe that there are few opportunities for investors to earn stable income without exposure to or correlation with the volatile stock market. We give our investors the ability to earn monthly income, with returns of up to 12% per annum secured by one of the UK’s best performing asset classes: residential property.

Who are your target customers? What’s your revenue model?

We generate our revenue from the borrower from two sources:

(1) An loan arrangement fee of up to 2.5%

(2) A annual loan Servicing fee of 1%

Our lenders are not charged any fees.

We service the entire country, and our customers come from all walks of lives, professions and age. Our new IFISA product tends to attract people mostly outside of London, which is interesting as we would imagine that Londoners would be quicker to try new innovative products.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

The retail banks in the UK are extremely inefficient and it takes lots of time and effort to do even the simplest of things. We mainly bank with one of the larger banks and they are an absolute nightmare to deal with. Even the simplest things takes hours to complete. Lots of that probably has to do with their regulatory requirements but much can also be attributed to out-of-date and inefficient systems. The banks still operate as they do not have any competitors and I believe that they are in for a surprise if they continue on this path.

What is your message for the larger players in the Finance industry?

Customers like efficiency and ease of doing things. The major banks unfortunately do not offer that.

What phone are you carrying and why?

I have a Samsung galaxy S7 Edge. I have always been a fan of Android phones due to their functionality and ease of using work related apps and actually never owned an iPhone.

Where do you get your industry news from?

FT for daily business and finance news and the Economist on the weekends for global events.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

I don’t really have time to follow other people in the sector, but if I would, I’d probably follow the founders of Transferwise as I believe that their service adds real value in a more globalised world.

What’s the best FinTech product or service you’ve seen recently?

I believe that our property-backed Innovative Finance ISA, giving investors the possibility to earn up to 12% per annum tax-free, is one of the best things that came to the market this year!

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Banks have too long had a monopoly over everything related to finance, including personal finance, currency exchange, saving and investing. They are being, and will be, bypassed by new, agile start-ups that have better systems in place and offer superior customer service.

After all, why should a customer choose a bank given the low level of customer service and slow and outdated systems?

– – – – –

Thanks to Filip for his answers today. You can find out more about LandlordInvest on their website, twitter, facebook and linkedin.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.