Gary Turner of Xero

For this week’s profile I am delighted to introduce the Managing Director of Xero, Gary Turner.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

I’m managing director at Xero – I joined the online accounting start-up shortly after its UK launch in 2009. Prior to heading up Xero’s UK operations, my career included executive positions at Microsoft where I was product group director for Microsoft Dynamics, and before that with accounting software vendor Pegasus Software, where I was managing director.

What is your job title and what are your general responsibilities?

My job as managing director involves lots of things including being the external face of the business, keeping everyone on track, hiring and building great teams and nurturing our culture as we manage through all the stresses and strains of hyper growth. Alongside that I ensure our strategy is the right one, making sure we hit our growth goals.

Can you give us an overview of your business?

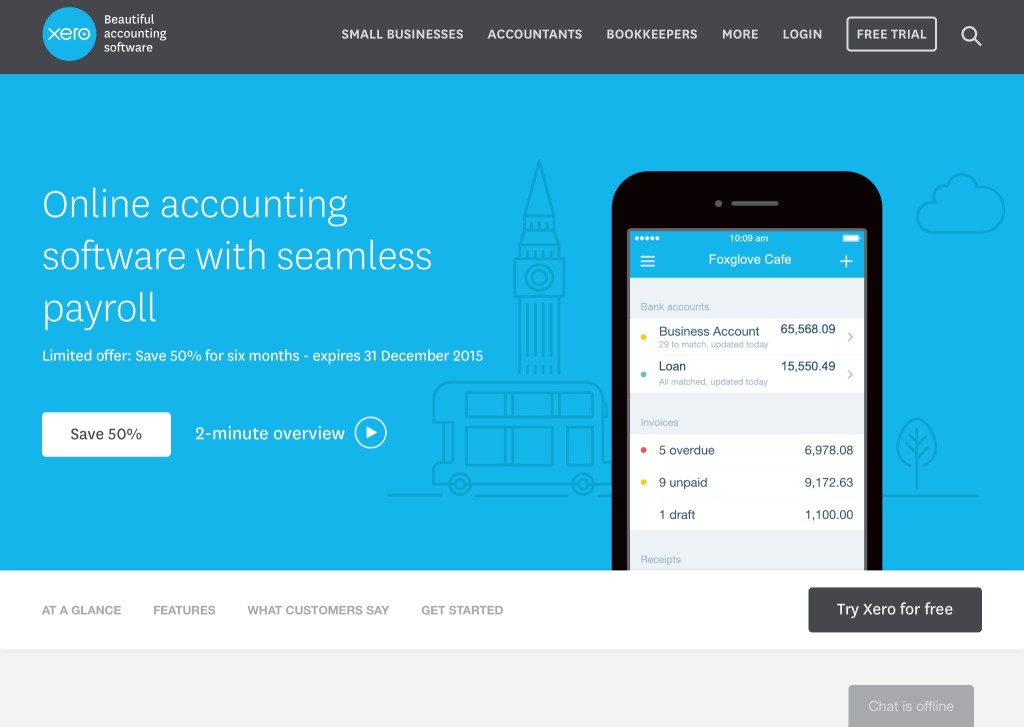

For many SMBs, Xero is the first financial business tool that gives them real control over their business finances, and lots of our customers tell us they love using Xero. So, a big part of what we focus on alongside thinking about how we create fresh solutions to some of the chronic problems all businesses face, like managing cash flow, is supporting over 100,000 UK businesses and hundreds of thousands of UK based users of Xero whenever they need it.

Most people would be surprised at the Xero price point of £20 per month, which means while we’re a B2B Fintech business, our model is more of a hybrid one where a lot of what we do would feel at home in a consumer business context.

How did Xero get funded when it started?

We had such faith in our vision that we went down the IPO route right at the beginning, really before we had any real revenues at all. We raised around £7M – enough to fund the hiring of the first fifty people for a couple of years which enabled us to build the core elements of the business early on and helped us get the first few thousand customers through the door.

What problems does Xero solve?

We conducted some research earlier this year that explored what separates successful entrepreneurs from those that fail, and found that 65% of businesses that failed in the first year because of a business problem, blamed financial issues. We keep our customers’ finances in check by improving cash flow control, helping them keeping on top of billing and supplier commitments and supporting them with their forecasting and payroll so that they can focus on other areas of growth.

Who are your target customers? What’s your revenue model?

Our customers range from one person fledgling startups through to mid-sized SMBs, but the majority of our customers employ fewer than 20 staff and turnover less than £1m per annum. We bill monthly and our most popular price plan is £20 per month. However, all those relatively small value billing plans soon add up and with over 600,000 businesses now on Xero globally, we’re on track to do almost £100M in revenues in this financial year.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

The banking industry needs to be more agile and move quicker. There’s still far too much organisational treacle to wade through which means things tend to take much longer to get going than they really should.

What is your message for the larger players in the Finance industry?

We’re in the early part of a huge generational shift in the world of finance and technology, whether that’s Blockchain or connecting the new generation of SMB services like Xero to other systems and service providers. If we get it right, the UK has a great chance to get ahead of the curve and build itself to a position of real strength globally. But now’s the time!

What phone are you carrying and why?

An iPhone 6S Plus. It’s big, fast, does about 50 things really well and the battery lasts forever.

Where do you get your industry news from?

Twitter, and pretty much everywhere in fact.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

@roddrury – our CEO and true visionary in this space.

@duanejackson – Founder of Kashflow (he sold it in 2013) and generally inspirational figure in UK Fintech.

@pmarca – Marc Andreessen – Founder of Netscape and investor whose insights I admire greatly.

Can you suggest the name of an Angel Investor or VC that might be interested in being profiled?

Marc Andreessen

What’s the best FinTech product or service you’ve seen recently?

I love the thinking behind TransferWise as it’s really simple and hugely disruptive, and Crunchboards is another up and coming reporting and forecasting app that’s getting rave reviews.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Blockchain holds a lot of promise if it can land effectively in the world of business and accounting as it could remove a lot of the trust-based frameworks that currently exist around billing and accounting. Blockchain is pretty exciting if we can make it work in accounting.

– – – – –

Thanks to Gary for his answers today. You can find out more about Xero on their website, Twitter and Facebook.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.