James Tuckett of investUP

I’m delighted to bring you the very first of our profile pieces here on FinTech Profile. Our first featured company is the crowdfunding supermarket, investUP. Answering our questions is the company’s Managing Director, James Tuckett.

Our questions are in bold.

Let’s get started — over to James.

– – – – –

1. Who are you and what’s your background?

I’m a dreamer. Dreamers possess both good and bad traits and the last 20 or so years have been about teasing out the good ones. Very early on I took an interest in space exploration and concluded, aged 4, that there were two routes to getting there – become very wealthy, or build the vessels that take you there.

This belief created two competing agendas – become an entrepreneur or become an engineer. The result, I did both. After leaving school, I started an online business selling computers which failed dramatically, then went on to study Aerospace Engineering. Realising, eventually, that I had failed academia – showing smatterings of excellence in an otherwise unremarkable academic career – too much daydreaming – I knew which route was for me.

Engineering led on to accountancy, three of my cousins did extremely well from going down this route and I believed it to be exactly the right foundation for an entrepreneur. During my time at my old firm Crowdfunding began to emerge as an alternative. Still almost completely unknown to the majority, I had concluded this was the solution – these tiny startups were in essence replacing the banks historic function of providing capital to SME’s and individuals.

Four years on and Crowdfunding is in the press daily, funding volumes are growing dramatically and investUP has nearly launched. Not just that, but the term “replacers” has been coined to signify those FinTech startups that don’t support the existing financial ecosystem but replace it entirely – I’ve just returned from a conference in Amsterdam where this was the subject of the whole event.

Along the way, I’ve picked up some utterly fantastic people to help make this happen. Of the four original founders, the oldest is 30. We are young, but what I had originally seen as a weakness has manifested as a massive strength. What the team lack in experience, they make up in flexibility, never assuming to know anything and thereby learning rapidly, secondly our young age and enthusiasm has drawn experience to UP. Our wider team and board are truly exceptional and I believe after we raise our final seed round (Seed C) our full team will be unbeatable.

2. What is your job title and what are your general responsibilities?

Managing Director. I’m responsible for an array of things, namely – business development (signing UP partner crowdfunding sites), investment readiness/fundraising/pitching, front-end web development and regulation/compliance/legal (for a few months longer anyway).

3. Can you give us an overview of your business?

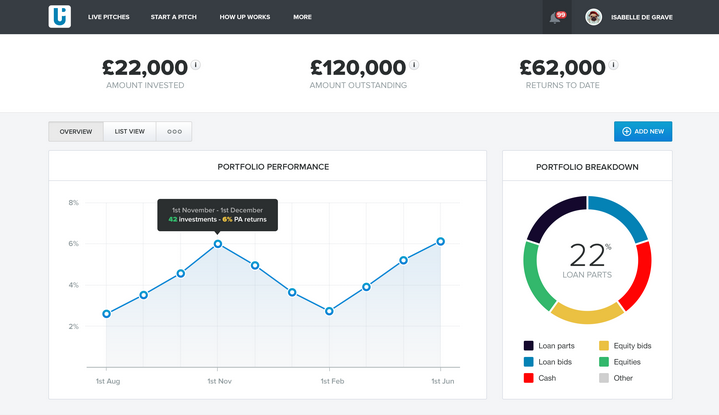

UP is the crowdfunding supermarket, allowing you to invest across all your favourite P2P, debt and equity sites using just one account, enabling you to build one centralised portfolio. UP is completely free, with no hidden costs.

4. Tell us how you are funded.

To date just over £300k in seed capital from family, friends and angel investors.

5. Why did you start the company? To solve what problems?

With Crowdfunding proving successful, a huge proliferation of Crowdfunding sites has occurred. Sifting through all these sites and keeping track of numerous accounts is hard work (time-consuming), discovering the best deals also becomes a chore (discovery issues) and the post-investment experience was also poor on most sites.

UP set out to solve these problems by creating, in essence, one giant crowdfunding site where users can pick from deals originated by our partner sites.

Secondly, users can place all their orders without ever leaving investUP (we accept bid placements). Finally, all users investments are held by a separate legal entity (a nominee company), what this means in practice is as legal title holder UP receives all news/earnings relating to a particular investment and reports this back to the user (no more paperwork/excel spreadsheets needed!!)

6. Who are your target customers? What’s your revenue model?

UP is primarily for sophisticated investors (although we are also available to everyday and institutional investors). Moneywise, we charge our crowdfunding site partners for the cash we deliver them – the more we deliver, and the more fees they earn on it, the more we charge. That being said, we have big plans for the future to further monetise the business in other new and exciting ways.

7.If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

Regulation. I believe in regulation wholly and completely, however I strongly believe that the job of regulating a sector as large as the financial sector is too large for one organisation. We need to think of a solution where the market self-regulates by exposing deficiencies in business practices via some form of peer-reviewed process. If a company is misleading clients then this should be exposed using social media or some other rapid delivery type system (disclaimer: these are just musings, not a well considered analysis).

8. What is your message for the larger players in the Finance industry?

Come and talk to UP. Where Crowdfunding sites are replacers, UP doesn’t have to be. Whilst we are starting with Crowdfunding sites, we are also seeing exciting opportunities for traditional lenders.

9. What phone are you carrying and why?

Samsung S5, because it’s a mini-computer which I can run the entire business from. It has a broken screen, is well worn and is quickly becoming part of my collection of shabby items that are nearly completely worn out. (Family heirlooms of the future…)

10. Where do you get your industry news from?

All over, news is fairly commoditised these days.

11. Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

- Chris Skinner – simply the best (@chrisskinner)

- Nektarios Liolis – a fantastic member of the FinTech London scene (@nekliolios)

- Sean Park – Anthemis (@paraparadigm)

12. What’s the best FinTech product or service you’ve seen recently?

Duedil – I just rate this product so highly.

13. Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

I think the big change will be the banks increasingly becoming regulated pools of capital that supply wholesale product to alternative lenders who know and understand their clients in a way that has proved so difficult for the banks.

I would also expect to see a massive payments revolution with fewer and fewer payments being routed through the old banking architecture. Banks will survive this change, but will have to modernise – overall I think these changes will be wonderful for the consumer.

Financial services will begin to lose its tarnished reputation as organisations start to demonstrate incredible value can be delivered for very little cost.

Finally, I expect to see Crowdfunding become an integral part of the financial ecosystem, raising money for the very small, but potentially also the very big in time (but then of course I’m biased…).

– – – – –

Thank you for taking the time to answer our questions James.

You can reach out to James on Twitter (@JWTuckett) and you can find him on LinkedIn here. You can sign-up free to investUP right now over at www.investup.co — do take a look! Are you looking for a bit more information? Check out this video of James pitching at the Startup Bootcamp FinTech demo day.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.