Jens Saltin of Klarna

We have another profile up this week from Jens Saltin of Klarna.

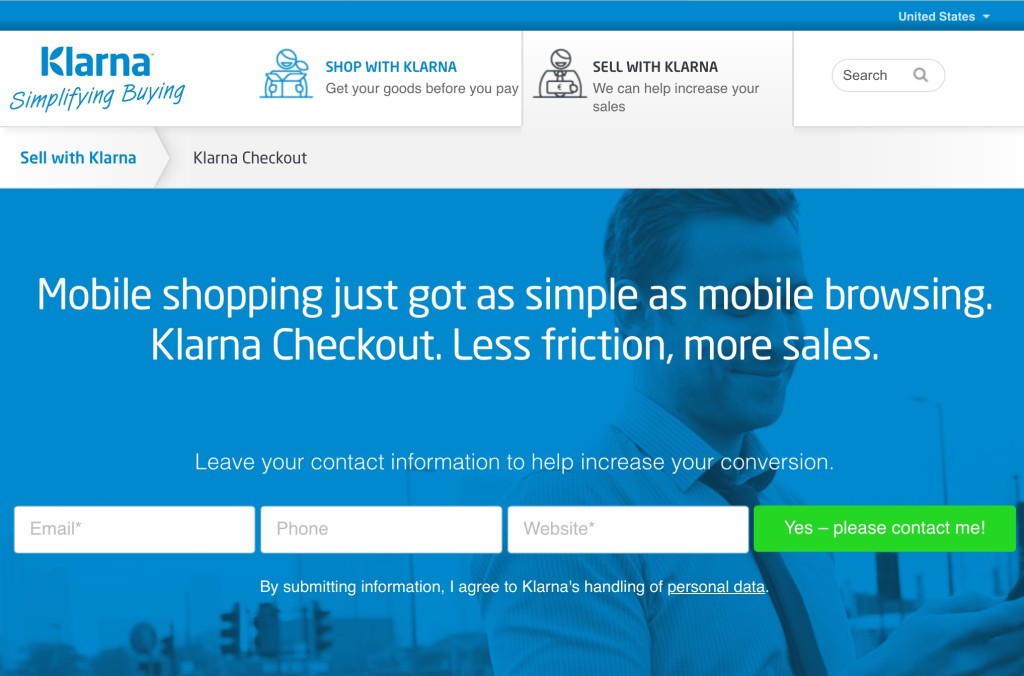

Klarna is an online ‘one click to buy’ checkout solution and payments provider that simplifies buying for consumers and retailers.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

My name is Jens Saltin. I am Head of Expansion at Klarna, having joined the company in 2009. I decided to get into the FinTech arena as I felt it was an exciting industry with incomparable opportunities. Previously, I worked at a handful of financial organisations, including Nordea Capital Markets, Rubicon and Goldman Sachs. I also worked in product development, heading a project that created Klarna Mobile, Klarna’s payment solution for digital products.

I hold an MA in Business Administration from the Stockholm School of Economics.

What is your job title and what are your general responsibilities?

As Head of Expansion, I am responsible for Klarna’s growth into new regions including the recent launch in the UK and setting up a local team to ensure Klarna has the same success in the UK as it has seen in previous markets.

Can you give us an overview of your business?

Klarna’s mobile first checkout solution is built to streamline the buying process between retailers and their customers. Klarna makes it as simple for consumers to buy online as it is in-store. The solution handles integration of all payment infrastructure and admin for the retailer.

It increases conversion rates for retailers by offering consumers a ‘one click to buy’ checkout solution that underwrites all risk. Customers are able to buy much faster and retailers always get paid.

Tell us how you are funded.

Klarna has so far completed six funding rounds, most recently receiving €90m in March 2014 from investors including Institutional Venture Partners, Sequoia Capital, General Atlantic and Atomico.

Why did you start the company? To solve what problems?

In the past 20 years the internet has completely transformed our shopping habits, yet for a long time we were not seeing a transformation in the process of paying for products online.

Klarna was created with the vision that the online buying process should be as easy as going into a store, purchasing an item and walking out again.

Klarna’s checkout solution is built to streamline the buying process between retailers and their customers, with the solution handling integration of all payment infrastructure and admin for the retailer. The checkout solution has achieved up to 60 – 70 per cent conversion rates on mobile, compared with the industry standard of just three per cent. On desktop, the Klarna checkout solution has achieved a 60 per cent conversion rate, compared with the industry standard of 33 per cent.

Who are your target customers? What’s your revenue model?

The company’s solutions are active in 18 markets around the world, serving 35 million consumers and working with 50,000 retailers. The solution is available in the UK, throughout Europe and will soon be launched in the US.

Klarna’s target customers are any retailers looking to boost their e-commerce conversion rates – retailers that want to make money from mobile sales – and we have the big names like ASOS, Marks & Spencer and Spotify on board already.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I would make all of the banks realise that the extra friction they add to secure payments for the 1% of possible fraudulent transactions, destroys the conversion for the 99% that are honest.

What is your message for the larger players in the Finance industry?

To stay on top of mobile, and try to always see the world from a consumers perspective.

What phone are you carrying and why?

I am carrying an iPhone and a Samsung, as I have both a Swedish and UK number. I carry two phones as I wanted to test which one felt the best for me. I have to say that the iPhone has won me over!

Where do you get your industry news from?

Retail Week, Internet Retailer and The Paypers.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

I will give you the only person from the FinTech sector that you need to be following: Sebastian Siemiatkowski – @klarnasebastian

What’s the best FinTech product or service you’ve seen recently?

Our mobile first checkout solution Klarna Checkout of course!

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Being truly mobile optimized will be absolutely instrumental for most businesses. Also, I believe that niche players will become more and more important to streamline businesses, and that we will see companies outsourcing more and more functions as they will need to focus on their core (such as brand) to stay competitive.

– – – – –

Many thanks to Jens for his answers. Klarna are also on twitter here.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.