Krzysztof Gogol of WealthArc

For today’s profile we are joined by Krzysztof Gogol of WealthArc. Let’s get started, our questions are in bold.

– – – – –

Who are you and what’s your background?

I’m Krzysztof Gogol, I studied mathematics and computer science at the University of Warsaw. My career took me to Switzerland, where I worked on the development of financial software and risk management. This is where I met Sebastian Manthei, my fellow co-founder. Sebastian studied banking and finance at the University of Lucerne, and worked in investment analysis, analytics and strategic business development.

Using our experience from working in these firms, we identified a need in the market for better solutions for wealth managers beyond simply printing reports and so we started our own business. This is how WealthArc, Inc. was born.

We’ve since brought on Radek Mastalerz and Miłosz Piechocki to form our research and development team. Radek is our VP quant and data expert, and Miłosz is our VP for cloud and architecture. Both of them came to us having worked for top-tier financial firms in London including JP Morgan and UBS, where they were focusing on Big Data, cybersecurity and artificial intelligence solutions for financial sector.

We’ve assembled a great team that will allow for WealthArc to constantly improve our offering for wealth managers, while expanding to offer solutions for asset managers, fund administrators and brokerage houses.

What is your job title and what are your general responsibilities?

I’m a President and CEO of WealthArc. Once upon a time, I was called an engineer, but since we closed our seed funding and expanded our team I don’t have much time left for development. I am broadly responsible for day-to-day operations, leading the R and D team, innovation, investor relations and supporting my startup partner in sales.

Can you give us an overview of your business?

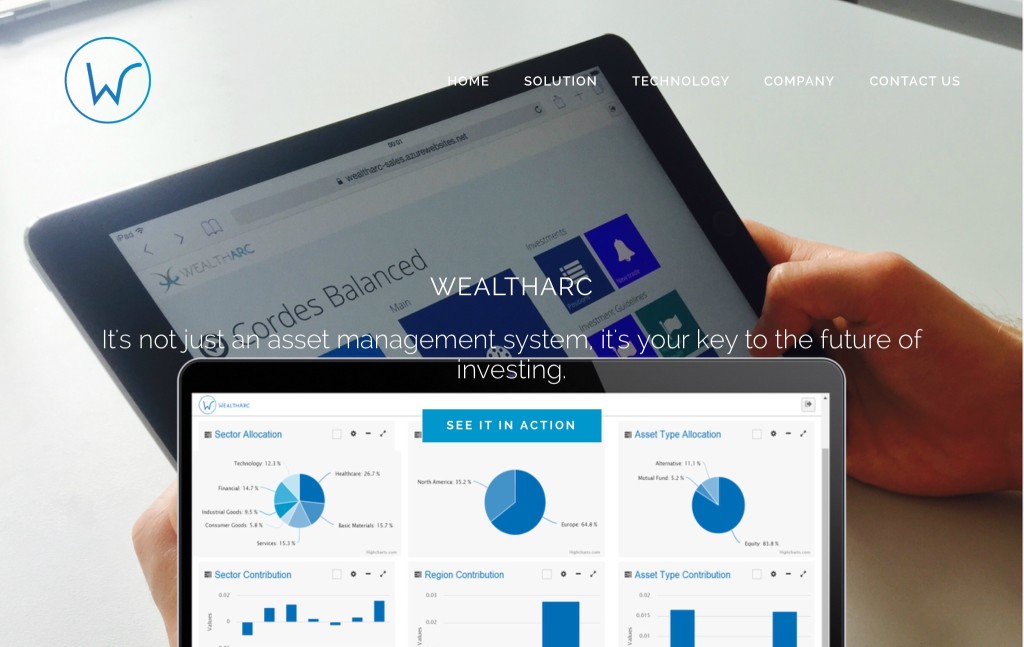

Our flagship product is our SaaS solution designed for wealth managers.

We created a full service, all-in-one solution that is sold on a subscription model for a flat monthly fee. Our clients don’t have to worry about costly IT infrastructure, hidden costs and expensive support calls.

This way, wealth managers can focus on building and maintaining their client relationships. Our software handles integration of data from custodian banks, daily compliance checks, documentation and portfolio management for our customers’ clients.

Reception from clients has been overwhelmingly positive, especially as we integrate secure digital communications and more advanced CRM modules into the solution.

At the moment, we are focused on improving and marketing this product for the Swiss and European market; but with our recent closed seed funding we have plans to expand to North America and other markets in the future.

Tell us how you are funded.

Earlier this year, WealthArc raised $300,000 in seed funding from U.S.-based venture capital firm Novit LP. This has allowed us to finalize our platform and work on new products, as well as continue and expand our research and development team, focusing on artificial intelligence for portfolio management as well as cyber-security for cloud based financial services.

The seed funding was closed with the assistance of global law firm Dentons, who continue their relationship with WealthArc as our legal mentor providing advice on entering new markets as well as patent registration.

Why did you start the company? To solve what problems?

All of us at the company have worked at top-tier financial firms. We have seen and experienced the software side of financial services first hand, both positives and negatives.

We’re believers in the power of big data and quantitative analysis, and wanted to create a platform for wealth managers to harness these innovations in automation, portfolio management and smart trading.

Our goal has always been to create solutions that any wealth manager can use, without having a rack of supercomputers and large IT staff in their office.

Early on we became a member of Microsoft BizSpark, a special program supporting highly innovative startups. Machine learning algorithms help leverage vast amounts of financial data, monitor investment guidelines and consequently make informed decisions, and by using Microsoft Azure Cloud we’ve been able to quickly deploy massive amounts of computing potential for our customers.

The problem of juggling compliance requirements, reporting and CRM aspects of managing client’s wealth is one we are constantly working to innovative so wealth managers can focus on their most important role, becoming and being a trusted advisor.

Who are your target customers? What’s your revenue model?

WealthArc is B2B SaaS platform for wealth mangers, family offices, private banks and hedge funds. With offices in Zurich, Washington, D.C. metro area in the United States and as well as strong R and D, and IT Team in Warsaw, we currently offer our platform to customers in Switzerland and the European Union.

We operate on a subscription model, offering our solution for a flat monthly fee to our customers.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

As a solution provider for wealth managers, we have to develop APIs (connections) to custodian banks which our customers use. I have already seen very different ways of sharing portfolio data, but so far we have always rose to the challenge and been able to create secure ways to connect and communicate with the various systems these custodian banks use. With standardized banking APIs, our work would be much simpler and we could scale and expand our business more quickly.

What is your message for the larger players in the Finance industry?

We are already working with well-established Swiss and European wealth managers .They are aware of important innovations that their clients will demand in the future, but don’t understand that the future is now.

What phone are you carrying and why?

Two models of Samsung and a Nokia, while my startup partner carries an iPhone 6 and Apple Watch

Where do you get your industry news from?

Inc, Wired, Bloomberg, Zerohedge.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

John Hucker, @finnovationCH – a leader of the FinTech community in Switzerland

TheCloudNetwork, @TheCloudNetwork – a great source of news on cloud computing

Marc Bernegger, @finance20ch – an organizer of the Finance 2.0 conference in Zurich

What’s the best FinTech product or service you’ve seen recently?

Tawipay – an online platform, where you can find and compare money transfer services and get access to exclusive deals.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Artificial Intelligence and robo-advisers!

I believe that the future of private wealth management will be like Mr. Spock from Star Trek – thinking like a machine but with a human mother.

We’re working hard with our research and development team to make this a reality.

– – – – –

Thanks to Krzysztof for his answers today. You can find out more about WealthArc on their website, twitter and facebook.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.