Lucas Jankowiak of SecurionPay

Today we are joined by Lucas Jankowiak from SecurionPay.

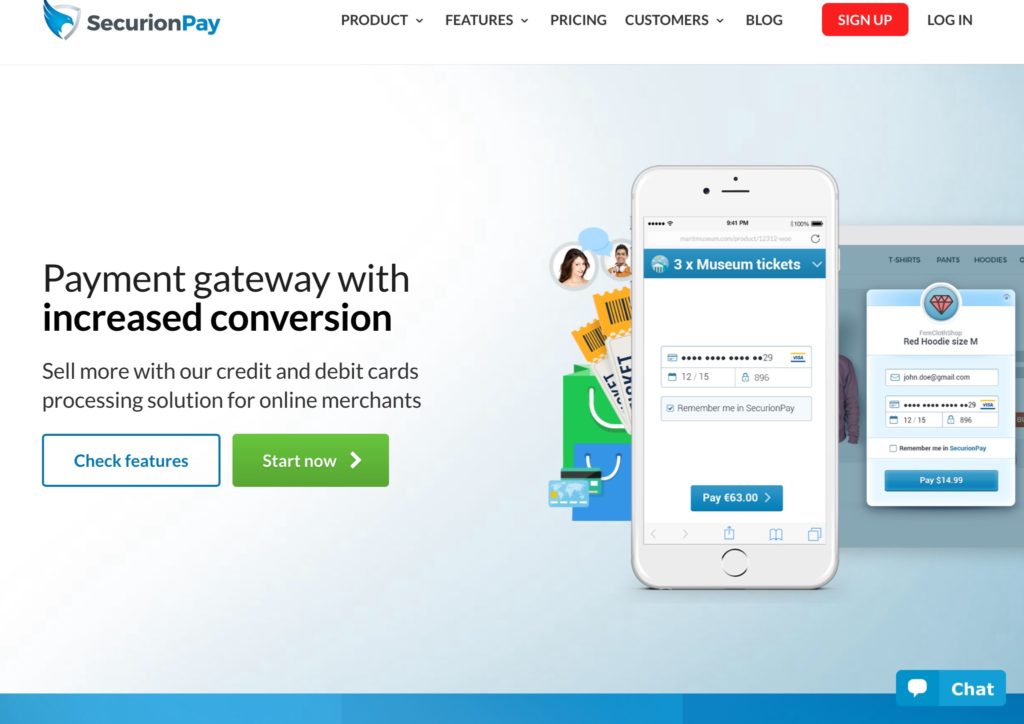

SecurionPay is one of the most innovative payment gateways for online (and mobile) business.

– – – – –

Who are you and what’s your background?

The SecurionPay team is made up of internationally experienced individuals who’ve been working in the FinTech sector for years. Some of us worked for international companies such as Google or Delivery Hero and others have gained experience working for various startups or well-established companies in the online payments sector. We are currently working and living in three different countries: Switzerland, Spain, and Poland.

What is your job title and what are your general responsibilities?

I’m co-founder and CEO of SecurionPay and except for my daily administrative and team building tasks, I’m also responsible for the pack of our hungry and smart salespeople.

Can you give us an overview of your business?

SecurionPay is one of the most innovative payment gateways for online businesses and mobile devices. If you are a merchant with an online shop that wants to receive payments for the products and services you sell, our solution is for you.

SecurionPay simplifies credit card processing, making it more user-friendly and easier for online merchants and their customers to use.

Our mission is to deliver products and services in an excellent way that wins us over with clients. Our API is the number one choice for developers, thanks to its ease of implementation and robustness. Our unique and one-of-the-kind drag and drop implementation technology allows merchants to add payments to their websites instantly. The technology is so easy to use that it doesn’t matter if the merchants are developers or have little technical knowledge.

Thanks to our features, such as checkout (payment in the popup form) and custom form (payment form embedded into the website), SecurionPay gives merchants the payment solution that boosts their sales and increases conversion in the last step of the payment process.

Tell us how you are funded.

We’re funded by seed capital.

Why did you start the company? To solve what problems?

Europe lacked a payment processor that was fast, agile and followed new trends that were appearing in the USA. While working for one of the European payment processors, I was constantly analyzing the market and our competitors. I noticed how much merchants were struggling with implementations, the never ending compliance process, PCI requirements, general onboarding and technological shortcomings of platforms. These were the reasons my customers were losing a lot of time and revenue. Therefore, one day we decided that it was time to change this. SecurionPay was born out of this general frustration and need for much better online payments.

Who are your target customers? What’s your revenue model?

We target all types of online businesses that need to process payments on their website. In addition to our flexible and robust API, we also developed a unique drag and drop implementation technology. Even non-technical users can easily implement payments on their website with a few drags and drops. Our revenue model is simple, we charge 2.95% and 0.25 Euro per transaction.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I would speed up the development of disruptive and innovative products, like SecurionPay, to give the end customers more access to FinTech products and services. I fully support Fintech solutions that are ready to compete with current banking systems. That would be something to look forward to.

What is your message for the larger players in the Finance industry?

They should observe how SecurionPay grows and disrupts the online payment space. We focus on the same speed, easiness and friendly approach with no hassle while giving clients the best overall service.

What phone are you carrying and why?

I use a Samsung as my business phone. I think it’s the best device that allows me to be connected whenever I need it.

Where do you get your industry news from?

I get my industry news from several places such as dailyfintech.com, paymentssource.com, etc. You can check out these news sites and more in one of our blog posts at https://securionpay.com/blog/2016/07/12/fintech-blogs-services.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Faisal Khan, @babushka99, FinTech influencer

Jessica Ellerm, @JessicaEllerm, interesting point of view about FinTech and growth hacking

You can also follow @SecurionPay to learn more about the online payments space

What’s the best FinTech product or service you’ve seen recently?

N26 (https://n26.com/) is a product that lets you run all banking operations from your phone.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Fintech is an extremely exciting space. We’re glad to be a part of it and take an active role in reshaping a significant part of one of Fintech’s major vehicles, online payments.

Moreover, mobile growth, wearable technology, the internet, big data, and social media are ways that industries like banking, wealth management, and others can be revolutionized. Cryptocurrencies (like bitcoin) is an extremely interesting trend that will shape how money can be replaced by online-only currencies.

– – – – –

Thanks to Lucas for his answers today. You can find out more about SecurionPay on their website, twitter, facebook and LinkedIn.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.