Luke Lang of Crowdcube

We are back with another profile. Crowdcube is the world’s first and leading investment crowdfunding platform. It was founded by Darren Westlake & Luke Lang and today we speak to Luke to find out more…

Our questions are in bold.

– – – – –

Who are you and what’s your background?

I’m Luke Lang, co-founder and CMO of Crowdcube, the world’s first and largest investment crowdfunding platform. After graduating from the University of Derby, where I studied Marketing, I gained experience working in blue chip and start-up companies. I also ran my own marketing consultancy, before launching Crowdcube in 2011 with my co-founder Darren Westlake.

What is your job title and what are your general responsibilities?

As co-founder my role is all encompassing, but my main focus is to ensure we continue to remain at the forefront of our sector. We were the world’s first investment crowdfunding platform, the first to have institutional investors alongside the crowd and most recently, the first to deliver a successful exit of a crowdfunded business following the sale of E-Car Club. With a history of firsts, we’re focused on ensuring we remain innovative to cement our market leader position.

Can you give us an overview of your business?

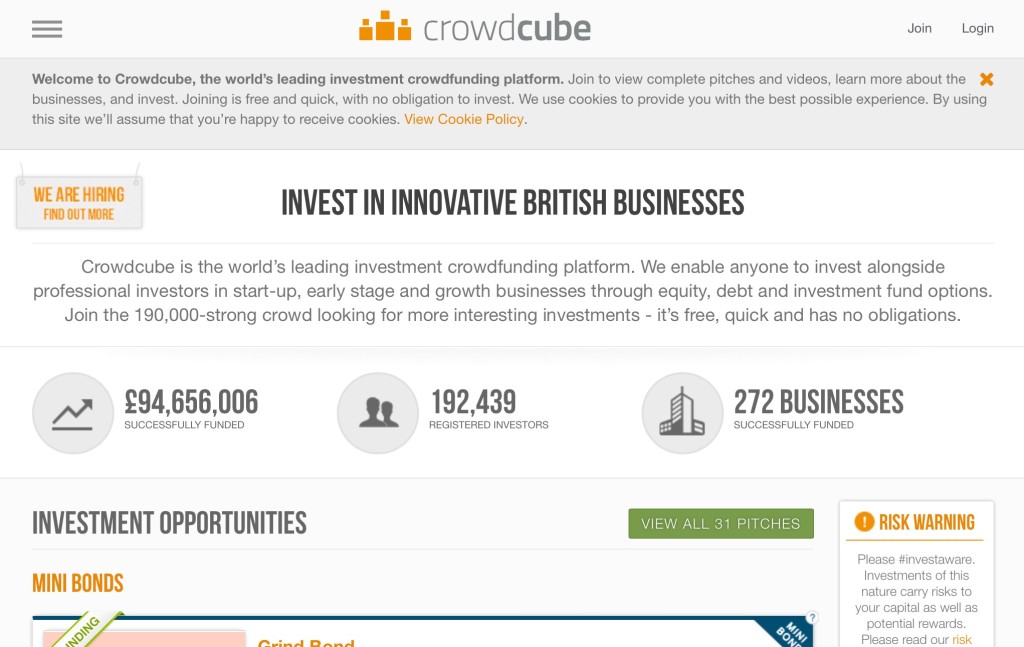

Crowdcube is an online platform that enables start-up, early and growth stage businesses, from a range of sectors, to raise finance with the added benefit of being backed by the crowd. For investors, Crowdcube enables anyone to invest as little or as much as they like alongside professionals, VCs and even the UK Government, democratising what was once reserved for an elite few. Since launching in 2011, Crowdcube has amassed a rapidly growing crowd of nearly 190,000 people who have invested more than £93 million, funding 270 businesses as a result.

Tell us how you are funded.

As with most start-ups we were self-funded and backed by family and friends in the early days. Since then we have raised finance through Crowdcube in three separate raises. Our most recent, in June 2014, saw us reach our investment target of £1.2m in just 16 minutes, alongside an investment from one of Europe’s largest VCs of £3.8m on the same terms as the crowd.

Why did you start the company? To solve what problems?

Before we launched Crowdcube, just four years ago, it was an uphill battle for businesses, particularly for start-ups, raising the finance needed to get an idea of the ground or grow.

The idea behind Crowdcube was sparked by the frustration of watching Dragons’ Den and seeing great business ideas fall by the wayside if the Dragons’ decided they were ‘out’. Having experienced the difficulties of raising finance first hand, Darren Westlake and I launched Crowdcube, which enables businesses to pitch their idea to a wider audience, giving everyone the opportunity to be an ‘armchair dragon’.

Who are you target customers? What’s your revenue model?

Crowdcube makes investing affordable, accessible and rewarding to the masses, so our target market ranges from everyday investors, professionals, VCs and even the UK Government, which is investing £5m through Crowdcube in the next three years.

In terms of our revenue model, there are no fees for investors either to join our investment community or if they receive any capital gains on their investment. For businesses, we work on a commission basis, charging a percentage of the amount raised for businesses that reach their investment target.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I’d give the go ahead for mini-bonds and peer-to-peer lending to be eligible for ISAs. Whilst it’s disappointing it wasn’t included in the summer budget a consultation has been launched so I’m hopeful it will be brought in this autumn to ensure investors get a better deal.

What is your message for the larger players in the Finance industry?

Although diminished, consumers’ trust in the banks remains a powerful and crucial asset in the post-crisis world, as is their relationship with their customers. Banks need to reassess and relearn how to engage and value their customers by demonstrating real leadership and humility to ensure a lost decade of business lending doesn’t turn into a lost generation.

What phone are you carrying and why?

An iPhone 6 because an Apple a day keeps the doctor away!

Where do you get your industry news from?

Altfi.com, Business Insider, Money Week, Tech City News and Meltwater, our press clipping service are all fantastic sources of market intelligence, trends and news.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Crowdcube co-founder and CEO, Darren Westlake is always worth a tweet, @dazwest

The CEO of Nutmeg, Nick Hungerford, never fails to give sound judgement and good opinions @nickhungerford

Financial journalist and author, David Stevenson is a must follow for anyone interested in alternative finance, @davidstevenson

What’s the best FinTech product or service you’ve seen recently?

Droplet, a mobile payments app that’s easy to use and completely fee-free for buyers and sellers. They recently raised over £570,000 on Crowdcube after attracting investment from our crowd and also the government-backed London Co-Investment Fund, which is investing £5 million through Crowdcube over the next three years.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

We’ve seen a growing number of professional investors, VCs, angels and institutions invest in businesses on Crowdcube and with more established brands turning to the crowd it’s a trend that looks set to continue. It is becoming increasingly clear that parts of the traditional finance sector are not shying away from crowdfunding in the next few years I think we’ll see the industry consolidate as the old and new funding models begin to collaborate rather than compete.

– – – – –

Thanks to Luke for his answers today. You can find out more about Crowdcube on their website, Facebook, Twitter, LinkedIn and Google+

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.