Martin MacMillan of Pollen VC

Today we will be talking to the CEO of Pollen VC, Martin MacMillan. Pollen VC gives app developers early access to their app store revenues on Apple’s iTunes and Google Play.

Our questions are in bold.

– – – – –

1. Who are you and what’s your background?

I’m a reformed investment banker turned FinTech entrepreneur.

Following an MA in Economics and Finance from St Andrews University, I joined the Fixed Income Trading division at UBS. I caught the FinTech bug from putting their Commercial Paper business online in 1998. Our biggest hurdle at that time was that many fund managers had such restricted access to the Internet that they couldn’t access the site!

After seven years at UBS, I left to join my first start-up in retail banking software, Level Four, which grew to be a leading global provider of ATM software solutions. After another longer tenure than expected, I was itching to work on something more creative than enterprise banking software, so in 2010 I set up an interactive music app business, Soniqplay.

Through running this business, I gained first hand experience of the payment delay issues with app stores and also the disconnect between traditional financial services providers and digital commerce platforms. Given my previous experiences, I realised that there was a way to connect the old and new worlds together, which lead to the birth of Pollen VC.

2. What is your job title and what are your general responsibilities?

I am the CEO & Co-Founder at Pollen VC. At this stage in our development, we are still very much a start up, so I am very closely involved with day-to-day operations. I lead business development and marketing operations, which feed our sales pipeline, and I meet with potential partners from Ad networks to publishers. I also spend time with both debt and equity investors ensuring we have the correct liquidity and structure to scale. I also travel to events across the US and Europe to talk to developers about the app economy and strategies they can use to build and sustain their businesses.

3. Can you give us an overview of your business?

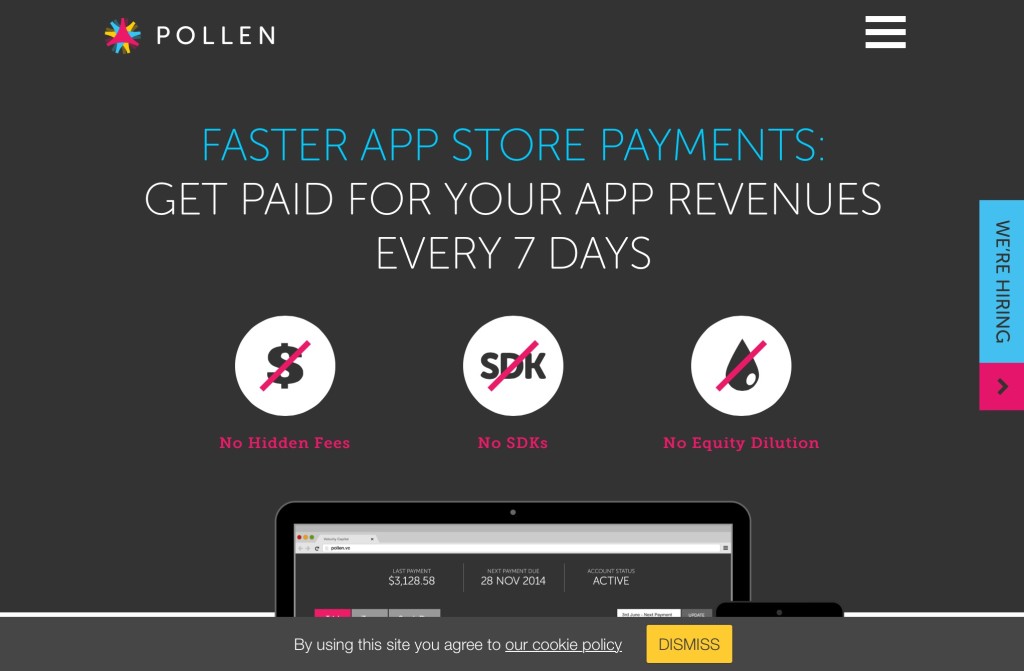

Pollen VC gives app developers early access to their app store revenues on Apple’s iTunes and Google Play. We plug into the developer’s account to verify earned revenues, and then we pay out based on that revenue data to the developer, every 7 days, rather than the 30-60 days it usually takes the app store to process. We then collect directly from the relevant app store.

We’re working with most of the major ad networks to allow developers to seamlessly reinvest their revenues directly into user acquisition – if developers choose this route, Pollen will fund their ad network of choice with 100% of the developer’s accrued revenue.

Pollen VC was the first to offer this type of service specifically to mobile developers, and the market reaction has been overwhelmingly positive, as developers are recognising how important timely marketing activity is to sustaining the apps or games they put so much into creating. We reached the finals of the BBVA Open Talent Europe competition in September 2014, and won the MEFFY for Monetisation and Engagement in November 2014 so we are getting great industry recognition for the service we provide.

4. Tell us how you are funded.

Pollen is seed funded. We have a great line up of FinTech and games industry investors as well as significant private debt facilities to fuel our lending operations.

5. Why did you start the company? To solve what problems?

In the early stages of my last company, Soniqplay, we found that the payment delays from the app stores were an impediment to growth. We could see from our daily app store reports that people were paying for content within our apps but we were waiting sometimes more than 60 days to be paid, at a time when we were trying to acquire more users. Our inability to access that cash early meant that we were using our investor’s money to fund our user acquisition, despite the fact we had visibility of revenue. I approached a number of traditional invoice discounters looking to unlock the liquidity but they insisted that we provide a physical invoice for our app store earnings, which is not how the app store’s digital billing systems work. They could not get their heads around a world where billing was not governed by bits of paper printed at the end of each month, despite the risk profile of the end creditors.

Talking to other developers, we found many who were having similar experiences, and found that the number one issue they faced was accessing funding quickly enough to acquire more users, so we decided to make this a core part of the service as well – developers who use Pollen VC to access their app store revenues will be able to channel these funds back into user acquisition immediately via our Ad network relationships, meaning that the app or game can become self funding quickly, provided they have the right monetisation formula to acquire users profitably.

6. Who are your target customers? What’s your revenue model?

Our target customers are pretty much anyone making revenues from the app store outside of the top 20. There are roughly 30,000 app developers in the “long tail” of which represents billions of dollars in revenue per year. Whilst some of these companies may be venture funded, VCs much prefer when someone else’s money is used to fund marketing/user acquisition, so we work with a lot of VCs to help their portfolio companies.

We ideally look to work with developers pre-launch, so that upon launch they can quickly access funds to capitalize on the initial launch traction or app store feature to fuel growth and sustain their chart visibility with paid advertising. The period just after launch is so important – research conducted by Pollen in January 2015 indicates that daily revenues drop by 85% within 60 days post an app store feature. This can be significantly reduced with the right paid user acquisition support.

7. If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

The regulatory environment in retail banking. It took four times as long to open a bank account as it did to close our seed round of investment, due to the amount of bureaucracy and just pure apathy in the sector. Whilst there is a clear need for appropriate regulation, it seems to be out of kilter with reality, and the time it takes is a real hindrance in the fast-moving tech world. It seems that it is particularly difficult for FinTech firms to establish traditional banking relationships, and few banks want to back other financial services providers. Perhaps they realize who is going to eat their lunch and it’s all a great conspiracy!

8. What is your message for the larger players in the Finance industry?

Significant change is clearly coming. A completely new approach is required if traditional providers are to remain relevant in the new world. Starting a FinTech corporate venturing fund is not the answer; nor is acquiring FinTech companies too early (and squashing them). Fostering and funding raw innovation outside of the organization, and insisting on driving new and cannibalizing customer pools and revenues streams is the way forward. But it’s easier said that done.

9. What phone are you carrying and why?

iPhone 5S – because I can’t decide whether the 6 Plus is too big or not!

10. Where do you get your industry news from?

FinExtra and Launch Ticker give me my best spread of tech and FinTech news on a daily basis.

11. Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Nigel Verdon: @nigelverdon – Currency Cloud/Orange Growth Partners – an old contact and a great inspiration.

Aneesh Varma: @AneeshVarma – see below

And of course @PollenVC – we’re still new to the sector but we carry out our own research into the app economy which should give our audience some insight!

12. What’s the best FinTech product or service you’ve seen recently?

Aire.io – Very interesting new approach to credit scoring. There are so many channels being ignored right now, and Aire are coming up with a great new approach. Go @AneeshVarma and @AireScore.

13. Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

1. Transaction costs continue to get squeezed and technology drives greater market efficiencies.

2. People will use data more intelligently to drive understanding of credit and price lending decisions differently

3. Crypto currencies will grow up and provide a frictionless cross border, real time settlement method, massively disrupting those who have built lucrative models on market opacity.

Thanks to Martin for his answers today. You can follow Pollen VC on Twitter too.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.