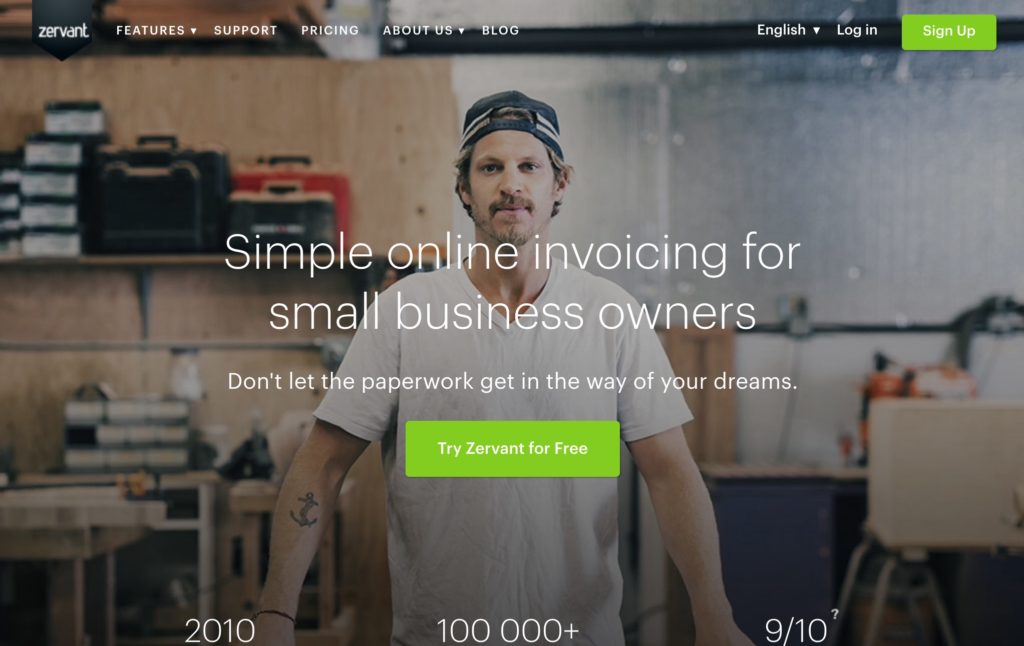

Mattias Hansson of Zervant

For today’s profile we have Mattias Hansson of Zervant.

Zervant is a simple online invoicing software for freelancers and micro business owners.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

My name’s Mattias, I’m the co-founder and CEO at Zervant.

I’ve worked at a few startups, as well as Nokia, which I guess most of you will know from Snake and 3210s. My roles have included building mobile and web services, and I’ve lived in Helsinki, Stockholm and New York.

The idea for Zervant came from a time when both Tuukka (Zervant’s other co-founder) and I were working as consultants. The job was great but there was just so much paperwork, and seemingly endless admin. We knew there had to be an easier way. After a bit of head scratching and brainstorming we came up with the idea for Zervant, a tool that we would have desperately needed ourselves as consultants.

What is your job title and what are your general responsibilities?

As I’m the CEO, I have overall responsibility for the company, which includes performance and strategic direction. When we first started out we were, quite literally, just three guys in a room with an idea. That meant wearing all sorts of hats in the business, be it product manager, sales, marketing, accounting, development and many more.

We’ve grown a lot since then and I’m really proud to say that we’ve recruited an excellent team to help us expand and develop Zervant even further.

A typical working day for me includes plenty of emailing, as well time on the phone with investors and partners. I always ensure I have time in my working day to spend with different teams in the office. I’m a firm believer in flat organisations and hands on management.

Can you give us an overview of your business?

Zervant is online invoicing software for freelancers and micro business owners. It’s designed to help send, create and manage invoices. The software also has financial reports to help with expense management, and there’s a time tracker for logging working hours.

The idea behind Zervant is two-fold. On the one hand we wanted to create something that makes it really easy for people to get paid and stay on top of their expenses. We wanted to build something that meant there was no need to run your business on Excel, a dusty old laptop, or a shoebox full of receipts.

The second point is that we wanted to make something that people actually like using, not something they feel they have to use. To date we have over 100,000 registered users, and paying customers in almost 50 countries. Our core markets are Finland, Sweden, Germany, France and the UK, which is where we focus most of our efforts. We recently announced a multi-million Pound deal with ING Belgium, and we were also recently voted the most promising fintech startup in the Nordics.

Tell us how you are funded.

Zervant is funded by private investors, Conor Venture Partners, and Tekes (the Finnish public funding agency).

Why did you start the company? To solve what problems?

There are plenty of great software solutions out there designed to help small business owners. But a lot of them are so feature rich and complicated that they are actually a little overwhelming. This is especially true if you’ve only just started your business, and don’t have that much experience of the financial side. When we built Zervant one of our guiding principles was to keep it as simple and intuitive as possible.

Another problem we are now focusing on is how to make e-invoicing cost-effective and readily accessible to small businesses. The EU has mandated that all invoices for B2G (business to government) transactions need to be electronic by 2018, and their aim is to make e-invoicing the most common way to invoice throughout Europe by 2020. We want to ensure small businesses don’t get left out of this change!

I hate jargon, so I should also take a moment to explain what e-invoicing actually is. A common misconception is that it means email attachments and PDFs. It doesn’t!! Simply put, e-invoicing means that all invoices are created, sent, received, processed and archived electronically., without any manual intervention whatsoever. Information flows seamlessly from the supplier’s machine to the buyer’s machine.

Who are your target customers? What’s your revenue model?

Zervant is designed specifically for freelancers and micro business owners. Our main mission is to make it quick and easy to help them get paid, so they can concentrate on running their business.

We take customer feedback very seriously, as it’s the best way for us to improve. Here’s a few quotes from our customers on why they use our software:

• “I like the fact I can create and send invoices in about 15 seconds.”

• “It’s easy to use, and jargon free.”

• “Zervant has everything I need under one umbrella.”

Anyone that’s interested in Zervant can sign up for a 30 day free trial. This gives you access to all the software’s features, including unlimited invoicing. It’s a great way to test drive the product.

After the 30 days users are automatically put on the free subscription package. This gives you access to all the financial reports, but in order to continue invoicing you need to upgrade to a paid subscription (starting from £5 a month). There are different plans based on the number of invoices you send a month, and the number of users your account has.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I would make sending e-invoicing free for SMEs, given that the majority of the cost savings with this method benefit the receiver of the e-invoice (as much as £25 / invoice).

What is your message for the larger players in the Finance industry?

Be open minded. Talk to and engage with new services from established startups. Don’t try to do everything yourselves. Collaboration brings synergies most of the time.

What phone are you carrying and why?

I’m a great fan of simplicity and I’ve been part of the Apple eco-system since 2008, so I carry an iPhone 6.

Where do you get your industry news from?

I have many sources, but I get a lot of industry related information from the Finextra daily newsletter. Additionally, I try to be active in my professional network that also gives me good insight on what is going on in the world.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Excellent question, I’m not sure I can name specific people on Twitter as there are so many activities and initiatives in this industry so you need to rely on a wider network.

What’s the best FinTech product or service you’ve seen recently?

There are so many great products it’s hard to limit my choice to just one. From a consumer perspective I think that iZettle is brilliant, as it allows you to accept card payment anywhere, with a smartphone or tablet. A variation on the same theme is Swish, which allows you take payments on your phone by pairing it with their Bluetooth chip and PIN reader. And I can’t talk about great fintech products without mentioning Kabbage, who are really revolutionising the whole small business finance space.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

I touched on the subject of e-invoicing above. More and more blue chip companies are moving over to this system, as the cost savings are huge. But to be honest the big players have been slowly moving over to e-invoicing for years, so it’s nothing new. The game changer will be when small businesses start to make the switch (and this is more a case of “when”, not “if”).

The problem right now is that every large business has their own, bespoke e-invoicing system. So if you’re a small business supplying to several large customers you have to comply with the specific requirements of each system. And yes, you guessed it, this is expensive, complicated and time consuming.

It’s a problem for both parties. As a small business you either have to turn down the work, or face long delays for payment. As a large business you’re faced with a weird twist on Pareto’s Law, where you spend 80% of your time trying to sort out payment for the small businesses that make up around 20% of your supplier base.

So what’s missing is a platform small businesses can use to pay e-invoices to all the bespoke systems their larger customers use. With such a platform small (and medium sized) businesses will start to use e-invoicing en masse. And when they do larger companies will save so much they’ll even be prepared to pay for their small businesses suppliers to switch over to such an e-invoicing portal. This is great news for the small businesses, as e-invoicing is quicker, safer and more efficient than existing methods.

It reflects a larger shift in the market toward digitalisation. Small and micro businesses don’t have the resources to invest in IT infrastructure, but these wholesale changes make the technology available to them.

– – – – –

Thanks to Mattias for his answers today. You can find out about Zervant from their website, Facebook, Twitter and LinkedIn.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.