Michael Wood of Receipt Bank

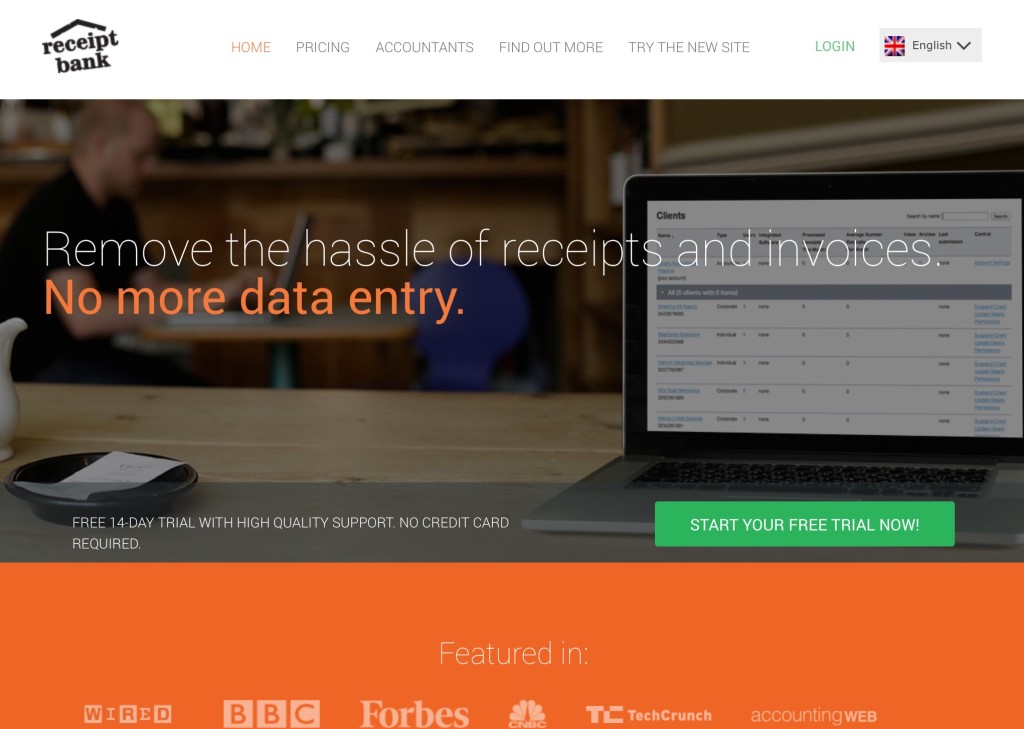

Today’s new profile is with Michael Wood from Receipt Bank, they are purveyors of automated bookkeeping solutions. Our questions are in bold.

– – – – –

Who are you and what’s your background?

Receipt Bank was started by Alexis Prenn and I in 2010. We both had prior experience in building companies, but five years ago we realised that the whole world of bookkeeping, accounting and small business banking, lending, etc. was about to be turned upside down.

We started the business to solve an immediate problem that SMEs faced on cloud accounting but also to help accountants, bookkeepers and SMEs capture the huge timesavings that were possible with automated bookkeeping.

Neither of us were the most obvious candidates for starting one of Europe’s fastest growing fintech companies – Alexis studied History at University, and has run a very broad range of companies, from a clothing factory to a loud-speaker manufacturer. I studied Zoology before working as a strategy consultant and founding an ad agency.

What is your job title and what are your general responsibilities?

My job title has varied as Receipt Bank has grown. In the beginning I had to do a bit of everything and now, as we have a team of 50+, I am able to concentrate on our future strategy and aligning product development to meet it.

As founders we are very focussed on growth. Today we have tens of thousands of paying clients and we have exponential growth – that’s our compass that tells us if we are doing things right!

Can you give us an overview of your business?

Every business is compelled by law to keep books and therefore do bookkeeping. Receipt Bank’s aim to make the process much, much more efficient.

Receipt Bank has automated elements of bookkeeping for the best accountants and bookkeepers around the world. Our business requires us to look at every element of the bookkeeping process and provide the right tools to make it more efficient for our clients and partners.

The service was launched in 2011 and is sold both to accountants and bookkeepers (to use with their clients) and to SMEs directly.

Tell us how you are funded.

Several million pounds of external capital.

Who are your target customers? What’s your revenue model?

Our primary clients are accountants and bookkeepers. Our revenue model is SaaS.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I would love to have the APIs of all the banks today but I’m being impatient. The APIs will unleash a torrent of innovation that’s going to be incredibly exciting to be a part of.

What is your message for the larger players in the Finance industry?

We are in conversations with large banks around the world, with start up banks, and with many startup fintech businesses. We are interested in speaking with anyone who can help us on our mission to make bookkeeping more efficient.

When we speak to the larger players, we are always interested in their view of how the market is going to evolve and my message is always the same – technology trends are irreversible and the rewards flow to those that embrace them, whilst those that resist always, always miss out.

What phone are you carrying and why?

The iPhone 5S because Apple made some incredibly smart decisions and bold calls about ten years ago and therefore I’m now on the conveyor belt that means I will be buying their products for years to come!

Where do you get your industry news from?

I’m fascinated by Warren Buffett’s perspective that 80% of his job is reading and learning. I think that is right – especially in a tech business. I find history books as useful as the tech blogs as a source of inspiration.

Can you list people you rate from the FinTech sector that we should be following on Twitter?

@patrickc – Patrick Collinson of Stripe

@pmarca – Marc Andreessen of A16Z

They are just incredibly smart people and I find myself learning from them everyday.

What’s the best FinTech product or service you’ve seen recently?

There’s so much happening that I’m going to go with the most recent (to me): WeSwap. At first when I saw it I thought – surely that has been covered by TransferWise but, as is so often the case, this space has more subtleties than is immediately obvious to an outsider. WeSwap’s provision of debit card specialised in holiday cash is just incredibly useful!

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

The fragmentation of banking. How far will it go…?

Historically infrastructure, regulation and the cost of capital have limited which organisations can be ‘banks’. Today we already see the emergence of really exciting new banks, but it is already clear that the meaning of “banking” depends hugely on demographics of the customer:

● Teenagers don’t need any kind of lending but would hugely welcome crowdsourced data on friends’ transactions i.e. all your friends are buying tickets to TayTay. So maybe Snapchat is best placed to be their bank.

● First-home owners have huge debts and tend to have to manage money carefully and would welcome all kinds of advice on opportunities to cut costs on the predictable, daily costs of life. Maybe Tesco should be their bank (as opposed to the white-labelled financial services they provide today).

● Affluent retirees have money to invest and limited borrowings. It is difficult to see the existing banks giving up this demographic without a fight. Therefore I would expect HSBC and others to make the changes necessary to ensure that they remain the bank of choice for this demographic.

– – – – –

Thanks to Michael for his answers today. You can find out ore about Receipt Bank on their website, Facebook, LinkedIn and Twitter.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.