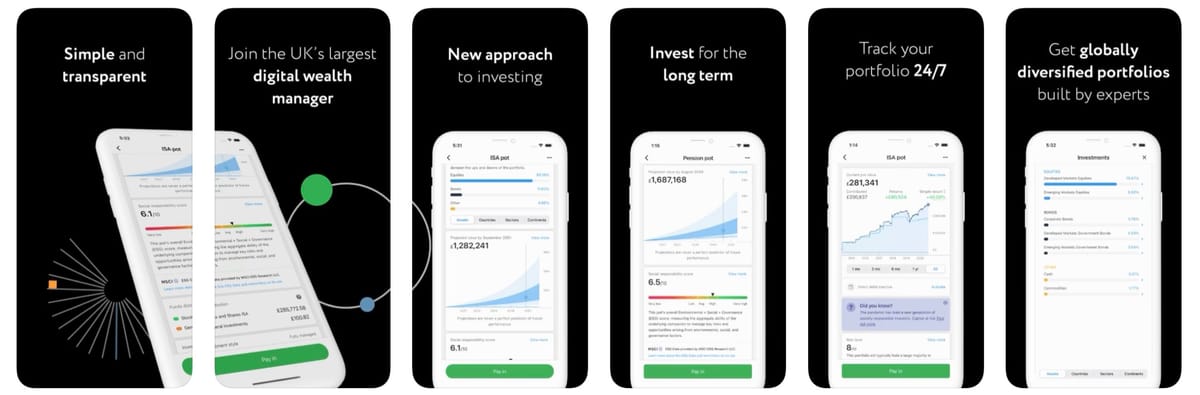

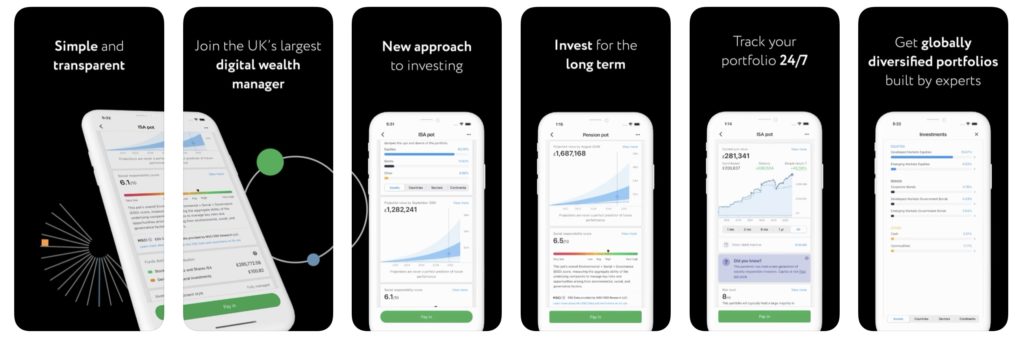

My favourite FinTech: Nutmeg

At the moment I’m not enjoying looking at any investment products because you know the answer is ‘negative’. Such is the fickle reality of markets, especially in these turbulent times.

That being said, I thought I’d kick-off my ‘Favourite FinTech’ feature by saying ‘thank you’ to Nutmeg for getting me started personally with robo-advised-investments, properly.

I knew of Nutmeg. I’ve been following for ages, ever since the service launched back in 2011 (so says Wikipedia, it must be right). I can’t quite recall when they launched their app. I was aware of the initial web-version of the service. I certainly downloaded the app when it launched and I remember setting up a test account effortlessly… I did everything but actually invest.

The timing just wasn’t right for me. A few years later though, I remember thinking, “Ok, it’s time to get organised now,” as I re-downloaded the app.

The first thing I did was setup some investment savings accounts for the children. It was a literal breeze. Tap, tap, done. I loaded each account with a starting amount. Super fast. Then I setup automatic monthly deposits… tap, tap, done.

Look at me. I’m such an organised dad. (Or, more accurately, thanks to the team at Nutmeg for designing such a simple approach to investing!)

It was so easy – and since I was getting into it now – I decided the children needed an investment account each for ‘university’.

“How much does that cost?” I thought to myself. I Googled. I did some estimates. I found some useful advice. I then instructed Nutmeg to help me reach a probable investment target over a specific time period adjusted to each child’s age. Again, effortless. Tap, tap, done.

Every now and again I login to the app and take a look at how things are going. Once or twice I’ve decided to increase the amount into one account or adjust the risk profile on another. I am certainly paying for the ‘ludicrous mode’ option that Nutmeg offers (that is a risk profile of 10/10) which is something I’ve been quite happy benefitting from when the times were good.

But with a decades+ investment horizon, the good times will be back again. At some point.

I’m really pleased I’ve been able to do everything from the app. Editing accounts, changing contributions, adding one-off payments and so on. Indeed their one-time-top-up capability is also effortless thanks to super-seamless TrueLayer’s open banking capabilities.

I was somewhat concerned when Nutmeg was sold to JP Morgan last year for a rumoured 700m GBP price tag. I’m pleased the team at JPM haven’t sought to radically change anything!

Meanwhile I am absolutely delighted with the experience of Nutmeg. Other services are available, of course. I do use a few others too. I’d love to know what your preferred tool is for managing your savings/investments – please do comment below or send me an email.