Nick Bortot of BUX

Today’s profile is with Nick Bortot from BUX.

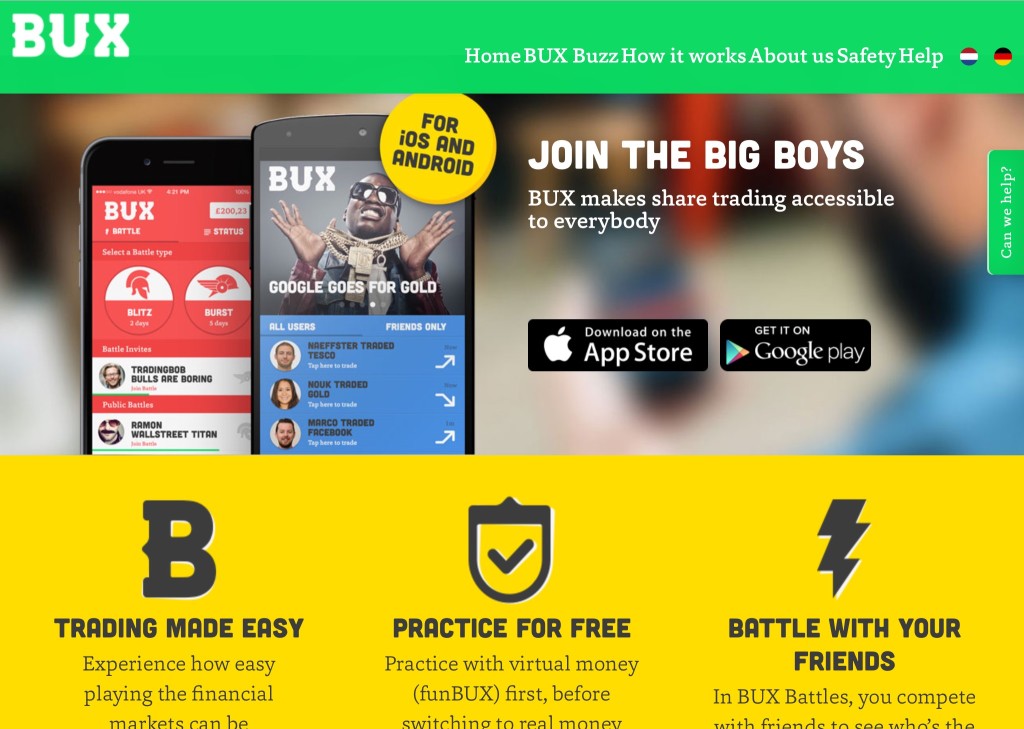

BUX is the smartphone app that makes stock trading accessible to everybody.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

My Name is Nick Bortot and I am the founder and CEO of BUX. Previously I was a board member and one of the driving forces of BinckBank – a major Dutch online brokerage company. I took BinckBank from start up, to IPO, to a 1 billion dollar company, resulting in over 15 years of experience in online brokerage. I have a Bachelor in Business Administration from Nyenrode University and a Masters’ degree in International Affairs from the University of Amsterdam. I believe I ended up in online brokerage because I really feel that the financial markets make up the biggest and best game in the world. 😉

What is your job title and what are your general responsibilities?

I am the founder and the CEO of BUX. I am focussed on building a great team and I try to keep all the noses of our people facing the same direction: to make the world of stock trading more fun and more accessible to all. On a day-to-day business I oversee all marketing, PR, media and communications efforts.

Can you give us an overview of your business?

BUX is a smartphone app that makes stock trading accessible to everybody. Playing the financial markets has never been so easy and straightforward. With BUX everyone can experience the excitement of the stock exchange even if a one doesn’t have tonnes of trading experience or wads of cash to spend. There’s a trader in everyone. Come and join the Big Boys!

Users (BUXsters in our vocabulary) start completely for free with funBUX. When they feel they’re ready they can decide to switch to trading with real money; seriousBUX.

At the moment we’re live in the Netherlands and the UK only and we very recently started in Germany. We’ve currently got around 220,000 users. The total trade value processed since BUX’s launch in September 2014 is over £1.2 billion.

Tell us how you are funded.

We funded BUX ourselves initially. Orange Growth Capital financed the first round of funding. Initial Capital led the recently closed second round of £1.2M, with Velocity Capital and other Angel Investors participating as well.

Why did you start the company? To solve what problems?

We think playing the financial markets is the best game in the world. A game that shouldn’t only be enjoyed by the Big Boy Bankers, but one that everyone should have access to. But unfortunately, up until today, stock trading has been way too complex. Your typical trading platform looks like a HiFi-set from the eighties: it’s a maze of buttons, sliders, blinking lights, numbers, and complex jargon, built to impress those ‘in the know’. That’s why BUX finally makes trading easily accessible and fun for everybody.

Who are your target customers? What’s your revenue model?

We’re here for everybody who is young of mind, who likes to compete and who has an interest in business, the economy or the financial markets in general, but who has no or maybe just a little trading experience. Our main target audience are the Millenials, young people between 18 and 35 years old.

Our revenue model is based on small trading fees that serious BUXsters pay while trading. Besides this, we’re currently experimenting with in-app purchases in our funBUX freemium model as well.

If you had a magic wand, what one thing would you change in the bank-ing and/or FinTech sector?

We’ve been down and out for too long: we like to bring the fun back into finance. And we like everybody to become more financially literate! We believe that helping people understand how the financial markets work is an important part of that.

What is your message for the larger players in the Finance industry?

To avoid becoming a dinosaur, try to let go of your legacy and become a responsive company.

What phone are you carrying and why?

An iPhone 6. I love the user friendliness of Apple products, though I feel that the screen of the iPhone 6 is a bit too large. When I’m on my bicycle, I have a hard time handling my iPhone 6 with one hand – something that was not an issue with the 5. (Note that in Amsterdam, it’s common to use your phone while on your bike 😉 )

Where do you get your industry news from?

I love twitter for following irreverent influencers and early adopters.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

People in the fintech sector are a bit too much absorbed in their own world and tend to share what others in the Fintech sector are sharing as well. I prefer to follow people outside of the fintech sector, sometimes even outside of the realm of business in general. @SUEAmsterdam is a great twitter channel from a cut-ting edge Amsterdam agency, sharing lots of interesting stuff on new school marketing. @Couplandism is really great twitter channel, based on writers Douglas Couplands work, to come to grips with our current hyper-connected culture in a very playful way.

@atst is the twitter channel of the All The Small Things Newsletter – great read on all things digital and tech in the marketing realm.

What’s the best FinTech product or service you’ve seen recently?

I really like what Knip (knip.ch) is doing – they recently went live in Germany, just as we did. They basically offer an app that makes your personal insurance much more oversee able and transparent. Their app shows you where you miss proper insurance and it shows you for which insurance you pay too much. And when needed, you’ve got all your insurance policies in one place. Extremely handy and cost saving!

What is your message for the larger players in the Finance industry?

If you don’t want to be outrun by young smart fintech startups, my advice to the larger players would be to focus on your basics of running a financial organisation. And then give young talent the opportunity and complete freedom to develop fresh products and services, not hindered by the legacy of the corporate organization.

A good metaphor is this: Think back to when you were young and just passed your driving test. Isn’t it great when your dad just hands over the keys to his car and goes back inside the house himself to continue reading his paper? In fact, it’s actually not very helpful at all when your dad decides to sit next to you in the car and intervenes with everything you’re doing. That’s nerve wrecking.

This is true for innovation as well. Corporate structures, compliance and checks and balances shouldn’t encapsulate innovation. Just rent an office space in Shoreditch where you put the young ones, give them maximum freedom and show up only a few times per year – that’s it. This is going to bring you much more than the prototypical Chief Innovation Officer or Corporate Innovation Centers.

Finally, let’s talk predictions. What trends do you think are going to de-fine the next few years in the FinTech sector?

Since virtually everybody nowadays is able to build technically complicated stuff, the company making complicated things very accessible by creating a very user friendly interface, based on heart-felt consumer insights, is going to be the winner. The interface is becoming more important than ever. We’re going to be seeing a lot of startups based on a better, friendlier, less complicated interface.

Another trend concerns the fact that financial products usually are very serious and boring to most people. I think that we will see a whole new range of startups that bring the fun back into finance. For example: I love what PayPal is doing, but why is my PayPal app so ‘corporate’ and dull looking? I really believe people like to use products that are designed in such a way that makes them enjoyable to use.

– – – – –

Thanks to Nick for his answers today. You can find out more about BUX on their website, Facebook, LinkedIn, Google+, Twitter and Instagram.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.