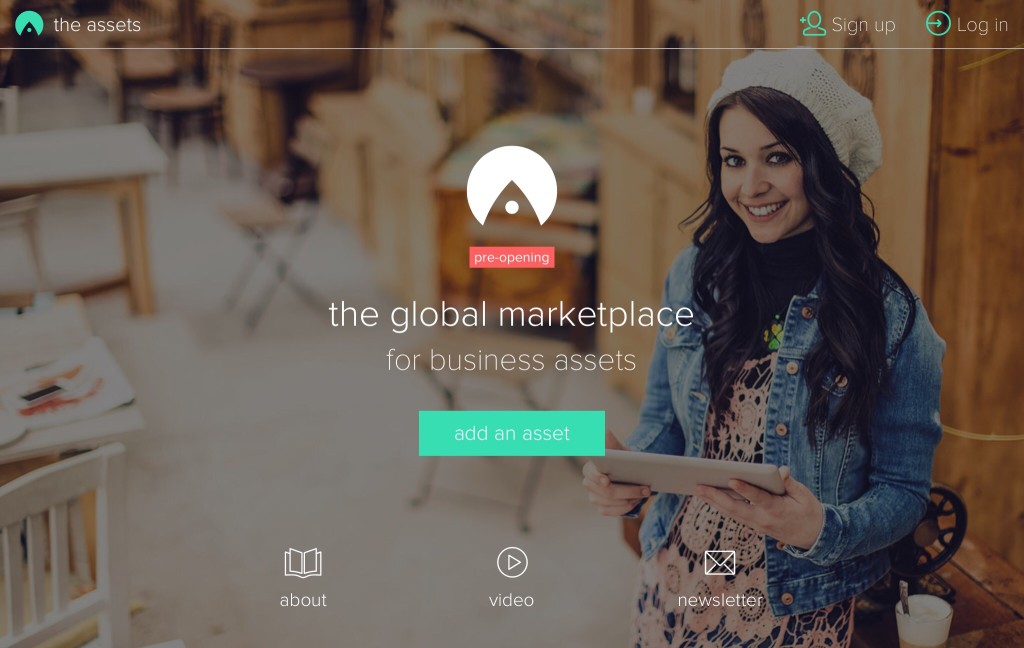

Nicolas Voisin of The Assets

This week’s profile is with Nicolas Voisin from The Assets. Our questions are in bold.

– – – – –

Who are you and what’s your background?

I have been an entrepreneur for 18 years – have founded a longskate company, a two times award digital media and an iPad focused startup that won its first quarter million users in 12 weeks.

Being around the startup ecosystem for quite a while, I realized the unlocked potential of startups that are failing to monetize their assets though they are looking for liquidity. I surrounded myself with 5 amazing co-founders and we created The Assets, the first p2p marketplace enabling companies – not only startups – to sell, buy, rent or swap business assets.

What is your job title and what are your general responsibilities?

CEO – vision, execution, management.

Can you give us an overview of your business?

The Assets is a horizontal marketplace where companies can monetize all parts of their balance sheet:

– Tangible assets (machinery, real estate, stocks…)

– Intangible assets (patents, softwares, databases…)

– Financial assets (shares, debt)

Unlike most existing B2B marketplaces that offer paid ad services, they can display their assets for free. Although some assets may have a low accounting value due to heavy amortization, they can have a high market value – by putting them on the market, companies can access new financial resources!

Very soon, advanced options will be available for users willing to add more information about their assets: for $49, they will benefit from fully dedicated pages, including a media gallery, videos, documents, key figures and multi markets entries. Most importantly, these assets will appear on top of the listings.

Tell us how you are funded

We a couple of angel investors that are already on board! Raised $2 million so far + 1 to come.

Why did you start the company? To solve what problems?

At every stage of its lifecycle, companies may need to get liquidity (early stage, pivot, ending a business unit…). We aim to ease the process of monetizing companies’ assets, and support inter-company transactions. Now more than ever, companies need to adopt an open innovation mindset. The Assets is the place where they can meet, connect and grow!

Who are your target customers? What’s your revenue model?

Tough question – our target customers are all companies, from startups to large corporations. Obviously, they do necessarily not share the same needs, but the different possibilities our platform provides makes it interesting for all of them. We have already sealed partnerships with large corporations and institutions that are interested in using our platform on a regular basis, while creating awareness within companies that may need to use it at some point.

Our revenue model is composed of premium classified listings, BI offerings and targeted ads.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I would make banks more customer-centric, but I am convinced this will happen one way or another. Financial institutions are realizing the potential of FinTech startups and reimagining their organization to cope with disruption. Let’s hope their culture will change accordingly!

What is your message for the larger players in the Finance industry?

Open up, and run!

What phone are you carrying and why?

An iPhone 6, the easiest for a Mac addict 😉

Where do you get your industry news from?

Twitter is by far the most comprehensive source of information. I actually always have my Twitter feed open, and I need to be aware of news at the very moment they are out there! Since recently, Facebook has become interesting for spotting news as well.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

I’ll go French on this one!

– Jean-Michel Pailhon, financial industry expert => @FinTechFR

– Nicolas Debock, VC @Balderton => @ndebock

– Rebecca Menat, our very own content director => @RebMelMen

What’s the best FinTech product or service you’ve seen recently?

Once again, as a proud French entrepreneur, I’ll choose three of the best representatives of the French FinTech landscape: Compte Nickel for alternative banking, Finexkap for factoring, and Leetchi for group payments.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Optimisation, optimisation, optimisation. This is the main word, and it will dominate all sub-sectors of finance, in every area. “Uberisation” and robotisation are only stages of a cycle that started with technological disruptions and the introduction of new habits. Mark my words!

– – – – –

Thanks to Nicolas for his answers today. Check out The Assets at their website, twitter, facebook, Google+ and LinkedIn.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.