Oz Azaria, Co-Founder & CEO, Hoox

Today we’re meeting Oz Azaria, the Co-Founder and CEO of the customer activation platform, Hoox. They help banks and card issues engage with their cardholders in order to gain top of wallet positioning.

Over to you Oz:

Who are you and what’s your background?

I’ve always been fascinated by the financial industry. As such, I’ve worked in the payments industry for almost 15 years. First for an issuer and then for Mastercard, one of the world’s largest payment networks. As part of my duties, I was in charge of encouraging card usage in Israel and some EU regions. I saw first-hand the tremendous resources and efforts being deployed through issuers and payment networks trying to differentiate and engage with their customers.

What is your job title and what are your general responsibilities?

I’m the CEO of the company, responsible for our vision, GTM strategy and most importantly – building a long-lasting culture

Can you give us an overview of your business?

US Issuers spend more than $100bn/year on card incentives across 1.5bn cards in circulation (Debit & Credit) – yet, more than 40% of all cards remain inactive (=eligible to use but not being used).

Cards are a great means for brand loyalty – and with FinTech booming – issuing cards became a commodity. As a result, the average US consumer carries more than 4 cards on average – and the competition between issuers is constantly heating up.

What ends up happening is the main tool issuers are using are what’s called ‘card-linked-offers’ where issues are using their internal marketing channels (bank’s website, emails etc.) to promote merchant incentives for their cardholders.

Usually consumers are required to pre-select incentives in order to utilise them, and those incentives are one-fits-all rather than a differentiated offer for different kinds of cardholder profile (inactive, semi-active, new, top-of-wallet etc.).

So we thought that if we could help issuers engage their cardholders with dynamic, personalised, real-time, measurable incentives at the point of purchase (‘embedded offers’) – we could be way more effective.

We built a vertical SaaS platform for issuers to help them (i) manage and optimise their entire card portfolio and (ii) engage their cardholders outside their internal network through embedded offers.

Our tech stack includes a proprietary zero-knowledge architecture that enables anonymous data collaboration, in real-time, among a few unrelated parties – all without PII and fully compliant with privacy legislation.

It’s a win-win solution: Issuers are getting better card activation for a fraction of the costs (we’re seeing up to 30% conversion rates for our offers, which is more than 10x better than legacy methods), merchants are boosting their conversion rates through externally funded incentives and consumers get access to personalised benefits without the need to download any app or extension.

Tell us how you are funded?

We bootstrapped for about a year and then raised a pre-seed through Mastercards’s accelerator, Fusion VC and some angels.

What’s the origin story? Why did you start the company? To solve what problems?

While working at Mastercard, I noticed first-hand how most of what we did and the tools we used to encourage card usage were spray-and-pray – and thought this industry is lagging behind the digital advertising industry.

Who are your target customers? What’s your revenue model?

Our target customers are issuers. There are about 5,000 issuers in the US alone, ranging from small card portfolios of <100k cards to some exceeding 100M.

Issuers are mainly:

- Banks

- Co-brand retailers (a merchant that issues a branded card)

- Loyalty clubs (e.g. airlines, hotels etc.) and

- FinTechs (Robinhood, Revolut etc.)

Co-brands are a sweet spot for us because they understand the pain from both angles and since their inactivity rates for their cards outside of their stores are even 70-80%.

We can really help those guys increase the daily usage of their cards and draw their cardholders back to their stores by embedding loyalty within their wallets.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

FIs are under extreme scrutiny – so onboarding new category-defining products is lengthy – I wish there was a way to accelerate adoption. And from a consumer PoV – I wish there were more tools helping me optimise the way I use my payments options.

What is your message for the larger players in the Financial Services marketplace?

Consumers are expecting consumer-level UI/UX, FIs cannot do it by themselves given understandable constraints – so ideally FIs could offer test-beds for new products – to analyse and deploy faster.

Where do you get your Financial Services/FinTech industry news from?

I get my news from LinkedIn industry players and Fintech Business Weekly.

Can you list 3 people you rate from the FinTech and/or Financial Services sector that we should be following on LinkedIn, and why?

What FinTech services (and/or apps) do you personally use?

As a consumer:

- Apple Pay

- Click2Pay

- PayPal

- Coinbase

- Revolut

- Credit Karma

What’s the best new FinTech product or service you’ve seen recently?

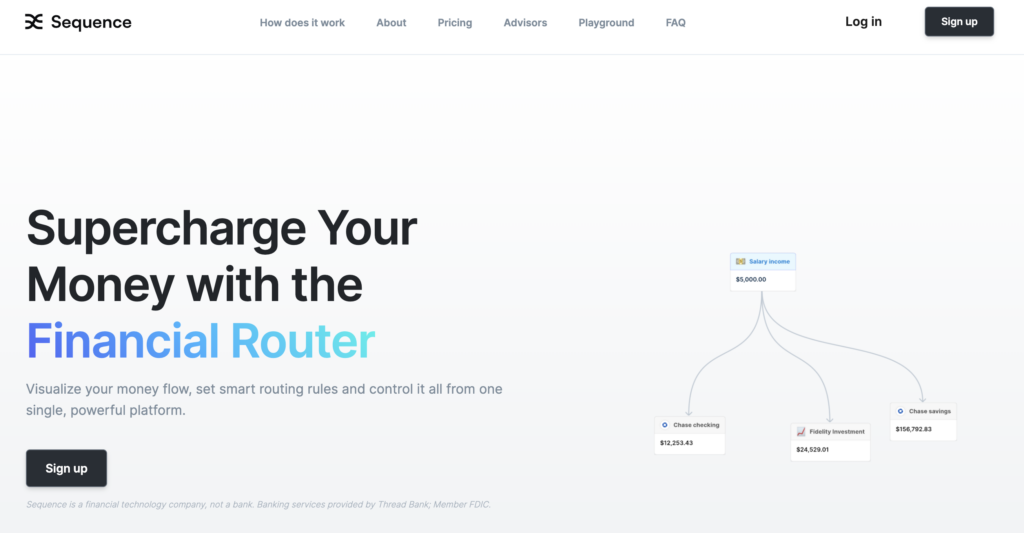

Check out: https://www.getsequence.io/ – money router

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

- AI and ML: Improve data analysis, fraud detection, and customer service, making financial decisions smarter and services more personalised.

- Digital Banks: Online-only banks

- RegTech: Simplify regulatory compliance

- Embedded Finance: Companies integrate banking services into their own

Thank you for taking the time to participate, Oz!

You can connect with Oz Azaria on LinkedIn and find out more about Hoox at https://www.hooxpay.com/.