Philippe Gelis of Kantox

Today on FinTech Profile, we have Philippe Gelis from Kantox.

Kantox is a pioneering peer-to-peer foreign exchange platform for businesses, bringing SMEs and mid-caps a cost-effective and transparent alternative to trading FX with banks and brokers.

Our questions are in bold.

– – – – –

What is your background?

I studied at the Toulouse Business School where I gained a Master of Business Administration, with a specialism in business strategy. After leaving, I was side tracked by corporate life and from 2007 worked as a strategy consultant for Deloitte. However, I always dreamed of being my own boss, and seeing the problems that FX had caused for some of my clients at Deloitte, I was determined to set up Kantox to help solve these issues.

What is your job title and what are your general responsibilities?

I am the CEO, so my job basically consists of three things: setting the long-term company vision, being sure that we have the best people on board, and being sure that we are well funded.

Can you give us an overview of your business?

We offer SMEs and mid-cap businesses a cost-effective and transparent alternative to trading FX with banks and brokers. For example, if you were a company located in Europe, importing goods from China and paying your Chinese provider in US Dollars, our marketplace would enable you to find another company, located in Europe, exporting goods to the US who has Dollars to sell in exchange for your Euros.

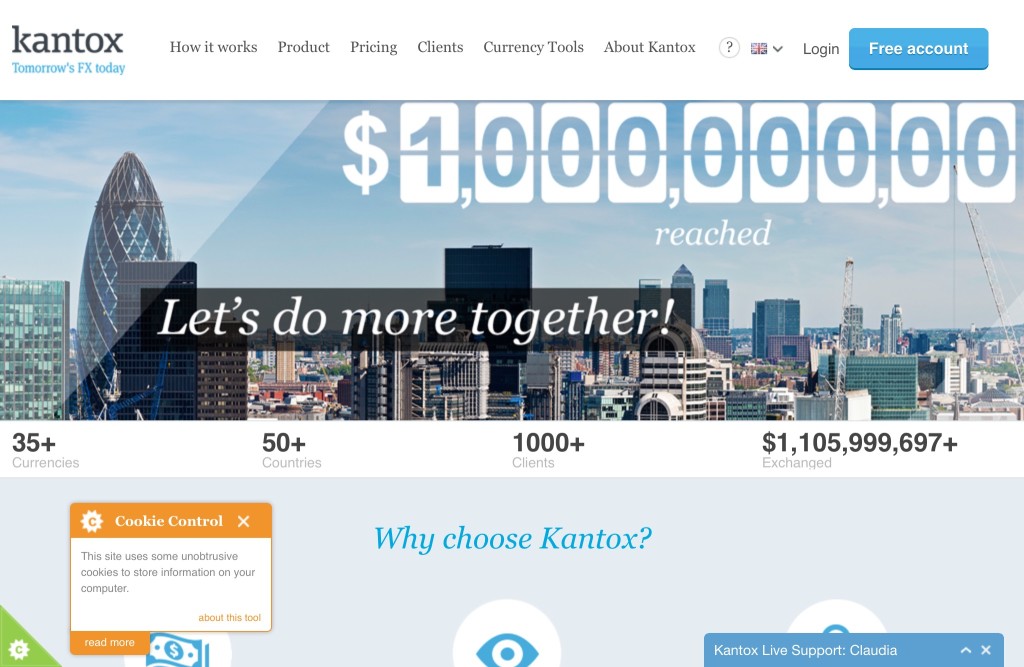

We currently have 1.000 business clients using our service, and are on track to hit a target of $1 billion worth of transactions by the end of the year. In December alone we traded more than 100M USD.

Tell us how you are funded.

In 2010 we took part in a 54-hour start up competition, Start-up Weekend. We met our CTO, John Carbajal, there and formed a team. The year after we won a start-up contest, OMExpo Investor Day, which came with a €25,000 prize. This provided a real sign that people were taking our business seriously and prompted me to quit my job at Deloitte to start running Kantox full-time.

Following this we raised a further €150,000 from family and friends, and concentrated on becoming FCA regulated. In 2012, we secured a €1 million investment, and from this were able to start scaling. In 2014, we secured a €6.4 million investment from Partech Ventures, IDinvest Partners, two leading venture capitalist firms, and Cabiedes Partners.

Why did you start the company? To solve what problems?

Whilst at Deloitte, one of my clients was exposed to a great deal of FX risk. With my co-founder, we tried to help them negotiate with their banks, but we soon realised it was expensive and complex for a mid-sized firm with no access to live rates. We spotted a gap in the market for supporting small and mid-sized firms with FX – not just the biggest corporates that the banks focus on – and so Kantox was born! Despite being based in Barcelona at the time, I knew that when setting up a FinTech company, it had to be London – the foreign exchange capital of the world.

Who are your target customers? What’s your revenue model?

We target both SMEs with revenues ranging from around £5-200 million, and also mid-cap businesses, some of which have revenues in excess of £1 billion, a couple of them are listed on the stock-exchange. The largest single transaction that was carried out by a customer was $21 million last year. We charge customers between 0.09% to 0.19% commission per transaction, whereas the banks charge between 1 and 3% upwards. We once saw that a client had previously received a charge of 3.39% by their bank due to the hidden fees on the transaction.

78% of Kantox’s clients achieve savings of 80% or more compared to when using a bank or broker.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

The FinTech sector has made amazing progress in the last few years – with alternative players increasingly moving into the mainstream and encouraging traditional players to revolutionise their practises.

Nonetheless, the recent Forex scandal demonstrated the extent of the opacity that continues to surround banks, the greediness culture is here to stay. The foreign exchange market would benefit greatly from decentralisation away from the dominance of a select few banks, in preference for company-to-company currency exchange. As long as this ‘power circle’ remains, there will always be hidden fees, small print, and the risk of collusion and manipulation.

What is your message for the larger players in the Finance industry?

The forex market is so big ($5.3 trillion traded daily), that banks will always play a big part – particularly with the largest companies, where they can make the biggest profit. Kantox concentrates on the under-served market – the SMEs and Mid-caps who are in some cases leaving themselves exposed to risk from foreign exchange movements, rather than engage with expensive, opaque banking products.

What phone are you carrying and why?

An old-school iPhone 4. I don’t really follow fashion trends and don’t have an interest in having the last trendy consumer products.

Where do you get your industry news from?

Finovate, Finextra and mainstream financial press. Fintech is now so hot that newspapers like WSJ or FT cover it a lot.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Chris Skinner (@Chris_Skinner) – an independent commentator on the financial markets, regularly discussing key issues and opportunities in banking

Dave Birch (@dgwbirch) – director of Consult Hyperion, Dave is a thought leader in digital money and has been ranked as Europe’s most influential commentator on emerging payments

Ana Irrera (@airrera) – trading and technology reporter at Financial News.

What’s the best FinTech product or service you’ve seen recently?

I am still waiting for the first true fintech bank!

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

We are in the middle of the first fintech wave, with many companies disrupting “verticals” such as FX, lending, invoice discounting, payments, etc. This wave will continue for around another 2 or 3 years, and we will start seeing M&A and partnerships soon, with banks “buying” what they are unable to provide, which is a good user experience (what BBVA did buying Simple) – transparent and fair prices.

Then, people will experiment with the second wave, the one that will really disrupt the market: fintech banks built from scratch. Once successful fintech entrepreneurs from the first wave build their second company, they will have enough credibility, experience and funding to get banking licenses and directly compete with banks on their core business. Here, I mean 100% online banks, based on connectivity and APIs, or “banking ecosystems”.

– – – – –

Our thanks to Philippe for his answers today. You can also follow Kantox on Twitter too – or reach out to Philippe on LinkedIn.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.