Quentin Colmant, Co-Founder & CEO of Qover

Today we’re meeting Quentin Colmant, Co-Founder & CEO of leading embedded insurance provider, Qover. In Quentin’s interview, we’ll find out about his own background and journey toward creating the company — along with the Qover origin story.

Over to you Quentin:

Who are you and what’s your background?

I graduated with an MBA and two Masters’ degrees, one in engineering science and applied mathematics and one in finance. So two very different stories, quite nerdy, techy, with lots of mathematical analytics. But I still ended up in the insurance industry by accident!

Back in 2007, everyone was looking to get into investment banking in London and I was applying everywhere. At the time, I recalled that when I was seven years old, I ran a small marathon, I think it was five kilometres. At the end, I got a pin, with the brand of AGF, which stands for Assurance Général de of France – a big French company that was acquired by Allianz. So, I decided to send my CV there, secured an interview and they offered me a job as the chief of staff of the COO.

I was very excited by this opportunity – and to have a very strong mentor heading up such a big company. I’ve had the chance to gain very deep knowledge of the insurance world. I’ve done several roles such as the chief of staff of the COO initially, where I was a bit like the internal consultant working on the organisation.

Apart from this, I managed the Operations department of Personal Lines P&C, which is non-life insurance. Later on, I was involved with the Allianz Belgium and Allianz Netherlands merger.

What is your job title and what are your general responsibilities?

My previous experience in the insurance industry, coupled with my background in internal consulting, strategic planning, and multi-country operations management, has equipped me with the knowledge and credibility needed to lead Qover. This experience has been instrumental in shaping our strategic direction and guiding our growth trajectory.

My role as the CEO of Qover now involves leading the management team and the board of directors, strategic planning and vision, amongst other responsibilities.

Can you give us an overview of your business?

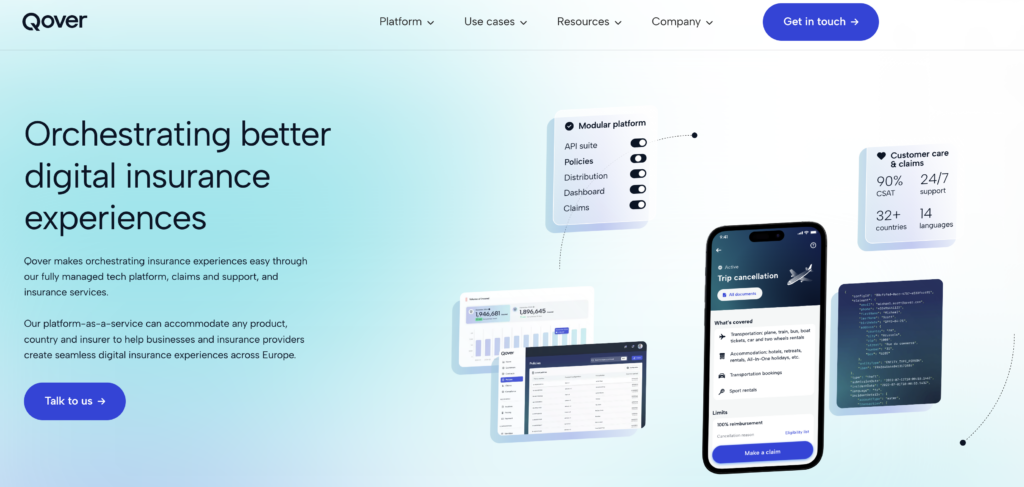

Qover makes orchestrating insurance experiences easy through our fully managed platform, claims and support, and insurance services.

Our ‘managed’ platform can accommodate any product, country and insurer to help businesses and insurance providers create seamless digital insurance experiences across Europe.

Tell us how you are funded?

Qover’s investors include major venture capital firms such as Alven and Anthemis Cathay Innovation, Prime Ventures, along with strategic investors like corporate venture investor Zurich Global Ventures and venture debt provider BlackRock. The insurtech’s total funding is at $70 million since its founding in 2016. You can find out more about Qover’s various fundraisings on Crunchbase.

What’s the origin story? Why did you start the company? To solve what problems?

The gap in the market that inspired the creation of Qover was the absence of Pan-European insurtech companies. I recognised this void and sought to fill it by establishing a company that could offer a seamless digital experience for businesses, with the ability to smoothly embed insurance through an API-first approach. This approach ensures that our partners and customers have access to a global safety net that is tailored to their specific needs, rather than a one-size-fits-all solution.

Having worked at Allianz Benelux for 8 years, I gained valuable insights into the insurance industry and identified the opportunity to create a more tech-driven customer-centric model. By focusing on embedded insurance orchestration, Qover is enhancing the way businesses approach insurance, making it more accessible, convenient, and effective.

Who are your target customers? What’s your revenue model?

We are pretty unique because most other insurtech companies have been focused on one single product or one single market while we are offering multi-product and multi-country options.

I think of it as a more complex and holistic insurance solution. We do motor insurance, we do purchase insurance, we do travel insurance. So it’s very broad and it makes a lot of sense because insurance is ultimately about managing your technical loss and technical profit.

Thanks to our modular embedded insurance orchestration platform, we provide meaningful insurance experiences to over 4.5 million users across 32 European countries, and we have had the pleasure to work with longstanding partners like Revolut, Monzo, Deliveroo, Fisker, Canyon and many others.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

We believe in the significance of insurance coverage in constructing a global safety net.

So with my magic wand, I’d ensure that insurtech companies aim to better society by prioritising maximising the loss ratio rather than minimising it, while maintaining profitability.

A loss ratio of 0% indicates no claims paid, while 100% indicates claims equal to premiums, rendering no profit.

What is your message for the larger players in the Financial Services marketplace?

If they are looking to add insurance into their value proposition, I bet they will think they can do it themselves.

So I’ll quote Warren Buffett:

It’s not an easy business. The success of the auto companies getting into the insurance business is probably as likely as the success of the insurance companies getting into the auto business.

So cut the bullshit, focus on your core business and let companies that have made it their core business to help you make it a long-term success for you.

Where do you get your Financial Services/FinTech industry news from?

I don’t rely on any one source. Instead, I look at multiple publications to get a broader and unbiased understanding of the financial and technology landscape. I’d strongly recommend TechCrunch, Crunchbase, FT Partners, PitchBook News, Sifted and CB Insights.

Can you list 3 people you rate from the FinTech and/or Financial Services sector that we should be following on LinkedIn, and why?

- Bobby Molavi Partner and Head of Execution services at Goldman Sachs for his macro view of the market in the newsletter ‘Ruminations – Macro, Micro, Markets, Tech’

- Nik Storonsky, Founder and CEO of Revolut, is trying to make the best product in the most accessible way possible. He is working hard to make the best Super App in the world.

- Michael Jackson, Venture Capitalist – for his sarcastic view on the financing world.

What FinTech services (and/or apps) do you personally use?

I probably will not surprise you with my list since it’s made up of the usual suspects.

My go-to apps include Wise, Revolut, Binance, Stripe, and PayPal because of their convenient features and innovative solutions.

What’s the best new FinTech product or service you’ve seen recently?

Definitely Wise for all my wild international payment needs. It’s super fast and very competitive, and I am really blown away by its offering.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

API integration and AI adoption are pivotal trends in the insurance space, enhancing operational efficiency and customer service. While we may not expect an overnight revolution, there are already numerous applications for 2024 that are enhancing operational excellence and improving the customer experience.

For instance, AI-powered systems are now surpassing traditional OCR and scanning systems, enabling more accurate and efficient data extraction from documents. This not only reduces manual errors but also accelerates processes. Additionally, AI is playing a vital role in fraud detection, customer ticket screening, and response preparation, further enhancing operational efficiency.

Thank you very much for participating Quentin, that was great!

Find out more about Quentin on LinkedIn here Quentin Colmant and follow Qover at www.qover.com.