Rainer Plentl of Finpoint Ltd

Today we are joined by Rainer Plentl from Finpoint Ltd.

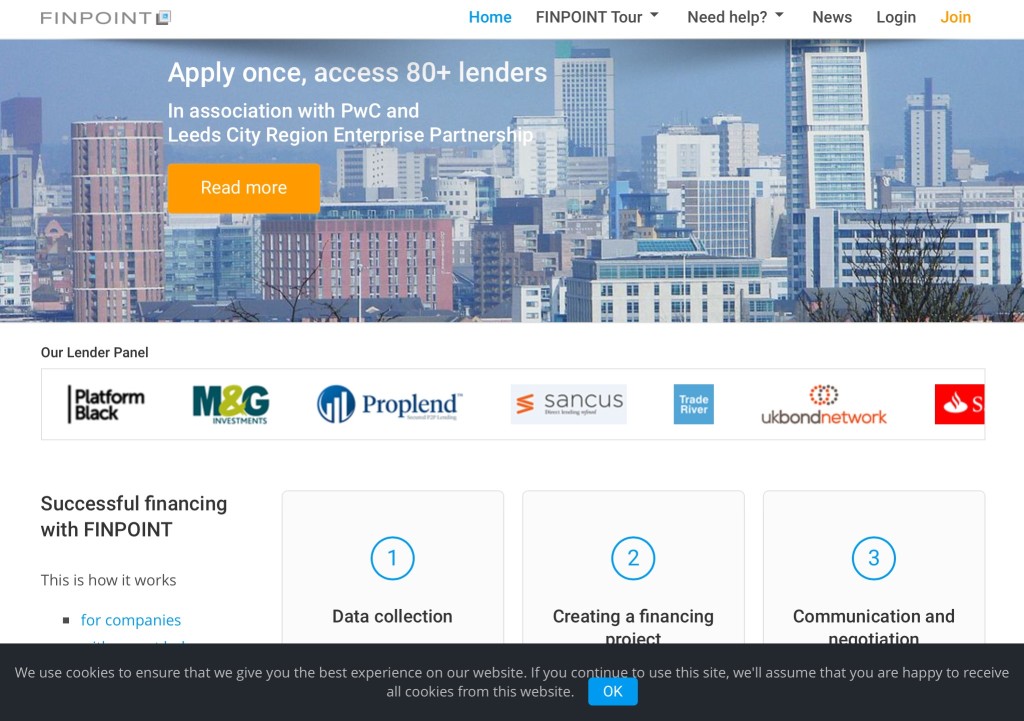

Finpoint.co.uk is a free online platform that allows SME business owners, finance directors and their advisors to connect with 80+ lenders. We help SMEs save time by capturing finance requirements in a single application that can be shared securely with our lender panel consisting of high street banks and alternative lenders (e.g. P2P platforms, trade finance houses, etc.).

– – – – –

Who are you and what’s your background?

My name is Rainer Plentl, and I am FINPOINT’s chief executive. After graduating from the Universidad Catolica, my career started as a merchant banker with Citi Group in Buenos Aires. Subsequently, I have worked in senior banking positions in Toronto, Paris, and London for CIBC.

I headed up Corporate Finance of Morgan Grenfell in Argentina to assist privately owned companies raising finance. Then I joined Jardine Matheson, the international trading, hotel, and retail group. As their Managing Director I developed corporate finance, debt finance, partnerships and cross-border opportunities. I was also Deputy Chairman of Matheson Bank.

With a proven track record in finance, I developed a clear vision on how to design FINPOINT as a customer-centric platform. By allowing SMEs to save time and get access to multiple finance providers with one single application that increases the chances of finding one or more suitable lenders; I am confident in saying that FINPOINT effectively reverse-engineered the process of finding funding.

What is your job title and what are your general responsibilities?

As CEO of Finpoint, I have a leadership role that encompasses our long term plans, developing our strategic partnerships and getting hands-on in the day-today decisions of running a technology-enabled small business.

Can you give us an overview of your business?

The FINPOINT platform was pioneered in Germany, where it has proven highly successful over the past five years and works as a one-stop shop for sourcing business finance. Since launching in the UK in Spring 2014, we have built a panel of over 80 finance providers that caters for all types of SME lending, irrespective of amount sought. Our panel is vetted by us before we give access to SME data and includes banks, specialist finance houses, and alternative finance providers.

Our service is designed to help small and medium-sized businesses (SMEs) to prepare an anonymous funding application that can be shared with multiple lenders in one go. The platform gives hints as to what information is required and saves time for SMEs. No need to phone around or hold meetings with lenders that may never lend. Coincidentally, it is also a more efficient way for lenders to get in touch with businesses that fit their lending criteria.

Tell us how you are funded.

We are fortunate to be backed by one of the leading investors in the rapidly emerging alternative finance sector, GLI Finance. They have helped us enormously to get established in the UK with their expertise and funding. We are now looking at the best way to grow the business from here and may add additional investors in due course.

Why did you start the company? To solve what problems?

Whether it’s cash flow or growth plans, every so often small and medium-sized businesses need external finance. No matter what their funding needs are, the questions remain:

• Do they find applying for business finance difficult?

• Do they have enough time to shop around for the best deal?

• Can they replace expensive credits with more suitable finance?

Moreover, SME owners may have applied for a loan but been rejected. This doesn’t mean they are not eligible to get the finance they need. But how will they find out who else could help?

That’s why FINPOINT exists. With FINPOINT, multiple lenders show interest in an anonymous preview of the SME requirements, and it’s up to the SME to decide which finance providers they would like to connect with for further negotiations.

HOW IT WORKS

Each SME needs to register their company details and create a user account. Uniquely, our platform also allows advisors (e.g. accountants, mentors) to collaborate with their client or act on behalf of SMEs.

Following on from the registration, the SME or the adviser completes a finance request that consists of 4 sections:

• Company address and contact details

• Financial performance (typically the last three years of filed accounts)

• A brief description of the how the finance is to be used

• Supporting information or attachments (e.g. security provided by the company or its directors, project details, business plan, cashflow forecast, etc.)

By giving the user a structure to follow, we ensure that finance requests contain accurate and relevant data about each business. Once it is ready, the user can submit the request and lenders get to see an anonymous preview. Any lender interested in finding out more can express interest instantly, and the SME or adviser then has to accept this in order to open up access so that borrower and lender can negotiate directly with each other.

If your business is registered at Companies House, you can prepare a funding application in under 10 minutes, at any time of the day. A wide variety of financial products is on offer with no specific limits by amount or sector.

Who are your target customers? What’s your revenue model?

At a high level, we have two types of customers; borrowers and lenders.

1) Regardless of the industry they operate in, any UK-based SME can apply for business finance. The same goes for advisors of SMEs. The financing types, as well as the amount, vary – the minimum amount is £1,000 and on average between 3 to 8 lenders come forward for each application on our platform (based on Q4 2015 data).

2) We are actively growing our lender panel, to ensure we have relevant finance providers registered with us who are active in the SME lending market. A big part of our work before we give them online access to SME opportunities consists in speaking with each lender and to capture their preferences, so we can effectively match-make between borrowers and lenders.

FINPOINT has a transparent business model. We publish a public list of all our lenders on Finpoint.co.uk/lenders and we also transparently share our fee structure: the use of the platform is free for companies, advisors and lenders – a success fee becomes payable by the lender for each successfully completed request. Typically this is 1% of the arranged amount (for business loans).

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

I would love to wave a magic wand and make SMEs more comfortable in shopping around for business finance. For too long, companies have been under the impression that the best place to get finance from is their Business Current Account provider, which is no longer true. With in excess of 100 alternative finance providers in the country, it is much more sensible to look beyond the traditional banking sector!

What is your message for the larger players in the Finance industry?

We do have a very collaborative approach to the larger players and are working with some of them already, but we are under the NDA so I can’t share details on that yet. The general message is that larger players should look at the emerging FinTech players with an open mind, in the knowledge that some of the innovation and technology breakthroughs cannot happen in a big corporate structure. Its not really a ‘size issue’, but anyone who has ever worked in a business that has become successful in one core area will know how hard it is to branch out and try new, ancillary ideas.

What phone are you carrying and why?

Not sure it’s a major revelation, but I carry a smartphone that allows me to make calls and check emails on the go? I’d prefer not to disclose the brand or operating system, just in case any hackers are listening.

Where do you get your industry news from?

Having grown up in the now old-fashioned financial services industry, I regularly read the Financial Times and newspapers such as City AM. But I also look to get news online, with LinkedIn and some industry groups (CBI, FSB) coming to mind.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Since there are so many different facets to the world of FinTech (FX, lending, robo-advice, etc.), mentioning three people doesn’t sound like nearly enough to do the space justice. I’d say, try www.onalytica.com/blog/posts/fintech-2015-top-100-influencers-and-brands/ and pick your personal favourite.

What’s the best FinTech product or service you’ve seen recently?

Our Head of Product is very excited to be one of 500 Alpha-Testers of getmondo.co.uk/static/images/blog/2016-01-14-alpha-update/alpha-update.jpg, but then again, FinTech covers so many areas … perhaps financial inclusion is worth highlighting: www.osper.com does great things to help kids become financially savvy, and so does www.aire.co for ‘thin-file’ consumers. Oh, I nearly forgot the great innovators in the SME lending space on our panel: www.finpoint.co.uk/lenders (iwoca, YesGrowth, etc.)

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Well, there is a lot of talk around Blockchain and how it can be useful for so many applications. For that topic and some other data-driven ones (predictive analysis, robo-advice, etc.), I guess we are at this point where the real challenge is no longer the innovation in itself, but finding the innovation that makes it into the mainstream. In part because the bigger players are bound to fight back, either by partnering with smaller innovators (as we start to see in the US) or by adjusting their own business models. But at the end of the day, many of the FinTech players I’m aware of are have moved from hype to adoption and are now working on the ‘broad acceptance’ of their model. We do it by extending our platform through partnerships.

– – – – –

Thanks to Rainer for his answers today. You can find out more about Finpoint Ltd on their website, LinkedIn and twitter.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.