Richard Dana, Founder & CEO, Tembo

Today I'm bringing you an interview with Richard Dana, Founder & CEO of Tembo, the award-winning platform offering products to help people buy or refinance their home.

Over to you Richard – my questions are in bold:

Who are you and what's your background?

I’m the founder of Tembo, an award-winning digital savings and mortgage platform in the UK. Prior to founding Tembo I had worked as CFO at Founders Factory, a venture investment company backed by Aviva.

I started off my career working in corporate finance at EY in London and Melbourne, but I think it’s fair to say that I am an entrepreneur at heart.

A decade ago, I co-founded a budget boutique hotel booking business which we grew and then sold to Chic Retreats (backed by Maven Capital) in September 2017.

More personally, I’m also a married father of two and I live in Guildford, Surrey.

What is your job title and what are your general responsibilities?

As founder and CEO, it is my role to ensure the business has sufficient resources and investment to continue to grow. I also help to set the direction and culture of the business. Everyone is very hands-on at Tembo so I also am responsible for people, finance and, until recently, managing partnerships.

Can you give us an overview of your business?

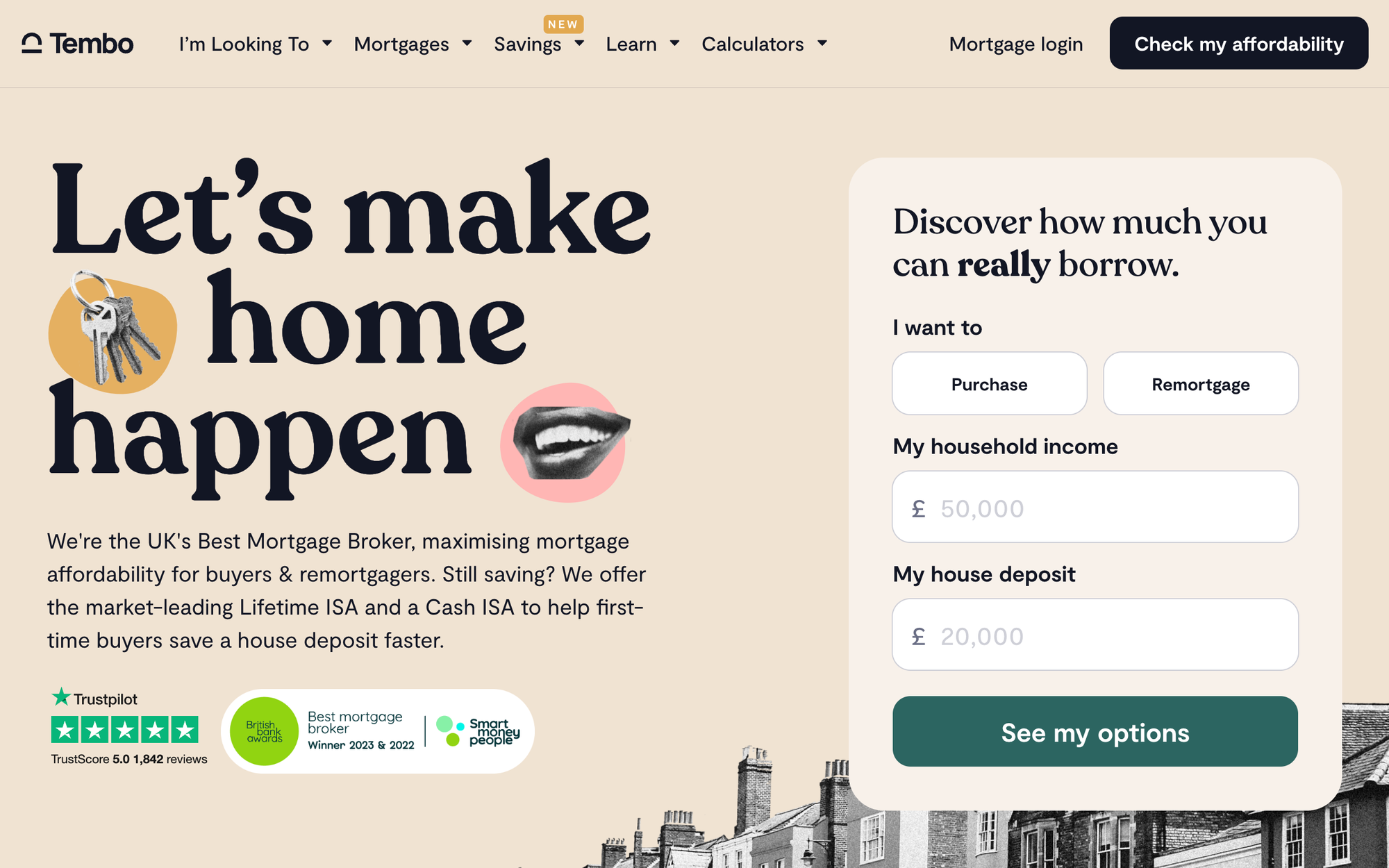

Tembo is a specialist digital mortgage and savings business that helps our customers - primarily first-time buyers - to buy their home sooner.

I set up Tembo in 2020 with the aim of trying to find alternative ways for families to help their loved ones to buy their first home. I’m often asked where the business gets its name from as it sounds quite unusual. Tembo means elephant in Swahili, and I wanted this as the company brand because the elephant is the most family minded animal on the planet.

We’ve slightly broadened our proposition over the last few years, focusing on helping people who are struggling with affordability. While that was historically mainly first-time buyers we now see affordability issues occurring throughout our customers' lifetimes - for example when they are looking to upsize to support a growing family, when they are going through a separation or when they reach retirement and still have a mortgage outstanding.

Tell us how you are funded?

Just two months after our official launch, in 2021, Tembo secured £2.5 million of funding in a round led by investors including Aviva and Fair by Design.

In April 2023 we secured an additional £5 million of investment from investors including Aviva, Ascension Ventures, Love Ventures and McPike Family Office.

To further accelerate our growth, we closed a £14 million Series B funding round at the end of 2024 in a round led by Goodwater Capital with participation from our existing investors, which brings our total funding raised to £20 million.

What’s the origin story? Why did you start the company? To solve what problems?

It started from my personal experience. I’d returned from living in Australia and was living with my parents, at the age of 30, in their house in London. I’d gently asked if they might be willing or able to help me towards increasing the size of my house deposit, but they didn't feel they had the funds. They had a house in London with significant equity so I felt that as a family we were not best using our assets. But I put that to one side and bought a house on my own, albeit at a pretty high interest rate.

I thought about that situation quite a bit over the following years - and felt strongly that I wanted to increase access to home ownership. Too few would-be home owners are aware of a range of new mortgage and savings products that have come to market recently which really can make all the difference for first-time buyers and people facing affordability issues.

Within a few months of launching Tembo we expanded into a broader range of family mortgages and alternative buying schemes, including the joint-borrower/sole-proprietor product that, back then, was the industry’s best-kept secret.

We’ve continued to grow Tembo by continually enhancing our platform with the best, most innovative solutions to make the dream of home ownership a reality. Since February 2024, for example, we have offered a lifetime ISA to help our customers save for that all important deposit. Tembo is now, more broadly, about helping people navigate the challenging property market in as many different ways possible.

Who are your target customers? What’s your revenue model?

We distribute both direct to consumers and also via a number of partners, including Saga Mortgages.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

There is an unbelievably low level of financial education in a large proportion of the population. Although we’ve made huge progress in providing better value and services to customers in financial services, there is still such a long way to go. It is hugely motivating to think that we’ve really only just scratched the surface. Whether we’re saving a customer £500 a month on their mortgage by switching from their long-standing lender or generating an extra £2,000 for them in interest on their Cash Lifetime ISA, there are huge, tangible, monetary gains that consumers could be making if they were aware and better educated about money.

What is your message for the larger players in the Financial Services marketplace?

We partner with pretty much all of the banks and main insurers in the UK and quite a few of the wealth managers too - so I would only have complimentary things to say about them! There is a great partnership to be had - we can offer speed, amazing service and technology and they have large balance sheets, stability and industry knowledge. Bringing the two together is a killer-combination - as we’ve found with many of our partners - including three of the five largest banks in the UK.

Where do you get your Financial Services/FinTech industry news from?

I look at Linkedin and I also see the Sifted newsletter emails that come through.

Can you list 3 people you rate from the FinTech and/or Financial Services sector that we should be following on LinkedIn, and why?

- Seb Johnson 📊 - provides timely updates on fintech news

- Richard Donnell - provides insightful and data focused views on UK property market

- Michael Jackson - amusing view on VC/investments

What FinTech services (and/or apps) do you personally use?

Starling Bank (for a joint account that I use with my wife to manage all our family spending). I also like Freetrade.

What’s the best new FinTech product or service you’ve seen recently?

The Tembo Cash ISA of course!

Finally, let's talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

We are a consumer fintech business and I’ve found it interesting that over the past few years that’s become a bit of a dirty word for many venture capital firms. One in five UK unicorns are consumer fintech so it seems a little counterintuitive, but I think that there will be huge growth in these businesses over the coming years.

They often offer far superior service, experience and value to many of the existing banks, insurers and wealth managers. As trust in new challenger providers continues to build, we’ll see the end consumer relationship being owned by the challengers with the existing providers involved in managing/lending the underlying assets.

Thank you very much Richard!

You can read more about Richard Dana on LinkedIn and find out more about his company Tembo at http://www.tembomoney.com