Stuart Lucas of Asset Match

Another profile this week with a look at Asset Match.

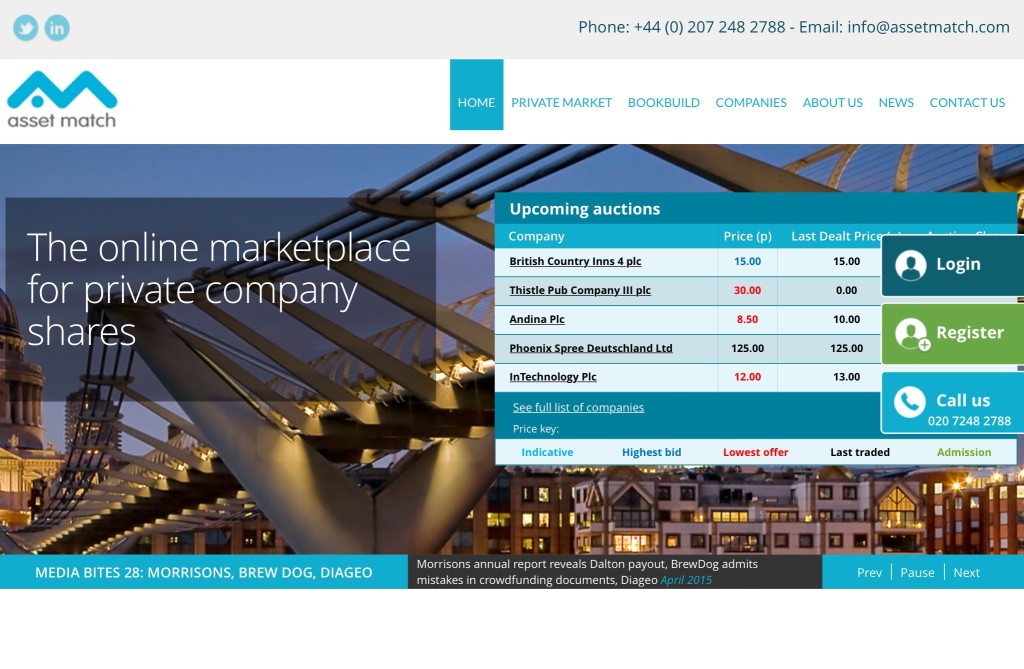

Asset Match is the online marketplace where shares in UK private companies can be bought and sold. Stuart Lucas answers our questions below

Our questions are in bold.

– – – – –

Who are you and what’s your background?

Asset Match was formed in 2011 by two city executives, Stuart Lucas and Iain Baillie.

As shareholders in UK private companies, both Stuart and Iain found it easy it is to invest in private companies, but then much harder to exit from an investment. With most companies offering only two forms or exit – trade sale or IPO – and the likelihood of these events happening being statistically very low, they were frustrated at how hard it was realise some or all of their assets. Drawing on their extensive capital markets experience and use of electronic platforms , they created Asset Match, an online market place to buy and sell shares in private companies.

Stuart Lucas has spent his career in the City. He started working on the trading floor of the London Stock Exchange and has also held senior roles at Bear Stearns Int’l (Senior Managing Director); IBJ ( Head of Dept responsible for trading, sales and research); and Nomura (Head of Credit Trading). In 2000 he established Bracken Partners, an investment banking boutique, private equity investor and fund manager. Stuart has been an active user and investor in fintech platforms such as Bloomberg, Sportingbet, iProfile, Transact (Integrafin), and Interactive Investor (III).

Iain Baillie began his career at Strauss Turnbull and Co and has been involved in UK and European Capital Markets for over 35 years as a trader of both equities and corporate bonds, culminating in heading European credit trading as a Managing Director of Salomon Brothers. He has been a founding director of LBDP, a successful agency broker in European credit; CEO of MarketAxessEurope, the leading platform for electronic execution in the credit market; and Head of Fixed Income at Christopher Street Capital.

What is your job title and what are your general responsibilities?

As co-founders and co-CEOs of Asset Match we are equally responsible for developing and growing the business. It means both of us have a solid understanding of all aspects of the business. Responsibilities will change as the business evolves.

Can you give us an overview of your business?

Asset Match is an online platform where business owners and shareholders can buy and sell shares in private companies. We are all about equity release for early stage investors, angels and entrepreneurs, which we do in a regulated, transparent, efficient and low-cost manner.

Companies control; who buys, who sells, and when. We also help later stage investors access companies previously unattainable.

We have two services:

1. A market place for trading shares: We host online auctions, which are held over a defined period of time, on behalf of clients to bring buyers and sellers together. Participants submit bid and sell offers electronically. Our technology then determines the best price at which most people are able to transact; at the close of the auction anyone who has offered to buy shares at or a higher price that that determined by our system can buy shares and anyone who was willing to sell shares at the price or lower can also transact. This ‘Dutch’ auction system ensures that shares are bought and sold in a fair and transparent way. Holding auctions also corrals investors together to get the maximum level of interest.

2. AM BookBuild. This is a service that enables established private companies to raise growth capital using a dynamic pricing mechanism. Like in the lead up to an initial public offer, BookBuild works to determine a fair and transparent price for a Company’s shares. We help market the company’s shares to a body of registered sophisticated investors.

We were selected as one of Britain’s 250 Fast Growth companies in 2013 by Accelerate (backed by Lord Young and former Tesco boss Sir Terry Leahy.

Tell us how you are funded.

We started with £1 million of investment from ourselves, friends and family in July 2012 and raised £289,000 from 100 investors on Crowdcube in 2013. We also sold a stake in the business in August 2014.

Why did you start the company? To solve what problems?

Frustration that 3 to 5 year investment periods became 11+ years and there was no viable alternative to a statistically irrelevant, IPO or trade sale. Asset Match identified over 2,500 UK private companies that meet that criteria.

We seek to solve the problem of locked in share assets in UK private businesses, which Asset Match estimates to be as much as £300bn amongst around 500,000 investors. Business owners often see trade sales or IPO’s as their only way to release equity but we provide a third way.

As more private companies raise capital from new alternative finance options (such as crowdfunding and debt finance), there are more private shareholders who will eventually want to release some of the value from their investments. This opens ups a whole new secondary market for share purchasing/investing in British businesses.

Who are your target customers? What’s your revenue model?

Our target customers are private companies or anyone who has ever bought shares in a private company (owners, investors, angels and the crowd). We find that private companies are often not aware that they can provide their investors with an exit without a trade sale of IPO. We work to educate the owner, founders and senior management that they can remain in control of their business and still offer their shareholders an exit.

On occasion we start with investors who ask companies to provide them with an exit and they come to us asking us to help.

We are also approached by companies that are on-route to an IPO and want to establish a market-driven share price ahead of their IPO so that they have evidence when they want to raise further funds.

Our revenues are twofold; 1) we charge companies a token amount to be on our platform. 2) wecharge fees to the seller and buyer, but only on completion of successful trades.

All shareholders should have the right to an exit and the onus should be on the business to map out the exit alternatives and path. With new financial technology, the long term problem of buying and selling shares, or liquidity, in private companies is over. What’s more the timing of the promised exit can be controlled and costs a fraction of IPO listing fees.

A good example is BrewDog, the irreverent Aberdeen based craft brewery has carried out three ‘Equity for Punks’ share issues since 2009. An early commitment to its crowdfunded shareholders to provide a liquidity event was realised in November last year over the Asset Match platform. Buyers and sellers were brought together in a five hour ‘Dutch’ auction where 220 investors took part. Participants were able to see the range of bids and offers which spanned from £25 to £300 and adjust their orders accordingly. In the end 118 individuals traded successfully. The smallest seller sold just one share while the largest buyer invested over £80,000. At the close shares were transacted at £125 per share giving BrewDog a paper value of just under £150 million.

The concentration of activity over a defined time ensured that there was a market to determine a transparent fair price. Many shareholders chose not to exit while others invested more; crucially those wanting to realise their investment were offered a way out.

Providing a path to exit that is fair and transparent and costs a fraction of traditional routes is a win-win for businesses and shareholders. Companies pay a small fee to become registered on Asset Match. We also take a small percentage on any share transactions made through our platform.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

Simplified and consistent regulation that encourages business.

One of the biggest challenges we face is the level of tech sophistication of investors. While they may be financially sophisticated, we find that some in fact, rarely use a computer. As an online platform our magic wand would enable investors navigate the platforms. We also need to make all FinTech services user friendly!

What is your message for the larger players in the Finance industry?

Whatever product or service you are offering, whether it is uses technology or not, client responsiveness and building relationships are really the key. Even though technology allows us to do what we do, we are still fundamentally a relationship based business. We spend a lot of time with our clients and build trust. Technology needs to enable a product or service – it is not the starting point.

What phone are you carrying and why?

iPhone- mostly because they are intuitive to easy to use and have lots of apps. I can stream my music collection too..

Where do you get your industry news from?

We read a lot of the business sections of the broadsheets and the FT – City news is very influential to our business. I also look at e-publications like Growth Business and EN. Investment press such as Shares, What Investment, Citywire, Investors Chronicleto read about the issues surrounding the investment industry.

For fintech news: finextra, Financial News / efinancial news Fintech Focus alerts us to othercompanies in the sector.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Fintech circle

1. Anna Irrera, Financial News @annairrera

2. James Hurley (@jameshurley)

3. George Whitehead (@georgewhitehead) – Venture Partner Manager at Octopus Investments

What’s the best FinTech product or service you’ve seen recently?

ArchOver – provide secured and insured P2P loans to sophisticated investors with a minimum ticket size of £5,000. We feel that they are approaching the P2P lending space in the “right way” with clear returns and risk levels. They are also forward thinking in looking to implement a secondary marketplace for these loans in collaboration with us.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

The future is going to be about secondary markets. With so many start-ups looking to alternative finance to raise money, companies need to start thinking about the future and how they are going to provide their investors with share liquidity.

Secondary marketplaces like Asset Match will be competing with more traditional equity markets and will give companies the option of remaining private.

Also fintech companies will become more mainstream, rather than alternative. Traditional financial institutions will either acquire fintech companies or they will offer their own fintech based services. In the meantime I see the traditional institutions working closely with the alternatives – this is already happening as brokers are already using crowdfunding platforms to help them raise finance on behalf of their clients.

– – – – –

Thanks to Asset Match for answering our questions today. You can follow them also on Twitter and on LinkedIn.

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.