Toby Triebel of Spotcap

For this week’s profile we have Toby Triebel from Spotcap.

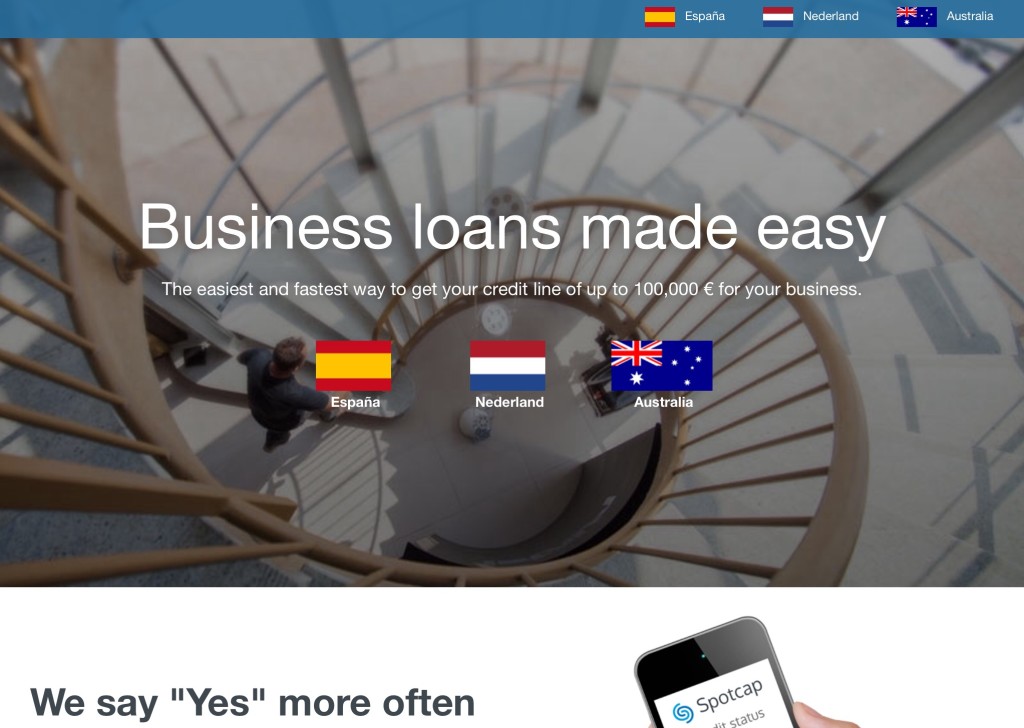

They are the provider of short-term loans to small businesses online.

Our questions are in bold.

– – – – –

Who are you and what’s your background?

I’m Toby Triebel, and I’m the CEO and Co-Founder of Spotcap, an online lending platform that seeks to address financing challenges faced by small businesses. I was driven to enter the fintech world, after witnessing first-hand how small businesses find it very difficult, and often impossible, to receive bank financing.

I hold economics degrees from Cambridge University and The London School of Economics, as well as a Masters degree in Game Theory from LMU Munich; I have more than 10 years of experience in the finance industry, starting my career at Goldman Sachs, and more recently as an investor at Finisterre Capital, a leading emerging markets hedge fund.

At Finisterre, I invested in corporates and banks in all Emerging Market regions across asset classes with a focus on debt investments. Prior to Finisterre, I was with AlixPartners, where I worked mainly on financial and operational restructurings of companies across sectors throughout Europe. I started my career at Goldman Sachs where I spent four years in corporate finance.

What is your job title and what are your general responsibilities?

My official title is Co-Founder & CEO – a title which covers a lot, believe me. Along with my co-founder, Jens Woloszczak, it is my job to run the company on a daily basis, define and execute our growth strategy, and provide a vision for Spotcap, both inside and outside the company. I try to work closely with our team, mainly to encourage them to work creatively and bring out their talents, as I’m a firm believer in allowing people to apply their initiative and ideas in the workplace.

While I would love to say an ‘average day at Spotcap’ exists, the truth is no two days are the same for me. On any given day, I could be in strategy sessions with my team all day, or giving interviews about fintech to the international press, or sitting with my excellent developers and translating vision into coding, or approving budgets, or discussing Spotcap’s business plan with my Co-Founder. It is a combination of big-picture-thinking and meticulous work, all the while managing and learning from an excellent team we have put together across four countries.

Can you give us an overview of your business?

Spotcap makes financing accessible to small businesses online – in a very fast, simple, transparent and flexible way. Small businesses are often underserved by banks and traditional financial institutions. As a result, alternative-financing options such as Spotcap are the only solution for these businesses to receive funding.

We also save business owners time: instead of the estimated 25 hours it takes to search and apply for funding options, Spotcap gives entrepreneurs incredibly fast decisions online. This means they can grow their businesses immediately. Banks are often not interested in providing financing to small businesses because they are seen as too risky, too young, too small or simply not worth the time and effort. Structural elements, such as ever more stringent regulatory requirements play their part on the banks as well. As such, small businesses are better off with Spotcap: We are not only accessible when it comes to funding, we are highly attuned to small business needs, as is evidenced by our client testimonials. Spencer Smith of RV Solar Supplies in Australia, for example, said: ‘“Spotcap’s online process was simple and straight-forward and I was approved for finance in no time at all.”

Headquartered in Berlin and with local offices in Spain, the Netherlands and Australia, Spotcap has adapted to the challenges of three different markets, serving small businesses and disrupting the finance industry. Since its launch in September 2014 the company has served thousands of Spanish, Dutch, and Australian businesses.

We offer short-term, unsecured lines of credit of up to $250,000 (in Australia), or €100,000 in Spain and the Netherlands. The innovative algorithm Spotcap uses to measure the real-time performance of small businesses is a vast improvement on the criteria and processing technicalities of large incumbents. Many small businesses are not in that position, being operational for fewer than 5 years – but in an ideal position to grow. Finally, security is an important topic for Spotcap: we use state-of-the-art encryption to make sure that all data is secured.

I am proud of what we as a team have achieved in our first 1.5 years: we now provide credit lines in three countries; in just 12 months, we have reached €500m in credit inquiries and 20,000 registered users. What’s more, there is a growing trend of repeat customers, with 46% of active customers reapplying for loans.

Tell us how you are funded.

The company has raised £13m (€18m) in equity and debt capital thus far. £9.6m (€13m) in equity money was initially secured from a group of investors including Rocket Internet, Access Industries and Holtzbrinck Ventures. Spotcap has also raised £3.7m (€5m) in debt capital from Kreos Capital, Europe’s largest provider of growth debt to high-growth companies.

Why did you start the company? To solve what problems?

Traditional financial institutions often cannot serve small businesses efficiently. Small businesses have many obstacles to obtaining the funds they need to grow: long-waiting times, outdated processes, antiquated metrics measuring success and failure. What small businesses need is a way to make financing fast, easy and practical; what they need is Spotcap.

Spotcap makes SME loans accessible: no need for brick-and-mortar banks, or their brick-and-mortar processes. We use an innovative algorithm to assess businesses’ real-time performance and decide on the client’s suitability for a loan right away. We provide credit to business that often do not have the chance to qualify for bank financing.

Who are your target customers? What’s your revenue model?

Spotcap addresses the financing need of small businesses. SMEs are the backbone of the global economy and often the driving force behind important innovations. These businesses often struggle to get financing because of their size or lack of credit history.

Our target customers are those who have been operating their businesses for at least 12 months, and are looking to grow. There are minimal requirements, such as the need for a bank account, being registered in one of our operational regions (Spain, Australia, The Netherlands) and certain minimum revenue thresholds.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

The key to greater development and success in both industries is collaboration. If I had a magic wand, I would make collaboration between banks and fintechs happen much sooner. I believe collaboration is inevitable, however, the road to working together will be bumpy; banks will resist fintech growth, and the fintech industry may feel tempted to push out on its own. But the truth is, fintech is an industry that disrupts banks, but thrives on banks’ existence; and banks, on the other hand, cannot compete with the lean service delivery startups offer. With my magic wand, I’d hope to abra-cadabra away the tough route to collaboration; but perhaps it’s also necessary for a strong restructuring of both environments.

What is your message for the larger players in the Finance industry?

I would say you have done a great job in serving certain sectors of the market, but too many people and businesses are underserved. Work with the fintech industry to increase your share of the market, and provide service for more people out there who need it. It’s all about collaboration.

What phone are you carrying and why?

The iPhone 6. Because it’s an iPhone 6.

Where do you get your industry news from?

TechCrunch is indispensable, as is VentureBeat – and not just because I’ve been published in both. I like to keep abreast of UK and US news through The Financial Times and The New York Times. Of course there’s Twitter and LinkedIn which provide a lot of different insights, and I check in with Bloomberg and CNN daily. In terms of a broader European and global perspective, there’s no paper more comprehensive than the Economist.

Can you list 3 people you rate from the FinTech sector that we should be following on Twitter?

Oliver Bussmann, @obussmann: need I say more?

Eileen Burbudge, @eileentso: American VC, leading the UK’s fintech game.

Spiros Margaris, @SpirosMargaris: VC and all-round fintech genius.

What’s the best FinTech product or service you’ve seen recently?

Everyone is talking about it, but Number26 really has captured the imagination. It’s showing people that fintech can be an integral part of your financial life, and it doesn’t need to be a ‘fancy add-on’. It’s a bank account that uses your smartphone as its interface – a wonderfully simple idea, elegantly executed and endlessly functional.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

I’ve recently written an article for memeburn on this subject, where I do not make predictions, but discuss necessary conditions to make 2016 a big year for fintech. For fintech to flourish this year, I think we need to discuss the industry’s social impacts more, as well as help shape regulation so that fintechs get a fair opportunity to grow. Furthermore, government support for the industry needs to be strong, and collaborations need to take off between fintechs and banks. Finally, the industry really needs to step up its branding game. Only when these things happen can we make worthwhile predictions – up until then, we’re just speculating about individual successes and failures, and not discussing an entire industry. You can check out my article here:

http://memeburn.com/2015/12/what-needs-to-happen-to-make-2016-fintechs-breakout-year/

– – – – –

Our thanks to Toby for his answers today. You can find out more about Spotcap on their website, twitter, facebook and LinkedIn.

If you would like to receive email updates whenever we publish, sign up to our Newsletter. You can unsubscribe at any time and we will never use your email for anything else.

If you’ve any suggestions for hot FinTech companies (startup, or established ventures) that we should be profiling, or have an opinion piece to offer, or a FinTech related event you’d like to tell us about, have a look here for more details.