Tom Beevers of StockViews

Next up on FinTech Profile is StockViews; the exciting new crowdsourced platform for equity research. Tom Beevers, CEO, gives us an insight into the business which is based out of Level39, Europe’s largest technology accelerator space.

Our questions are in bold.

Over to Tom.

– – – – –

1. Who are you and what’s your background?

After graduating from Cambridge University I worked in the City of London, first in corporate finance and later in asset management. In 2004 I joined Newton Investment Management, where I was a fund manager of European equities, managing over £1bn of AUM.

In 2014 I quit my job to set up StockViews. While I loved the world of investment, I also had an entrepreneurial streak and in recent years I had become interested in the future of the equity research industry. The industry has been going through a huge amount of turmoil, impacted by falling commissions and pressure from the regulator. Most fund managers are frustrated with research from Wall Street banks because of declining quality, conflicts of interest and lack of value-add. It was this frustration that led me to investigate alternative models of supplying equity research, in particular the potential of online platforms.

Around the time I was formulating my ideas, I met Sandeep Bathina, an ex-Google engineer and AI researcher at the tech accelerator, Level39. He became equally convinced of the potential for this market and, with his experience of a startup environment, we formulated a more robust business plan. We went on to co-found StockViews in June 2014.

2. What is your job title and what are your general responsibilities?

I am the CEO at StockViews. Because we are a relatively small company, in practice this means I have to wear many different hats. I’m involved equally in strategy, finance, product development, marketing and customer service. Much of my time is spent putting in place some of the big initiatives we’ve been running, including the StockViews university tour and the StockViews mentorship program. I like to spend time on the educational side of things – including my blog on investing (http://blog.stockviews.com) and the StockViews Campus channel on YouTube (www.youtube.com/stockviews).

3. Can you give us an overview of your business?

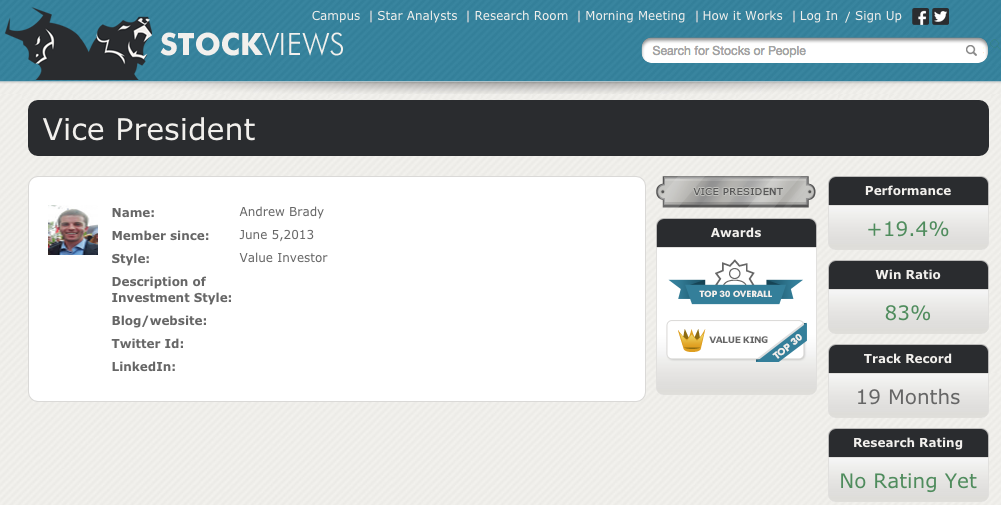

We are a crowdsourced platform for equity research, matching investors with top analysts. In recent years we’ve seen an explosion in the supply of online equity research. However investors find it difficult to derive much value from this community when there are serious trust issues and excessive levels of “noise”. Our aim is to “professionalise” this industry by subjecting our analysts to measurement on two criteria – the performance of their stock ratings and the quality of their research. By creating a meritocratic platform we establish an element of trust between investors and analysts that is absent from other platforms.

4. Tell us how you are funded.

We are currently self-funded, although we are planning to raise funding from angel investors later in the year.

5. Why did you start the company? To solve what problems?

There is a large gap in the market for high-quality equity research. While larger asset management firms have traditionally relied on Wall Street research, they are increasingly dissatisfied with the level of service and the high fees. Meanwhile there is a whole swathe of smaller investors and retail investors who have no access at all to research. The Federal Reserve estimate that there are 19m households in the US with direct ownership of equities, who hold in aggregate $12.9tn in assets under management.

This population is woefully underserved in terms of stock research. The supply of equity research online is quite plentiful, but it’s not organized in a way that’s appetizing for investors – the issue of credibility remains the key blocking issue to wider adoption. By subjecting our analysts to measurement and by creating a hierarchy of talent, we solve the credibility issue for this nascent industry.

6. Who are your target customers? What’s your revenue model?

Our key target customers are US retail investors. As mentioned above, the Federal Reserve estimate there are 19m households in the US with direct equity ownership (13% of the population). Over time the platform will generate a tier of analysts on the platform who have proven themselves as alpha-generators and authors of high-quality research. We believe retail investors would be willing to pay a small monthly fee to access the opinions of this top rank. 80% of this fee would be passed onto contributors, creating a strong incentive for other analysts on the platform to contribute high-quality research and gain promotion into this top rank. The model should engender a virtuous circle where both the quality of research and the amount paid by investors increase in gradual increments.

7. If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

When you work as an entrepreneur, you soon start wishing the government would do less, not more. Less red tape is the most valuable thing that governments can do to benefit smaller companies in the fintech space, making it easier to hire, expand and flourish.

8. What is your message for the larger players in the Finance industry?

The last few years have brought a huge amount of change to the finance industry and the pace of change will only accelerate from here. Large banks need to be much more responsive to customer needs and much faster to adopt new technologies if they want to survive. The next generation of customer is much more demanding in what they expect, and if a bank doesn’t meet these expectations it won’t take them long to find an alternative provider that will.

9. What phone are you carrying and why?

I have an iPhone6 plus. I’m a bit of a technology geek, and I love to have the latest thing. I think this latest one is great, though I must say the large-sized screen takes some getting used to!

10. Where do you get your industry news from?

I read the FT and the WSJ daily for news on markets. For updates on the FinTech space I rely on the community here at Level39, where there is always a great buzz.

11. Can you list 3 people you rate from the FinTech sector that we should be following on Twitter.

- Adizah Tejani (@adizah_tejani) who is always a good source of scuttlebutt on the FinTech industry and what’s going on at Level39.

- Mike Baliman (@MikeBaliman), host of the London FinTech Podcast

- Heckyl Technologies (@HeckylTech) a fast-growing FinTech company with an outstanding product (see below)

12. What’s the best FinTech product or service you’ve seen recently?

I think Heckyl (fellow members of Level 39) have an incredible product for institutional investors. It aggregates and prioritizes a huge amount of market-relevant information, from a variety of news outlets and other public sources. I only wish I had been given access to this tool when I was a fund manager!

13. Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

Fintech has achieved incredible things over the past couple of years, and it’s still a very young industry. The financial industry, taken as a whole, has been far too unresponsive for too long and the profit pool remains huge. In particular I believe the investment industry looks ripe for disruption now. Investors are waking up to the poor deal they’ve been receiving as a result of high fees and worse-than-average results. There are already a number of innovative companies in this field (Betterment, Wealthfront, RobinHood), but there is room for many more. Between them, these companies are creating an entirely new infrastructure for the next generation of investors, and there will be space for many more companies besides.

– – – – –

Thank you for taking the time to answer our questions Tom.

You can reach out to Tom via LinkedIn. To follow StockViews on Twitter click here and if you would like more information, check out the web site; www.stockviews.com right away!

If you’ve any suggestions for other hot FinTech companies (startup, or established ventures) that we should be profiling, I’m all ears. Don’t hesitate to drop me a note at ewan@fintechprofile.com. There’s more information on this page.