UniCredit buying Vodeno would bring some excitement to the European Banking market

Here’s an opinion piece from Ewan published earlier today on LinkedIn:

UniCredit is rumoured to be interested in buying Banking-as-a-Service player, Vodeno. So says a Bloomberg report this morning.

Just what would that do to the European banking landscape?

It would electrify it.

For the longest time I have been obsessing over BaaS — and by extension, Open Banking/Open Finance. In various chief positions in banks over the years, I have felt the acute pressure to get it right, especially when the bank’s leadership and shareholders were looking to me to lead the way.

In previous roles, every single customer and FinTech I met assumed that we could offer BaaS easily.

They just assumed we could turn things on, really quickly.

They assumed we had APIs sitting there, ready to go.

Or at least, they thought we’d be able to do something quickly to respond to their specific requests.

They knew banks like mine routinely spent billions on their technology estates. They knew we had — in some cases — thousands of hardcore technology engineers.

“Can we plug into your pension systems?” No.

“Can we get a feed of your FX spreads and then do this thing?” No.

“Can you run these accounts for us?” No.

I mean, technically yes.

Technically yes.

Will we?

Will we as a bank actually do that?

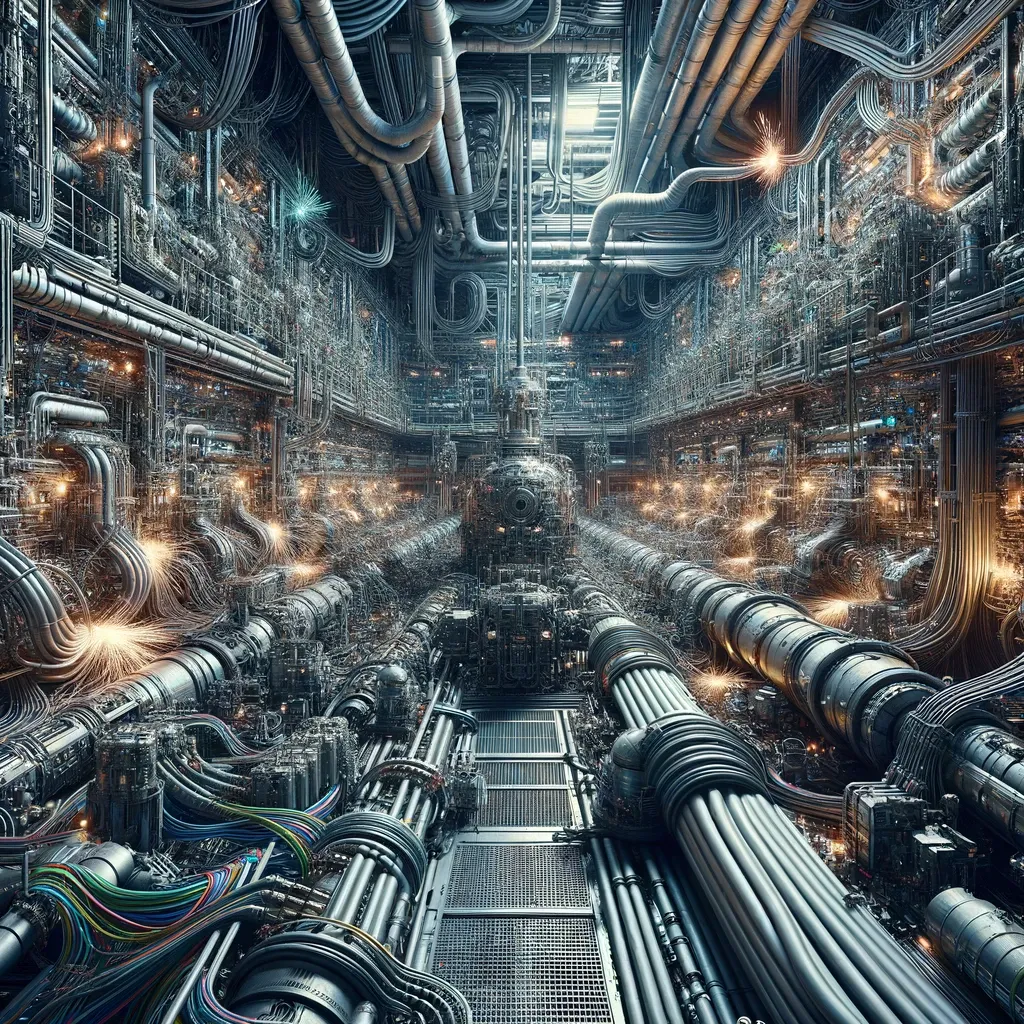

Even if the Chairman commanded it, there are some specific realities we all had to face. Incumbent bank infrastructure is not built for BaaS.

So I have been obsessing over build, buy, partner or invest in the BaaS space for a while.

The Unicredit/BaaS potential would strike fear, excitement and some horror into the banking landscape in Europe.

Legions of traditional banking executives who, I think it’s fair to say, haven’t been that impacted by ‘digital transformation’ (beyond having to do some ‘digital and regulatory PSD2 stuff’ in the corner) will suddenly be forced into making difficult, difficult decisions.

Andrea Orcel, CEO of Unicredit is “one of us” — that is, a traditional banker.

If he’s going all-in with BaaS as an underpinning offering… what does that mean for “us” at Deutsche, Danske, SEB, Lloyds, ING, ABN, BNP and so on?

Some have existing BaaS strategies.

Many have nothing.

Absolutely nothing.

As a leading bank, you don’t need a BaaS strategy to succeed, at all.

That’s not the point, though.

If Andrea has got one… your shareholders, your Chairman, your board is going to be asking what your response is.

Your CDO, CIO, and CTO will suddenly be reaching for their McKinsey partner.

I’m sure dozens of WhatsApps have already been sent to this effect this morning already. (“That BaaS thing you mentioned… bring it over this week, will you?”)

Yes, Andrea is more than likely to have a mini-nightmare integrating anything like Vodeno into a traditional incumbent bank culture… but what if he does succeed?

What if this is the start of the next-generation bank transformation trend?

Exciting times!

Update: 5 months later, UniCredit did indeed purchase Vodeno. Here’s the press release from UniCredit.